Opening an offshore bank account isn't just a transaction; it's about building a secure financial launchpad for your global business. For entrepreneurs and small business owners navigating a borderless economy, it's a strategic move that can unlock asset protection, smarter currency management, and direct access to international markets.

Why Smart Entrepreneurs Bank Beyond Borders

Let's be frank—the idea of banking outside your home country can feel a bit daunting. For many business owners, it conjures up images of complex paperwork and a world reserved for the super-rich. But in today's interconnected economy, it’s far less of a luxury and much more of a practical tool for any business with global aspirations.

Think of it this way. You wouldn’t limit your customer base to a single city, so why would you tie your entire financial strategy to one country's banking system? Expanding your banking footprint is really about building resilience and unlocking new opportunities.

A Strategic Toolkit for Global Growth

For a growing business, an offshore account is a powerful instrument for managing risk and streamlining international operations.

Picture a Hong Kong e-commerce founder selling to customers in Europe and the US. By holding funds directly in EUR and USD accounts offshore, they can slash currency conversion fees and shield their profits from volatile swings in their home currency. This isn't a clever trick; it's just smart financial management in action.

This isn't just about trimming costs; it's about safeguarding your profit margins. That’s one of the core strategic wins you get when you open an offshore bank account, and it’s something savvy entrepreneurs really understand. Beyond managing currencies, these accounts offer a few other massive advantages:

- Better Asset Protection: Storing capital in a stable, well-regulated jurisdiction can shield it from economic or political instability back home.

- Access to Global Investments: Many offshore financial centers provide investment products and opportunities you simply can't find through your domestic bank.

- Simplified International Payroll: Paying a global remote team becomes infinitely easier when you can manage multiple currencies from one centralized hub.

It's About Strategy, Not Secrecy

The world of offshore banking today is built on transparency and compliance, a far cry from old stereotypes. The Hong Kong offshore banking scene, for instance, is all about following the rules and leveraging practical advantages. It's a legitimate, powerful tool for international business.

In fact, as of 2025, Hong Kong continues to be one of the top five global jurisdictions for opening an offshore account, which speaks volumes about its stability and business-friendly environment. You can explore more about the benefits of an offshore bank account to see why certain locations are so highly regarded.

For an entrepreneur, an offshore account is fundamentally a diversification strategy. You diversify your investments, your supply chain, and your markets—so diversifying where you hold your capital is the logical next step in building a truly robust, international business.

For those looking to take their financial management to the next level, exploring comprehensive private banking solutions can also offer highly personalized services and even greater global access.

Ultimately, opening an offshore bank account is a move toward financial sovereignty. It gives your business the flexibility and security it needs to not just compete, but thrive on the world stage. It’s about smart planning for a future without borders.

Choosing The Right Jurisdiction For Your Business

Selecting where to open your offshore bank account is easily the most critical decision you'll face. It's not just a box to tick; it's the foundation of your international financial strategy. Getting this wrong can lead to years of headaches. Getting it right means building a stable, secure base for global growth.

This isn't about chasing the lowest tax rates. The real goal is to find a country whose entire financial and legal ecosystem clicks with your specific business needs. Think of it as finding a long-term partner for your global ambitions, not just a place to hold money.

Key Factors To Evaluate

It’s easy to get bogged down in details when you're comparing countries. To keep things clear, I always advise clients to focus on these core elements:

- Economic and Political Stability: You're looking for a jurisdiction with a boringly predictable track record. A country with a stable government and a robust economy isn't likely to spring surprises on you that could jeopardize your assets.

- Remote Account Opening: For most of us, being able to open an account without getting on a plane is non-negotiable. Modern, fintech-savvy jurisdictions tend to make this a much smoother process.

- Reputation and Compliance: Stay well away from any jurisdiction on an international blacklist. Partnering with a reputable financial center that adheres to global standards like the Common Reporting Standard (CRS) gives your business credibility and makes transactions with other banks far easier.

- Multi-Currency Support: If your business deals with clients or suppliers around the world, you absolutely need a bank that can manage multiple currencies effortlessly. This simple feature can save you a fortune in conversion fees and simplifies your cash flow management.

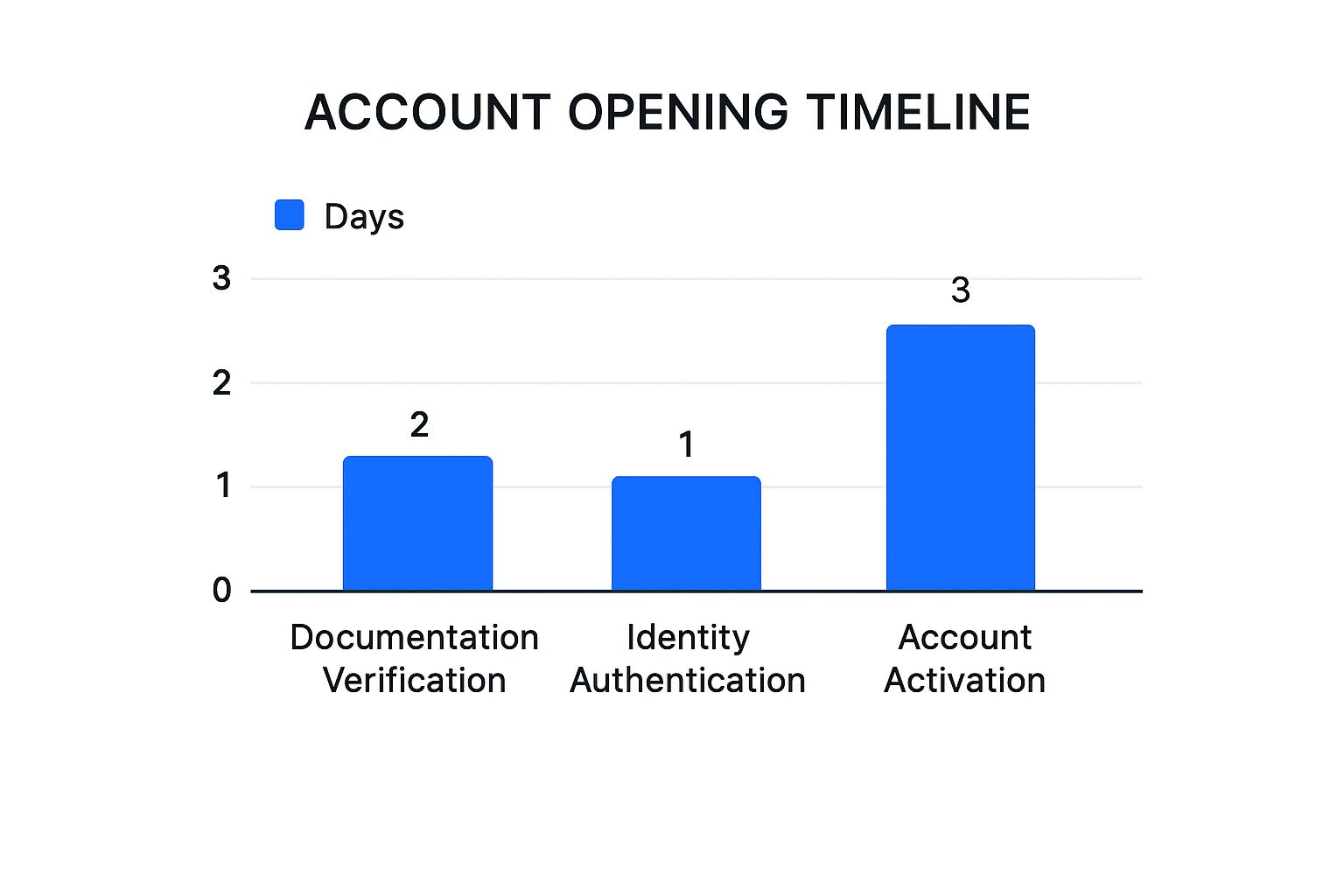

Once you’ve picked your jurisdiction and bank, the real process begins. This timeline gives you a rough idea of what to expect.

As you can see, the initial identity checks are usually quick. The real time-sink is the bank’s review of your documents before they finally activate the account. This is where having all your paperwork in perfect order from the start pays off.

Comparing Top Offshore Banking Hubs

To give you a clearer picture, let's compare some of the most popular options side-by-side. Each has unique strengths, and the "best" choice really depends on what your business prioritizes.

Key Factors for Comparing Offshore Jurisdictions

| Factor | Hong Kong | Singapore | Switzerland | Cayman Islands |

|---|---|---|---|---|

| Political & Economic Stability | Historically strong, but recent political changes require monitoring. | Extremely high; a globally recognized model of stability. | World-renowned for its political neutrality and economic resilience. | High, with a stable political system under British oversight. |

| Tax Environment | Territorial tax system (only local income is taxed). No capital gains tax. | Favorable corporate tax rates. No capital gains tax. Extensive tax treaties. | Low corporate tax rates, but varies by canton. Strict privacy laws. | Zero direct taxation (no corporate, income, or capital gains tax). |

| Reputation & Compliance | Highly reputable, major international financial center. Adheres to global standards. | Top-tier reputation for transparency and strong regulatory oversight. | The gold standard for banking privacy and security, fully compliant with CRS. | A leading hub for investment funds, but has faced scrutiny over transparency. |

| Ease of Remote Opening | Possible, but banks have become increasingly strict with due diligence. | Very difficult for non-residents to open remotely; a local presence is often required. | Challenging. Most major Swiss banks require an in-person visit. | Generally straightforward, with many institutions offering remote account opening. |

This comparison highlights that there's no single "perfect" jurisdiction. For instance, while Hong Kong's tax system is a massive draw, Singapore offers unparalleled stability. Switzerland provides legendary privacy, but the Cayman Islands makes remote opening much simpler. Your choice involves balancing these trade-offs against your business model.

The ideal jurisdiction isn't the one with the lowest taxes, but the one that offers the best balance of stability, accessibility, and robust legal protections. It should function as a secure and efficient financial hub for your global operations.

Ultimately, a European e-commerce business will have very different requirements than a digital nomad offering consulting services from Southeast Asia. To help you dig deeper, our guide on the best countries to open an offshore bank account offers a more detailed breakdown of the leading options. Taking the time to get this decision right will pay dividends for years to come.

Getting Your Paperwork in Order

This is the part of the journey where I see many people stumble. The list of required documents can look a bit daunting at first, but honestly, it’s all about preparation. Don't think of it as a bureaucratic hurdle; see it as your first real chance to show the bank you’re a serious professional they can trust.

Let's be clear: banks aren't out to make your life difficult. They are legally required to perform thorough due diligence to comply with international anti-money laundering (AML) and counter-terrorism financing (CTF) rules. Your mission is simple: give them a complete, organized package that makes saying "yes" an easy decision.

A well-organized application speaks volumes about you as a business owner. This is your first impression, and when you’re trying to open an offshore bank account from halfway across the world, it really counts.

Your Core Document Checklist

While the specifics can shift a little from one bank or country to another, the core documents are almost always the same. Get these sorted out first, and you'll be miles ahead.

- Certified Proof of Identity: This is non-negotiable. You'll need a high-quality, notarized copy of your passport. Make sure it’s not nearing its expiry date and that your photo and all details are perfectly clear.

- Proof of Residential Address: The standard here is a recent utility bill (like electricity or water) or a bank statement. "Recent" usually means less than three months old. Your full name and address must be clearly visible.

- Professional Reference Letter: Many banks ask for a letter from a professional who knows you, such as your lawyer or accountant. It's a simple letter confirming their professional relationship with you and your good standing.

- A Solid Business Plan: This is where you bring your business to life. It doesn't need to be a 100-page novel, but it must clearly explain what you do, who your customers are, how you make money, and specifically why you need an international bank account.

- Company Incorporation Papers: If you're opening a corporate account, you'll need certified copies of your key business documents. This typically includes the Certificate of Incorporation, Memorandum and Articles of Association, and a list of all directors and shareholders.

A pro tip from my own experience: have both high-quality digital scans and certified hard copies ready to go. You never know which format a bank will prefer, and this way you can act fast.

Explaining Your Source of Funds and Wealth

This is a critical step and, frankly, where many applications get held up. Banks have a legal duty to understand where your money comes from. They’ll want to know about both your Source of Funds (the specific money you plan to deposit) and your Source of Wealth (how you built your overall net worth).

The secret here is to tell a clear, logical, and verifiable story. If the money is from selling a property, have the sale agreement ready. If it’s from an inheritance, you’ll need the relevant legal documents. The easier you make it for them to connect the dots, the smoother the process will be.

For instance, an e-commerce entrepreneur might show sales reports from Stripe or PayPal to document their source of funds. Their source of wealth could be a narrative backed by tax returns showing accumulated profits over several years.

Ultimately, it’s about building a compelling case for yourself. When you understand what the bank needs and provide them with clear, professional documentation, you're not just another applicant; you're a low-risk, credible partner they want to work with. This proactive mindset is the key to getting your account opened without unnecessary delays.

Navigating the Application and Verification Maze

So, you’ve got all your documents organized and ready to go. Great. Now comes the actual application. Most of the time, this kicks off online, but don’t picture a slick, fully automated signup like you’d get with a local neobank. It’s more of a hybrid process—you’ll fill out forms online, but a real person at the bank will be handling your file from start to finish.

Right away, you have a decision to make: go it alone and apply directly, or bring in a professional service to help? If your business is dead simple, applying direct might be fine. But for most entrepreneurs trying to open an offshore bank account, using a specialized consultancy is often the smarter move. These firms already have relationships with the right people at the banks and understand the unspoken rules and risk profiles that aren't written down anywhere.

That kind of insider knowledge can be the difference between a smooth approval and a drawn-out, frustrating rejection. They know how to position your application to address the bank's likely concerns before they even ask.

The Make-or-Break Compliance Interview

Just about any credible offshore bank will want to speak with you directly, usually over a video call with a relationship manager. Don't sweat it—this isn't an interrogation. It's really just a conversation to confirm who you are and, more importantly, to get a handle on your business.

You'll need to be ready to explain a few things clearly and simply:

- What Your Business Does: What are you selling? Who buys it?

- How Money Moves: Where will funds be coming from, and where will they be going?

- Your "Why": Why this specific bank in this particular country? What problem does it solve for you?

My best advice? Be upfront and honest. If you’re running an e-commerce business with customers worldwide, tell them you need multi-currency accounts to cut down on conversion fees. If you're a consultant with clients in different countries, explain that you need a bank in a neutral, stable jurisdiction to make receiving payments easier.

Tackling this process also means getting the paperwork right, especially for non-US residents. For instance, understanding how to open a bank account without an SSN and using your passport or other valid ID is a crucial detail that can trip people up.

The bank is simply looking for a legitimate, logical reason for you to be there. They want to partner with genuine business owners, not someone trying to play games. How you present yourself on this call—with confidence and clarity—does most of the work in building that initial trust.

Think of it as your business pitch. You're selling the bank on you being a low-risk, valuable client they'd want to have. After the call, their internal team does its final checks. If you've done your homework and presented your case well, the next email you get should be the one you've been waiting for, complete with your new account details.

Managing Your Account For Growth and Compliance

Getting your offshore bank account open is a huge win, but honestly, it’s just the beginning. The real work—and the real value—starts now. Your focus needs to pivot from the application process to smart, day-to-day management. It's all about using this new financial tool to grow your business while staying on the right side of global regulations.

Think of it like being handed the keys to a high-performance car. The real skill isn't just starting the engine; it's driving it well. This means getting comfortable with international transfers, juggling different currencies to protect your margins, and making the bank's online platform work for you.

Mastering Day-To-Day Operations

Your new account is now your command center for global business. To really make it hum, you need to get the practicalities down pat. Firing off an international SWIFT transfer, for instance, has more moving parts than a simple domestic payment. You have to be meticulous with beneficiary details, SWIFT/BIC codes, and any intermediary bank info to make sure your money doesn't get held up.

Currency management is just as critical. Imagine you're an e-commerce entrepreneur selling in both the US and Europe. With an offshore account, you can hold both USD and EUR directly. This simple strategy means you're not forced into costly currency conversions on every single sale. Over a year, that can easily save you thousands of dollars and insulate you from wild swings in the currency markets.

Staying Ahead Of Compliance

Compliance isn’t a one-and-done checkbox. It’s an ongoing process. You can bet your bank will conduct periodic reviews to ensure your account activity lines up with the business you told them you were running. Staying in their good books is straightforward: keep your records organized and be ready to provide documents if they ask.

A big piece of this puzzle is understanding global transparency standards like the Common Reporting Standard (CRS). This is the system that ensures financial account information is automatically shared with the tax authorities where you reside. It's a standard part of modern international finance and reinforces the legitimacy of your setup. Getting this right is non-negotiable, and our guide on demystifying offshore sourced income tax exemption can shed more light on the tax side of things.

Your relationship with the bank is a partnership. Proactive communication and transparent record-keeping are the cornerstones of a long-term, successful relationship. Treat compliance as a routine part of your business operations, not an obstacle.

Using Your Account As A Growth Engine

Beyond just paying suppliers and getting paid, your account can be a launchpad for new opportunities. Banking in a major financial hub like Hong Kong, for instance, gives you a front-row seat to a vibrant investment scene.

In early 2025, Hong Kong's stock market was the world's 6th largest, boasting a market capitalization of around US$5 trillion. In 2024 alone, IPOs there raised a staggering US$11.3 billion. This kind of stability and activity means offshore clients often get access to unique investment products and capital markets that are simply off-limits through a typical domestic bank.

When you manage your account smartly, it becomes more than just a place to hold cash. It transforms into a powerful engine for your global expansion.

Common Questions About Offshore Banking

Even after getting a handle on the benefits and the process, it's completely normal to have a few questions rattling around. The world of international finance can seem a bit opaque from the outside, so let's tackle some of the most frequent queries we hear from entrepreneurs ready to open an offshore bank account.

Is It Legal To Open An Offshore Bank Account?

Yes, absolutely. There’s a persistent myth that offshore banking is all about stashing cash in secret. The reality is that opening and maintaining an offshore bank account is perfectly legal, provided you play by the rules—both in your home country and in the bank’s jurisdiction.

The modern system is all about transparency. This means you must declare the account to your local tax authorities and report any income it generates, just as you would with a domestic account. Think of it as a legitimate financial tool used by international businesses for everything from asset protection and easier global trade to diversifying investments.

Do I Need To Travel To Open The Account?

Probably not. The idea that you have to hop on a plane is one of the biggest misconceptions we see. While it's true that some very traditional private banks, especially in places like Switzerland, might still want a face-to-face meeting, the vast majority of modern international banks have moved on.

These days, you can often handle the entire process from your office. This typically looks something like:

- Submitting certified documents through a secure online portal.

- Hopping on a video call for a quick verification interview.

- Leveraging a professional firm like ours, which has an existing relationship with the bank and can help smooth the way.

The key is to check the bank's specific policy upfront. A fintech-heavy bank in Hong Kong will have a radically different onboarding process than a legacy private bank in the Cayman Islands.

What Is The Minimum Deposit Required?

This is the classic "it depends" scenario, but the range is surprisingly wide. On one end, you have digital-first banks and fintech platforms that have zero minimum deposit requirements. They're a fantastic option for startups and small businesses just getting their footing internationally.

At the other extreme, elite private banks might be looking for an initial deposit of anywhere from $100,000 to over $1 million. Most business-focused international banks, however, land somewhere in the middle. We often see minimums in the $5,000 to $50,000 range. It's all about finding a banking partner that matches your company's current scale and future ambitions.

The most important thing to realize is that offshore banking isn't reserved for the ultra-wealthy. With the right guidance and by picking the right institution, it's an accessible and powerful tool for businesses of all sizes aiming to compete on a global stage.

How Does CRS Affect My Account?

The Common Reporting Standard (CRS) is essentially an agreement between countries to automatically share financial account information to combat tax evasion. If your bank is in a jurisdiction that has signed on to CRS (and almost all of them have), it will report your account details to its local tax authority.

From there, that authority forwards the information to the tax office in your country of residence. All this does is create a trail of transparency, ensuring everyone is compliant. It doesn’t stop you from holding the account; it just confirms that everything is being done correctly and openly.

Making sense of international banking is what we do best. At Lion Business Consultancy Limited, we guide entrepreneurs and SMEs through the process of opening offshore accounts in top-tier jurisdictions, handling the complexities so you can focus on global growth. Let's build your international financial strategy together.