When setting up a business, you'll encounter numerous new terms. One of the most critical is the correspondence address. So, what exactly does correspondence address mean?

A correspondence address is your company's official mailbox. It is the single, designated address where all important mail will arrive—from government bodies, banks, clients, and suppliers. This isn't necessarily where you physically work, but it's the address the world uses to contact your business officially.

Getting to Grips with Your Business Correspondence Address

Imagine your correspondence address as your business's central mailroom. It’s the spot designated for all the operational paperwork that keeps your company running: bank statements, contracts from suppliers, invoices for clients, and official notices. Having one ensures you never miss a beat and maintain clear, prompt communication with everyone who matters to your business.

This is a crucial piece of the puzzle, especially when you start to explore the requirements for company registration in Hong Kong, as having valid, compliant addresses is non-negotiable. A key distinction to make is that your correspondence address is not your home address. This separation is fantastic for entrepreneurs, as it provides a valuable layer of privacy and professional flexibility.

Correspondence Address at a Glance

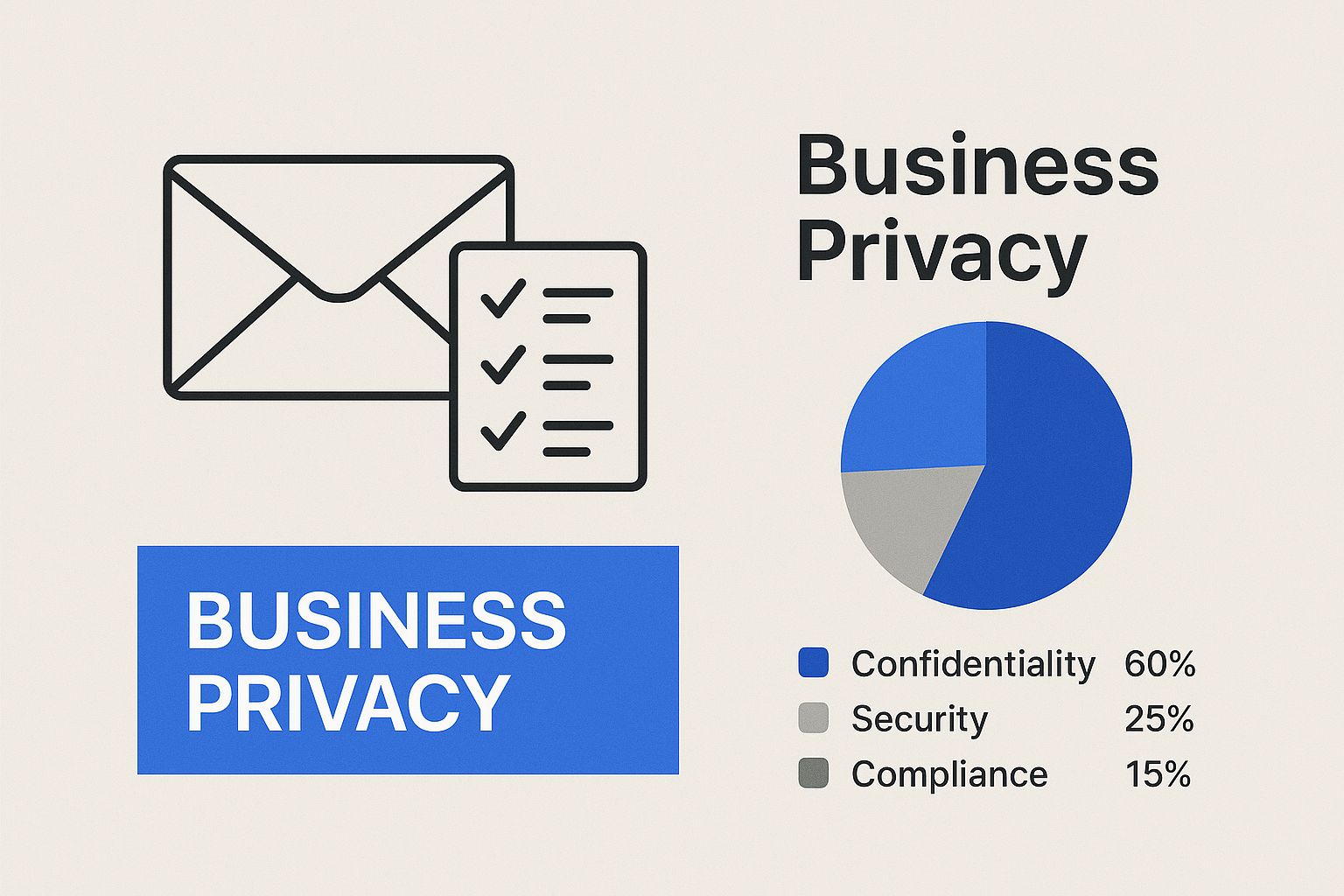

A well-chosen correspondence address does more than just centralise your mail. It plays several critical roles in building a professional, compliant business from day one.

Here’s a quick summary of what it does for you:

| Characteristic | Description |

|---|---|

| Primary Function | Serves as the official mailing point for all your business communications. |

| Flexibility | Can be completely different from where you actually work or live. |

| Professionalism | Projects a credible, stable image to clients, partners, and financial institutions. |

| Privacy | Keeps your personal home address off public records and separate from your business life. |

| Compliance | Satisfies Know Your Customer (KYC) requirements for banks and other regulated services. |

Ultimately, a dedicated correspondence address brings reliability. It’s a guarantee that your important documents will find their way to you securely and on time, which is absolutely fundamental to running a business smoothly and effectively.

Correspondence Address vs Registered Address

When you're setting up a new business, it’s easy to get tangled up in the terminology. Two terms that often cause confusion are the 'correspondence address' and the 'registered address'. Getting them mixed up isn't just a minor slip-up; it can lead to real compliance headaches down the line.

Think of it this way: one address is for your official, legal life, while the other is for your day-to-day business conversations. They serve completely different functions, and it's vital to understand how each one works from the get-go.

The Official Face: Your Registered Address

Your registered address is a non-negotiable legal requirement. This must be a physical location in Hong Kong and is listed on the public Companies Register for all to see. It’s the official address where government bodies, like the Inland Revenue Department, will send important legal notices and statutory mail. This address anchors your company's legal existence in Hong Kong.

The Operational Hub: Your Correspondence Address

The correspondence address is your practical, everyday mailing hub. This is where your bank will send statements, where clients send their payments, and where suppliers direct their invoices. The key here is flexibility. It doesn't have to be the same as your registered address, which gives you a huge advantage when it comes to privacy and convenience.

This simple separation is one of the smartest moves a new business owner can make to protect their privacy.

As you can see, choosing a separate correspondence address isn't just an administrative detail—it's a strategic decision to shield your personal details while building a professional business presence.

Comparing Your Key Business Addresses

To really hammer home the differences, it helps to see them side-by-side. While the specifics can vary by jurisdiction—for example, it’s useful to understand the role of Companies House in the UK—the core principles are similar for Hong Kong's Companies Registry.

Let’s break it down in a simple table.

| Feature | Correspondence Address | Registered Office Address |

|---|---|---|

| Primary Purpose | Handles day-to-day business mail (clients, banks, suppliers) | Receives official government and legal correspondence |

| Public Record? | No, it can be kept private. | Yes, it is publicly listed on the Companies Register. |

| Location Requirement | Can be a P.O. Box or virtual office anywhere. | Must be a physical address within Hong Kong. |

| Flexibility | Highly flexible—ideal for remote or international founders. | Fixed and formal—changes must be officially registered. |

| Example Use Cases | Invoices, client contracts, bank statements, marketing mail. | Tax notices, court documents, official company letters. |

This comparison makes it clear: one address is about legal compliance and public record, while the other is all about operational efficiency and personal privacy.

Getting this right is a fundamental step when you are incorporating a company in Hong Kong. By using each address for its intended purpose, you’re not just staying compliant—you’re setting up your business to be professional, secure, and ready for growth from day one.

Why Bother With a Separate Correspondence Address?

When you’re just getting started, using your home address for your business can feel like the easiest path. It's simple, it's free, and it gets you up and running quickly. But this convenience is deceptive and comes with some serious downsides.

Choosing a separate correspondence address isn't just about ticking a box on a form. It's a smart, strategic decision that pays off in privacy, professionalism, and plain old peace of mind. For new startups and international founders especially, it's a foundational step in building a brand that people trust from the very beginning.

Keep Your Home Life Private

The single biggest reason to get a separate address is to protect your privacy. As soon as your home address becomes your business address, it's out there for the world to see—on your website, on invoices, and in public records.

This can quickly lead to a letterbox full of junk mail, unexpected sales visits right at your front door, and, in a worst-case scenario, genuine security risks for you and your family. A dedicated business address, like one from a virtual office provider, acts as a firewall, keeping your personal life completely separate from your professional one.

This isn't just a preference; it's a recognised need. Hong Kong's Companies Ordinance has been updated to better shield the personal details of directors on the Companies Register. You can learn about these protective measures on the Companies Registry website.

Look Like the Professional You Are

First impressions count for everything in business. An address in a well-known commercial area immediately makes your company look more credible and trustworthy. It sends a powerful signal to clients, banks, and investors that you’re a serious operation, even if you’re running the show from your kitchen table.

Think about the practical advantages:

- Builds Client Trust: A proper business address gives customers the confidence that they're dealing with a legitimate, stable company.

- Strengthens Partner Confidence: Potential partners and investors are far more likely to take you seriously when you present a professional image.

- Makes Mail a Breeze: Virtual offices often include mail forwarding and scanning services. This means you get all your important post promptly, no matter where you are in the world—an absolute lifesaver for global entrepreneurs.

Getting Your Hong Kong Correspondence Address Sorted

So, how do you actually get a professional correspondence address in Hong Kong? It’s surprisingly simple, and you can sort it all out without ever setting foot in the city. Forget the headache and expense of leasing a physical office space; there are much smarter ways to establish a credible local presence.

The go-to solutions for most businesses are virtual office providers or company secretarial services. Think of them as your business's front door in Hong Kong. They offer a prestigious address bundled with mail management services, giving your company an instant boost in professionalism. It’s a cost-effective approach that’s perfectly suited for modern entrepreneurs running their businesses from anywhere in the world.

Choosing the Right Service Provider

When you're looking for a provider, remember you're buying more than just an address on a building. You're getting a service package that can make or break your remote operations.

Here are a few essential services you should look for:

- Mail Forwarding: This is the bread and butter. They’ll collect your post and forward it to you, wherever you are. Absolutely vital for keeping on top of official letters and documents.

- Mail Scanning: For anything urgent, this is a lifesaver. Your provider will open, scan, and email documents straight to your inbox. No more waiting for international post to arrive.

- Dedicated Phone Number: Some packages throw in a local Hong Kong phone number. It’s a small touch that adds a significant layer of professionalism and makes it easier for local clients and partners to reach you.

How to Format Your Address Correctly

Once you’ve got your address, you need to use it correctly everywhere – on your website, your business cards, and especially on bank and government forms. Getting the format right is crucial.

Hong Kong has a standard, logical format. Here’s a real-world example of what it looks like:

Your Company NameSuite 1234, 12/FTower 5, The GatewayHarbour City, Tsim Sha TsuiKowloon, Hong Kong

Using this exact format shows you mean business. It signals attention to detail and helps you avoid any frustrating delays with banks or government agencies. Getting it right from day one ensures your operations run smoothly without any silly administrative hiccups.

How Your Address Impacts Your Business Bank Account

Picking an address for your new company might seem like a simple box-ticking exercise, but it’s one of the most critical decisions you'll make. It directly affects your chances of opening a business bank account, especially in a world-class financial centre like Hong Kong.

Traditional high-street banks are notoriously rigid. They demand solid proof of a physical office, like a recent utility bill or a signed tenancy agreement in your company's name. For a brand-new startup, a remote-first business, or a company with international founders, this can be an impossible hurdle. It’s a classic chicken-and-egg problem that leads to nothing but frustrating delays and rejections.

This is where a correspondence address becomes your secret weapon. Using a professional address from a recognised provider completely changes the conversation. It gives you a legitimate, verifiable Hong Kong address that ticks all the right boxes for the bank's strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Suddenly, you're not an outlier; you're a viable applicant who understands the rules of the game.

Why Starting with a Digital Account Should Be Your First Step After Company Incorporation

For startup founders, foreign investors, and small business owners across the globe, opening a business bank account is a critical first step post-company incorporation. However, traditional bank accounts can pose significant challenges, especially for non-local companies or recently established local firms without any business proof. This is where digital accounts provide a clear advantage.

The Challenge with Traditional Bank Accounts

Traditional banks typically require strong local business justification before opening an account. They often ask:

- Do you have local customers, suppliers, or employees that require a local bank account?

- Do you hold a personal account with the bank and seek to add a business account?

Applicants must provide proof such as invoices, transaction records, or employment documents. For fresh companies with no prior transaction history, these requirements can be almost impossible to satisfy upfront, leading to frequent application rejections.

Why Digital Accounts Are Ideal for New and Non-Local Companies

Digital banking solutions like Airwallex, Aspire, Currenxie, Transwap, and Payoneer prioritize speed, flexibility, and inclusivity, allowing new companies to open accounts without extensive business proof.

Key advantages include:

- Remote and Fast Account Opening: Usually completed in less than one week once documents are submitted, enabling businesses to start operations immediately.

- Multicurrency Business Accounts: Support currencies such as USD, EUR, GBP, HKD, SGD, and more, helping global businesses operate seamlessly.

- Global Payments Without Restrictions: Send and receive funds worldwide without limitations.

- Corporate Visa Cards: Useable globally for in-store, online purchases, and ATM withdrawals.

- Accounts from Top Banks: Receive account details from reputed banks like Citibank, DBS, or Standard Chartered in Hong Kong and Singapore.

- Integration with Popular Payment Gateways: Compatible with PayPal, Stripe, and more, simplifying payment collection and accounting.

Example account details typically provided are:

Account Name: YOUR COMPANY NAME

Account Number: 7*******0

SWIFT/BIC Code: DHBKHKHH

Bank Name: DBS Bank (Hong Kong) Limited

Bank Code: 016

Branch Code: 478

Location: Hong Kong

Legal and Compliance Considerations

For non-local companies and local companies with non-resident owners, digital accounts comply with KYC and AML regulations while offering a smoother onboarding process. Although documentation is required, the digital platforms are designed to accommodate international documentation and proof, avoiding the rigid requirements often seen in traditional banking.

Data-Backed Benefits

Studies and industry reports reveal that digital bank account openings take on average 70–90% less time compared to traditional banks. Businesses report up to 50% lower costs in banking fees during the first year with digital accounts. Furthermore, 85% of startups cite ease of integration with payment gateways as a critical factor in choosing digital banking.

Step-by-Step Guide to Opening a Digital Account After Incorporation

- Gather company incorporation documents, identification of beneficial owners, and proof of address.

- Choose a reputable digital banking provider (e.g., Airwallex, Aspire).

- Complete the online application form and upload required documents remotely.

- Await verification—usually completed within 3 to 7 days.

- Receive account details and start using your business account immediately.

Remember, this isn't just a banking preference. Over 90% of government communications depend on having an accurate, verifiable address. Regulations often demand proof from official documents dated within the last three months. You can dive deeper into these standards by exploring data from Hong Kong's Census and Statistics Department.

Streamlining the KYC and AML Process

The KYC stage is where most bank applications get stuck. Banks are legally required to verify who you are and where your business operates to combat financial crime. A residential address from another country or a freshly registered location with no history can raise immediate red flags for a bank's compliance team.

A professional correspondence address takes that headache away. Financial institutions recognise these addresses and the providers who offer them. To make things even smoother, you can engage professional address verification services to get all your documents in order beforehand. This proactive step gives the bank the confidence it needs, paving the way for a much faster approval.

For more hands-on advice, check out our guide on successful bank account opening in Hong Kong.

Answering Your Top Questions About Correspondence Addresses

Even once you’ve got the basics down, a few practical questions always pop up when setting up a business in Hong Kong. It’s completely normal. Let's walk through some of the most common queries we hear from entrepreneurs, so you can get these details right and ensure a smooth, compliant start.

Can I Just Use a P.O. Box?

The short answer is no. While a P.O. Box is fine for casual mail, it won't work for official business purposes in Hong Kong.

Government bodies like the Companies Registry, along with banks and other financial institutions, need a physical address on file. This is a non-negotiable requirement for Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which demand a real, verifiable location. A simple P.O. Box just doesn’t meet that standard.

Will My Correspondence Address Be Made Public?

This is a really important question, especially for home-based entrepreneurs. Here’s the key distinction: your correspondence address is only public if you also use it as your company's registered address.

The registered address is legally required to be listed on the public Companies Register, where anyone can look it up. By using a separate, private address for your day-to-day correspondence with banks and clients, you can keep it completely off the public record. It's a smart, effective way to protect your privacy while still presenting a professional image.

What Documents Count as Proof of Address?

When a bank or government body asks for proof of address, they're looking for an official document that’s recent—usually issued within the last three months.

Generally, they'll accept documents like:

- A recent utility bill (electricity, water, gas)

- A statement from your bank or credit card company

- An official letter from a government department

The great thing about using a virtual office provider is that they can often issue a formal service agreement or a confirmation letter. Many digital banks and other modern institutions now accept this as valid proof of your business's correspondence address in Hong Kong, making the process much simpler.

Is It a Good Idea to Use My Home Address?

While it might seem like the easiest option, using your home address is something we strongly advise against for a couple of major reasons.

First, it puts your personal, residential details out there on everything from invoices to contracts. This creates obvious privacy and security risks you probably don't want to take.

Second, it can make your business look less established. A dedicated business address signals credibility and professionalism to potential clients, investors, and partners. It's a small investment that pays off by helping you build a safer, more credible company image right from the start.

Ready to establish your professional presence in Hong Kong without the compliance headaches? Lion Business Consultancy Limited specialises in providing startups and SMEs with the tools they need for global success, including compliant company formation and seamless bank account opening. Get started with Lion Business Co. today!