Thinking about opening a business bank account in Hong Kong? Let's get one thing straight: this is more than just a box-ticking exercise. It's a strategic move that plugs your business directly into one of the world's most dynamic financial hubs.

To get it right, you need a smart approach. It’s about choosing the perfect banking partner, meticulously preparing your company and personal documents, and building a solid case for why your business belongs in Hong Kong.

Understanding The Hong Kong Banking Landscape

First, you have to get a feel for the local banking scene. It's a unique ecosystem, purpose-built for global commerce. For any entrepreneur with international ambitions, a Hong Kong bank account isn't just a place to hold cash—it's a powerful tool for growth.

The city's reputation as a top-tier financial centre wasn't built overnight. It's the result of a solid legal system, world-class infrastructure, and a heavy concentration of global banking power. This combination creates an incredibly stable and reliable platform for businesses juggling cross-border payments, making it an ideal base for international trade and investment.

A Hub of Financial Stability

At the core of this stability is the Hong Kong Monetary Authority (HKMA), which acts as the city's central bank. The HKMA keeps a tight rein on things, ensuring banks operate with integrity and security. This isn't just bureaucratic fluff; it’s the very reason a Hong Kong bank account carries so much weight with suppliers, clients, and partners around the globe.

When you open an account here, you're tapping into a system known for:

- A Strong Legal Framework: Based on English common law, which gives businesses a clear and predictable operating environment.

- Free Port Status: With no foreign exchange controls, you can move capital, profits, and dividends in and out of the city without any restrictions.

- Global Connectivity: The city offers seamless access to major markets, especially Mainland China, making it an indispensable gateway for anyone doing business in the region.

This regulatory muscle creates a secure and predictable environment—exactly what a growing business needs when managing international cash flow.

Before we go further, it’s worth taking a quick look at the direct advantages this brings to a small or medium-sized enterprise.

Key Benefits of a Hong Kong Bank Account for SMEs

Here's a quick look at the strategic advantages an entrepreneur gains by securing a Hong Kong business bank account.

| Benefit | Why It Matters for Your Business |

|---|---|

| Multi-Currency Support | Manage funds in USD, EUR, RMB, and other major currencies effortlessly, reducing conversion costs and simplifying international payments. |

| Global Reputation | A Hong Kong bank account enhances your company's credibility, making it easier to do business with international partners. |

| Gateway to Mainland China | Provides a direct and efficient channel for cross-border transactions with Chinese businesses, a huge competitive edge. |

| No Foreign Exchange Controls | Move your money freely without government restrictions, giving you complete control over your capital and profits. |

| Advanced Digital Banking | Access sophisticated online and mobile banking platforms designed for efficient, secure international business management. |

Ultimately, these aren't just features; they are tools that can give your business a serious competitive advantage on the global stage.

Navigating a Concentrated Market

Now for a dose of reality. The banking scene in Hong Kong is dominated by a few big names. Think of it like a premier league where a handful of top teams—HSBC, Standard Chartered, and Bank of China—control most of the game. This concentration directly affects how you, as an SME owner, will approach the account opening process.

In practice, this means that while you get access to world-class banking, the largest institutions are also the most demanding. They have strict due diligence protocols in place to protect the integrity of the financial system. In fact, World Bank data from 2021 showed that bank concentration in Hong Kong was around 62.47%. This figure highlights just how much of the market is held by a few key institutions and explains why most businesses naturally aim for these established banks. You can dig deeper into these banking dynamics on Trading Economics.

Key Takeaway: The real challenge isn’t just finding a bank. It’s about proving to the right bank that your business is a credible, low-risk partner worthy of joining this exclusive financial club. Your application is your first sales pitch.

Getting a handle on this landscape is your first step. It explains why the application process is so thorough and why your preparation has to be on point. It’s less about filling out forms and more about presenting a compelling business case to a world-class financial institution. In the sections that follow, we’ll break down exactly how to do that.

Meeting Eligibility: What Banks Actually Want to See

So, you're ready to open a bank account in Hong Kong. The first real hurdle is the eligibility check, and it's about much more than just having a registered company. Forget the generic checklists for a moment; let's talk about what the bankers sitting across the table are really looking for.

Think of it as a pitch. The bank is your potential partner, and they're asking one core question: "Is this business worth the risk?" Your entire job is to build a case that makes the answer a confident "yes."

This means proving your business has genuine substance, a clear purpose, and a solid connection to Hong Kong. It's about showing them you're more than just a name on a piece of paper.

Proving Business Substance

A Certificate of Incorporation is just the entry ticket. What banks need to see is a living, breathing, operational business. This is where so many entrepreneurs get tripped up—they have a fantastic idea but no tangible proof that it's actually happening yet.

To get past this, you need to show the engine is already running. This means providing hard evidence like:

- Signed contracts or client agreements: Proof that you have customers and confirmed orders.

- Invoices, both paid and unpaid: These are concrete evidence of commercial activity and cash flow.

- Supplier agreements: This shows you have an established supply chain and are actively engaged in your industry.

I remember working with a founder who ran an e-commerce business sourcing goods from Shenzhen. He was initially struggling to get an account approved. The game-changer? He didn't just show his business plan; he presented three key supplier contracts and a stack of invoices to his international clients. That tangible proof immediately shifted the bank's view of him from a "potential" business to a "real" one.

Key Takeaway: Banks are naturally risk-averse. They aren't here to fund a dream; they're here to facilitate a functioning business. Your documents need to tell the story of a company already in motion, not one waiting at the starting line.

Demonstrating a Clear Purpose and Connection

"Why Hong Kong?" You need to answer this question with absolute clarity. Banks are the gatekeepers against illicit activities, so they need to understand your logic for being here. A vague answer like "for international business" simply won't fly.

Your business plan has to spell out your connection. Are you sourcing products from Mainland China? Are your biggest customers in the Asia-Pacific region? Do you need access to Hong Kong’s financial markets for a future funding round?

Be specific. For instance, instead of just saying you need a multi-currency account, explain that 70% of your supplier payments are in USD and 30% are in RMB, making a Hong Kong account essential for managing foreign exchange costs.

It really helps to get inside the bank's head. They are under enormous regulatory pressure to perform strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. If you want to understand their perspective, it's worth looking into how banks utilize AI in financial risk assessment to screen applicants. This knowledge can help you build a profile that ticks their boxes.

The Non-Resident Challenge

If you're not a resident, the scrutiny gets even tighter. Banks need to be convinced that you've chosen Hong Kong for strategic business reasons, not just as a flag of convenience. Our detailed guide on the Hong Kong bank account requirements for non-residents goes into much more detail on this specific challenge.

To succeed here, you must tie your business activity directly to the region. This might mean showing:

- A regional client base: Provide invoices or contracts with clients in Hong Kong or nearby Asian markets.

- Supply chain links: Show proof of partnerships with manufacturers or suppliers in Mainland China or Southeast Asia.

- Future local plans: If you have plans to hire staff or lease an office in Hong Kong, make sure you include this in your business summary.

In the end, meeting the eligibility requirements is all about building a narrative of trust and legitimacy. The more evidence you can provide that your business is real, active, and has a logical reason to be in Hong Kong, the easier your path to account approval will be.

Assembling Your Application Document Toolkit

Think of your application file as your business's passport. One missing stamp or an out-of-date photo can stop you in your tracks. When you want to open a bank account in Hong Kong, getting your documents together isn't just about collecting papers; it’s about telling a clear story that the bank can easily understand and say "yes" to.

For entrepreneurs and small businesses, this can feel like navigating a maze. You know you need the basics, but what about the extra documents that really build a strong case for your business? Let's walk through how to prepare a file that’s not just complete, but professional and ready for any question the bank might throw at you.

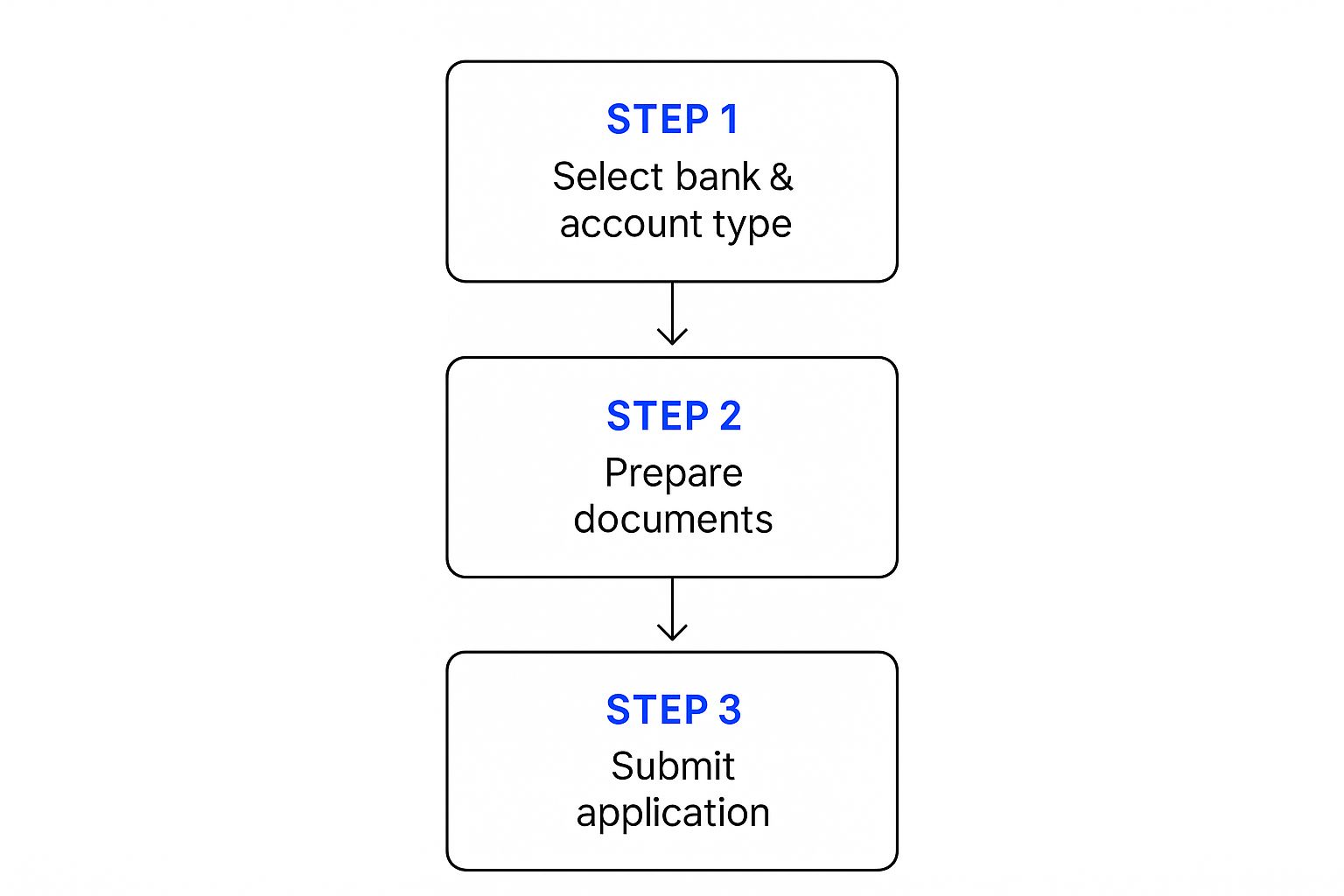

The process has a few key stages, from picking the right bank to getting your paperwork sorted and finally submitting the application.

As you can see, preparing your documents is the critical bridge connecting your choice of bank with your final application. It’s the foundation of the whole process, and getting it right is everything.

The Core Documents: Your Non-Negotiables

First things first, let's cover the essentials. Every single bank in Hong Kong will ask for a standard set of corporate documents. These are the absolute fundamentals—there’s no wiggle room here.

- Certificate of Incorporation & Business Registration Certificate: These are essentially your company’s birth certificates. They prove you're a legally registered entity in Hong Kong.

- Articles of Association: This document lays out the rules for how your company is run internally. The bank will look at this to understand who has the authority to open an account and manage the finances.

- Director and Shareholder Information: You'll need certified true copies of passports and a recent proof of address (like a utility bill or bank statement) for every director, major shareholder (usually anyone with 10% or more), and authorised signatory.

These documents form the bedrock of your application, but they only tell part of the story. To really make your application shine, you'll need to go a bit deeper.

To make it easier to see what's what, I've broken down the paperwork into two categories: the must-haves and the nice-to-haves. Getting the essentials right is mandatory, but providing strong supporting documents can dramatically speed up your approval.

Essential vs Supporting Documentation

| Document Type | Purpose for the Bank | Pro Tip |

|---|---|---|

| Essential: Certificate of Incorporation & Business Registration | Verifies your company is a legal HK entity. | Ensure the BR Certificate is valid and not expired. This is a common oversight. |

| Essential: Articles of Association (M&A) | Shows corporate governance and who can act for the company. | Highlight the clauses specifying powers to open and operate bank accounts. |

| Essential: Director/Shareholder/Signatory ID | Fulfills "Know Your Customer" (KYC) compliance. | Use a recent utility bill (less than 3 months old) for proof of address. |

| Supporting: Business Plan | Explains your business model, revenue, and need for the account. | Be specific. Instead of "international trade," say "paying suppliers in Shenzhen." |

| Supporting: Proof of Business | Provides tangible evidence of commercial activity. | Signed contracts are gold. Even a link to your company website or a director's LinkedIn helps. |

| Supporting: Financial Projections | Demonstrates financial viability and expected transactions. | Keep projections realistic and well-reasoned. Banks are wary of overly ambitious figures. |

Having this full set of documents ready shows the bank you're organised and serious, which immediately builds confidence in your application.

Documents That Prove You're a Real Business

This is where a lot of applications stumble. Hong Kong banks are under huge regulatory pressure to prevent financial crime, so they need to see more than just your corporate filings. They need proof that you run a real, legitimate business.

A solid business plan is your best tool here. It should clearly outline your business model, who your customers are, and your revenue forecasts. Most importantly, it has to explain why you need a bank account in Hong Kong. Is it for paying regional suppliers? Or maybe for receiving payments from clients across Asia? The more specific, the better.

But don’t stop there. You need to back up your plan with real evidence of your business activities. Think about including things like:

- Contracts you’ve signed with clients or suppliers

- Invoices you’ve sent for services or goods

- Your company website or marketing brochures

- The CVs of the company directors

Put yourself in the bank’s shoes. A business plan full of forecasts is one thing, but a signed contract is hard proof that you’re already in business. I once worked with a founder who simply included a short bio and a link to his professional LinkedIn profile in the application. It was a small touch, but it helped humanise the directors and build trust with the compliance officer.

Key Insight: Your goal is to paint a complete picture of a legitimate, low-risk business. The more evidence of commercial substance you provide, the less risk the bank perceives, and the smoother your application process will be.

Financials and Accounting: The Final Piece of the Puzzle

Finally, let's talk numbers. Your financial documents tie the whole story together. Banks need to understand where your funds are coming from and the kinds of transactions you expect to make. This isn't just a box-ticking exercise for them; it's about making sure your actual account activity will match what you’ve told them in your application.

Well-organised financial records are a clear sign of a well-run company. If you're a startup, you might not have a long history, but providing clear financial projections is absolutely vital. For established businesses, having professionally prepared financial statements can make a huge difference. If you're unsure what's expected, our guide on accounting services in Hong Kong can shed more light on what banks look for.

Your financial toolkit should include:

- Proof of initial funding or source of wealth for the shareholders.

- Financial projections for the next 12-24 months.

- Existing financial statements if your company is already up and running.

By meticulously putting this all together, you're doing more than just meeting the minimum requirements. You're presenting a compelling, transparent, and professional case that makes approving your account an easy decision for the bank.

Choosing the Right Banking Partner for Your SME

Picking a bank in Hong Kong isn't just about finding a place to stash your cash. It's a strategic decision. Get it right, and your bank becomes a partner that helps you grow. Get it wrong, and you’ll find yourself tangled in bureaucracy when you should be running your business.

The big international names like HSBC and Standard Chartered are often the first ones people think of, but they aren't always the best fit for every SME.

The trick is to look past the fancy logo and focus on what actually matters for your company's day-to-day operations. You need to dig into their appetite for your industry, how good their multi-currency features are, the quality of their online banking, and, of course, the fees and minimum balances that hit your bottom line.

Traditional Banks vs. Virtual Banks

Hong Kong's banking scene is a fantastic mix of the old guard and the new school. You have the established giants, the nimble local players, and the disruptive virtual banks all vying for your business. Each type has its own personality and its own set of trade-offs.

- International Banks (e.g., HSBC, Standard Chartered, Citibank): These are the global powerhouses. They offer solid multi-currency platforms, huge international networks, and a full menu of corporate services. The downside? They’re notorious for their tough onboarding process, higher minimum balance requirements (often starting at HKD 50,000), and a more cautious approach to new clients.

- Local Banks (e.g., Hang Seng, Bank of East Asia): Often much more SME-friendly, these banks have deep roots in the local market and excellent connections to Mainland China. While their global reach might be smaller, they can offer lower fees and a more personal relationship. Be warned, though—their digital platforms can sometimes feel a bit clunky compared to the global players.

- Virtual Banks (e.g., ZA Bank, Mox Bank): As the new kids on the block, these digital-only banks promise a quick and painless account opening with low fees and often no minimum balance. They're great for local transactions and for tech-savvy founders. However, their corporate account features and international payment options are still maturing and might not cut it for a business with complex global trade needs.

A Real-World Example: I once worked with a tech startup that was dead-set on a top-tier international bank. After weeks of frustrating delays and endless questions, they switched their strategy. They approached a local bank that was more comfortable with their business model. The process was miles faster, and they ended up with a relationship manager who actually understood their need for flexible trade finance—something the bigger bank was never going to offer a new company.

Looking Beyond the Brand Name

When you want to Hong Kong open bank account, the name on the door is far less important than what’s happening inside. You need to size up each potential bank based on the factors that will directly impact how you do business.

Think of it like hiring a key employee. You wouldn't hire a new CFO just because they went to a famous university; you'd look at their actual skills and experience. The same logic applies here.

This is especially true in a market as strong as Hong Kong. The city’s financial stability is a major magnet for businesses globally. In fact, total deposits in Hong Kong's banking system recently climbed to an all-time high of approximately USD 2.26 trillion, which shows just how much confidence people have in its banks. This massive pool of capital means banks are well-equipped to serve businesses, but it also makes them selective. You can find more details about Hong Kong's deposit trends on CEIC Data.

Key Factors to Evaluate

To make a smart choice, create a simple scorecard for each bank you're considering. Focus on these critical points:

- Industry Appetite: Does this bank get your business? Some are brilliant with traditional trading companies, while others have developed a real niche in fintech or e-commerce. Don't be shy—ask a potential relationship manager about their experience in your sector.

- Multi-Currency Features: If you pay suppliers in USD and receive funds from clients in EUR, you need an account that handles this without bleeding you dry on fees. Check their FX rates and see how easy it is to manage different currency pots online.

- Online Banking Platform: Your business doesn't stop at 5 PM, and your banking platform shouldn't either. If you can, get a demo. Is the interface intuitive? Can you easily schedule international payments, manage user permissions for your team, and connect it to your accounting software? A clunky platform can waste hours of your time every single month.

- Fees and Balances: This is a big one. Go through the fee schedule with a fine-tooth comb. Look for account maintenance charges, transaction costs (especially for international wires), and those dreaded "fall-below" fees for dipping under the minimum balance. These little costs add up fast.

Choosing the right bank is the foundation for your financial operations in Asia. Take your time, do the research, and find a true partner that’s aligned with your business goals—not just one with a familiar logo.

Mastering the Application and Bank Interview

This is where all your careful preparation pays off. You've scouted the right bank and gathered every last document. Now it's time for the final stretch: submitting the application and acing the bank interview. This is the moment that determines whether you successfully open a bank account in Hong Kong.

Don't think of this as just another bureaucratic hoop to jump through. It's your final pitch. You're not simply filling out forms; you're convincing a compliance officer that your business is a legitimate, low-risk partner they'd be happy to work with.

Let's walk through how to navigate this crucial phase with confidence.

The Application Form Itself

That application form can look daunting. It's often dense with detailed questions about every facet of your business operations. My best advice? Slow down and be meticulous. A single inconsistent answer can raise a red flag and grind the whole process to a halt.

Pay special attention to these areas:

- Business Activity: Be incredibly specific here. "International trade" is too vague. Instead, try something like, "Importing electronic components from Shenzhen, China, for resale to corporate clients in Germany and the UK."

- Expected Transactions: Give them realistic numbers. Estimate your monthly turnover, the number of payments coming in and going out, and the average transaction size. Banks use this to create a financial profile for you, and any major deviations down the line could trigger an uncomfortable account review.

- Source of Funds: Be transparent about where your initial capital is coming from, whether it's personal savings, a business loan, or retained profits from another venture.

Think of the application as your chance to frame the narrative. Every field you fill in should perfectly align with the story you’ve told in your business plan and client contracts.

Nailing the Bank Interview

The interview is where you bring your application to life. It's an opportunity for the bank manager to look you in the eye and gauge your credibility. It’s less of an interrogation and more of a conversation to confirm you are who you say you are and that your business is sound.

Here’s how to turn what feels like a test into a genuine discussion about partnership.

Anticipating the Key Questions

Bankers are trained to sniff out risk, so their questions are designed to do just that. You should be ready to talk about your business with absolute clarity. The most common questions will almost always circle back to these points:

- Your Business Model: "Can you walk me through exactly how your business makes money?"

- Your Target Customers: "Who are your main clients, and where are they based?"

- Your Supply Chain: "Who are your key suppliers, and what are your payment terms with them?"

- Your Connection to Hong Kong: "Why specifically do you need a bank account here?"

- Your Financials: "What are your revenue projections for the next 12 months?"

The trick is to answer directly and immediately tie your answers back to the documents you've already provided. For example, when they ask about clients, you can say, "Our main clients are in the EU, as you'll see from the signed contracts we submitted with Company X and Company Y."

It also helps to show you understand the current climate. The Hong Kong Monetary Authority recently reported a 2.5% monthly jump in total deposits, largely due to strong corporate fund flows. This heightened activity makes banks even more careful about who they onboard. You can find more detail on these monetary trends directly from the HKMA. Mentioning you're aware of these dynamics shows you’ve done your homework.

Pro Tip: Dress professionally, be on time (whether it's in-person or a video call), and have a neat set of copies of all your key documents with you. Professionalism and organisation tell the bank a lot about how you run your business.

Common Red Flags Bankers Watch For

Knowing what not to do is just as important as knowing what to do. Bankers are on high alert for inconsistencies that signal risk. Make sure you avoid these common tripwires:

- Vague or Evasive Answers: If you can’t clearly explain your own business model, it suggests you either don't fully understand it or you're trying to hide something.

- Opaque Ownership Structures: Does a web of entities across multiple jurisdictions own your company? If so, be ready for some serious scrutiny. You must have a solid commercial reason for that structure.

- High-Risk Industries or Jurisdictions: If your business operates in a high-risk sector (like cryptocurrency) or deals with sanctioned countries, expect a much tougher interview.

- Inconsistent Information: Your verbal answers must match your written application to the letter. Any discrepancy, however small, will create doubt.

I once worked with a founder who nearly had his application thrown out because he gave a much higher projected turnover in the interview than what was in his business plan. He was feeling optimistic that day—an honest mistake—but it raised an unnecessary red flag that took weeks to resolve. Consistency is your best friend.

Ultimately, getting through this final stage comes down to transparency, preparation, and professionalism. If you can anticipate the bank's questions and communicate clearly, you'll show them you’re a serious entrepreneur ready to do business in one of the world's top financial hubs.

Answering Your Questions About Opening a Hong Kong Bank Account

Even with the best preparation, you're bound to have some questions. It’s a big step. Let’s tackle some of the most common queries we hear from entrepreneurs, giving you the clear answers you need to move forward with confidence.

What if My Bank Account Application Is Rejected?

First off, don't panic. A rejection isn't the end of the road; it's a sign that something in your application didn't quite click with that specific bank.

The tricky part is that banks rarely give you a detailed breakdown of their decision due to strict compliance policies. From my experience, the problem usually boils down to one of three things:

- Simple paperwork errors: It could be as minor as a missed signature or a proof of address that’s a few weeks out of date.

- A perceived high risk: Your business model, the industry you operate in, or the countries you deal with might have raised a red flag in their internal risk assessment.

- Not enough substance: The bank might not be convinced your business has a genuine connection to Hong Kong or a clear commercial purpose.

What should you do? Start by politely asking the bank for feedback. If they can't provide any, it's time to review your application with a fine-tooth comb. Look at it from their perspective. Often, the fix is as simple as providing more documentation to support your business case or applying to a different bank whose risk appetite is a better fit for your industry.

Can I Open a Hong Kong Bank Account Remotely?

This is probably the question I get asked most often. For traditional banks, the answer is almost always no. Most major banks in Hong Kong require at least one director or the primary signatory to visit in person to finalise the account opening. This face-to-face meeting is a non-negotiable part of their Know Your Customer (KYC) obligations.

While some of the newer virtual banks or fintech platforms offer remote onboarding, be aware that their services might not have the capacity for complex international trade or high-volume transactions. For a proper corporate account with a top-tier bank, you really need to factor in a trip to Hong Kong.

Expert Insight: Don't view the in-person meeting as a hassle. See it as your chance to make a great first impression and build a real relationship. It lets you put a face to the name on the application and personally clear up any questions the bank manager might have. This personal touch can make all the difference.

How Do I Manage the Account From Overseas?

Once you’re set up, managing the account from anywhere in the world is actually the easy part. Hong Kong's banks have some of the most sophisticated and secure online banking platforms available.

You'll have everything you need at your fingertips:

- Send international payments in various currencies.

- Set different access levels and permissions for your team.

- Check your balance and download statements in real-time.

- Connect the account with accounting software like Xero or QuickBooks.

The secret to smooth sailing is keeping the lines of communication open with your bank. If a large, out-of-the-ordinary transaction is coming up, give your relationship manager a quick heads-up. This simple, proactive step helps prevent your account from being flagged for suspicious activity, a common headache you'll want to avoid. For more on this, our Hong Kong banking checklist to avoid account freezes is a must-read.

Figuring out international banking is a crucial piece of the puzzle when you're expanding your business. At Lion Business Consultancy Limited, we specialise in setting up solid, compliant banking solutions that protect your assets and fuel your growth.

If you want an expert partner to make sure your Hong Kong bank account opening is a success, book a consultation with us today.