Opening a bank account in Hong Kong is a crucial first step for any entrepreneur looking to plant their flag in one of Asia’s most dynamic financial hubs. The entire journey really boils down to three key stages: picking the right bank, getting your company documents flawlessly organized, and confidently navigating the Know Your Customer (KYC) checks.

Be prepared for different timelines. With a traditional bank, you could be looking at anywhere from one to four weeks of back-and-forth. In stark contrast, many of the newer digital banks can get you up and running in just a few days.

Decoding the Hong Kong Banking Landscape

For anyone new to the scene, trying to open a corporate bank account in Hong Kong can feel like a real headache. You hear the stories—endless interviews, surprise document requests, and flat-out rejections. It's enough to make you second-guess the whole venture.

But let's look at it another way. This isn't about navigating a maze blindfolded; it's about having the right map.

Solid preparation is your best friend here. The real work starts long before you even think about filling out an application. It begins with understanding why banks in Hong Kong are so thorough. They are the gatekeepers to an incredibly stable and respected international financial system, and they take that role seriously. They simply need to be confident that your business is legitimate, transparent, and not a risk.

Traditional Institutions vs Modern Solutions

The banking world isn't what it used to be. You're no longer stuck choosing between a few old-school banks with their grand marble halls. A fresh wave of digital banks and fintech platforms has completely changed the game, offering a much different, more streamlined experience.

- Traditional Banks: These are the established names you know. They offer the full suite of services, from complex trade finance to major business loans. The trade-off? They often require in-person meetings and have much longer, more rigorous application processes. Think of them as a bespoke suit—powerful, but it takes time to get the fit just right.

- Digital Banks & Fintechs: These newcomers are built for speed and convenience. Their onboarding is often entirely online, making them a fantastic fit for startups and SMEs with more straightforward banking needs. They're the high-quality, off-the-rack solution that gets you moving fast.

The choice isn't about which is objectively "better," but which is the right fit for your specific business.

Traditional Banks vs Digital Solutions at a Glance

To make the decision clearer, here’s a quick breakdown of what to expect from each option.

| Feature | Traditional Hong Kong Banks | Digital Banks & Fintechs |

|---|---|---|

| Onboarding Process | In-person interviews often required; can take weeks. | Fully remote, online application; often approved in days. |

| Service Scope | Comprehensive (trade finance, complex loans, wealth management). | Focused on core business banking (payments, cards, FX). |

| Initial Deposit | Often require significant minimum deposits (HK$50,000+). | Low or no initial deposit required. |

| Ideal For | Established corporations, businesses needing complex credit facilities. | Startups, SMEs, e-commerce, and location-independent businesses. |

| Support | Dedicated relationship manager, branch support. | Primarily chat, email, and app-based customer service. |

Ultimately, both paths lead to a functional Hong Kong bank account. Your business model, urgency, and need for specialised services will point you in the right direction. For a more detailed breakdown, it’s worth comparing traditional banks vs digital banks in Hong Kong to see which truly aligns with your goals.

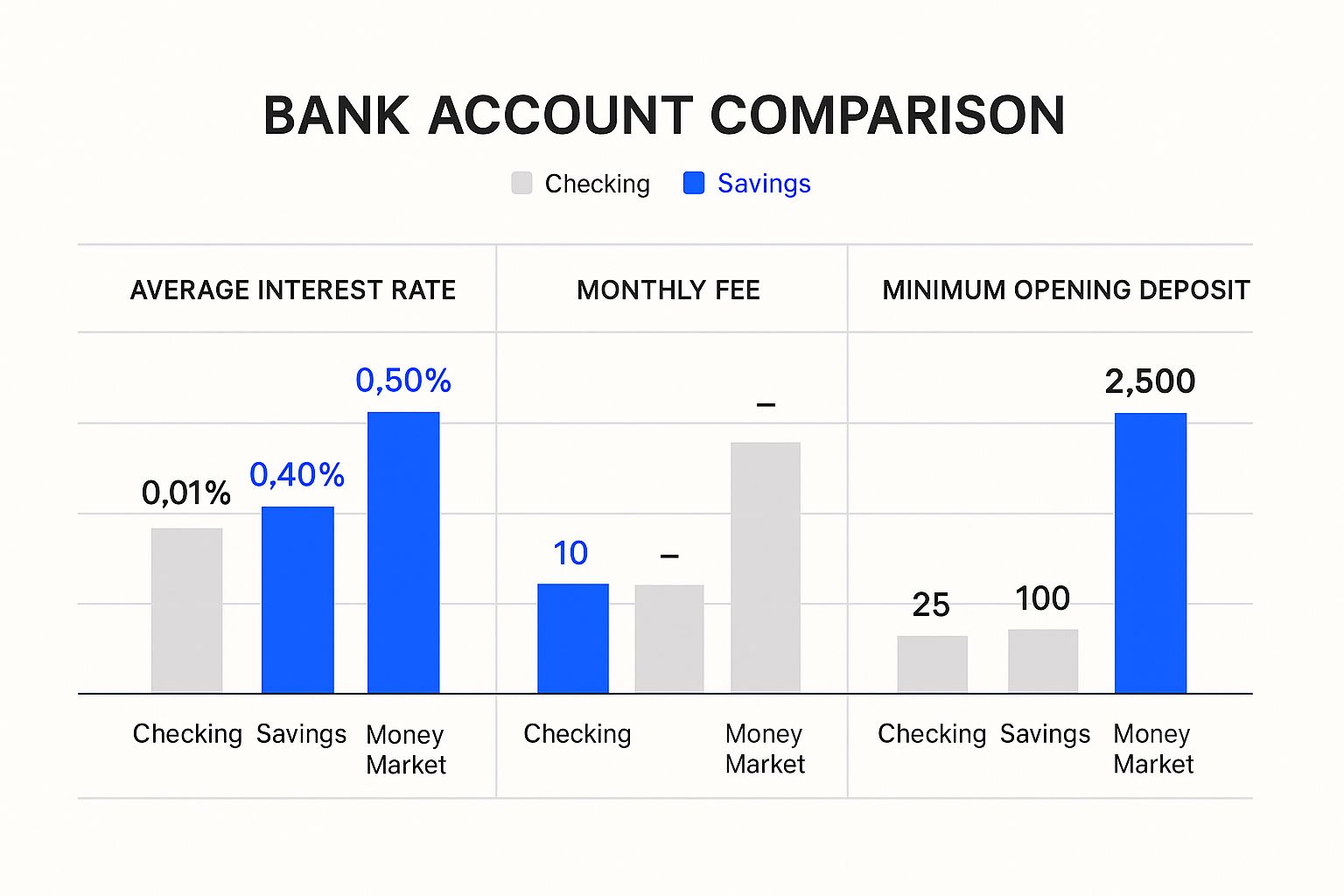

As you can see from the numbers, there's often a trade-off. Some accounts might offer you a better interest rate, but they'll expect a much higher minimum deposit. It’s a classic balance between growth potential and how much capital you can afford to tie up from the start.

In the end, this process demands patience and attention to detail. If you're a non-resident, expect a few more hoops to jump through, like extra interviews or additional due diligence questions—it's all standard procedure to protect the integrity of the system. If you approach it as building a strategic partnership rather than just another bureaucratic hurdle, you’ll find the entire experience much smoother.

Getting Your Document Checklist in Order

Let's be frank. The single biggest reason corporate bank account applications get delayed or rejected isn't the interview or the fees—it's the paperwork. A single missing document, an expired certificate, or a tiny inconsistency can send you right back to square one.

Getting your documents perfectly organised isn't just about ticking boxes for the bank. It’s your first real chance to tell them a clear, professional story about your business.

Think of it this way: the compliance team has never met you. Your application file is their only introduction. A messy, incomplete package suggests a messy, disorganised business. A clean, comprehensive one shows you’re serious and builds trust from the get-go.

The Core Corporate Documents

Every bank in Hong Kong will start with the basics—the legal documents that prove your company is a legitimate, registered entity. These are the absolute non-negotiables.

- Certificate of Incorporation (CI): This is your company’s birth certificate, proving it legally exists.

- Business Registration Certificate (BR): Issued by the Inland Revenue Department, this shows you're registered for business and tax. Make sure it's the most current version.

- Articles of Association (A&A): This is your company's rulebook, outlining everything from the powers of directors to shareholder rights.

I’ve seen applications get held up for weeks over something as simple as a slight variation in an address between the CI and the BR. A compliance officer is trained to spot these things immediately, so triple-check every detail for consistency.

Proving Who's Really in Charge

Once the bank knows your company is real, they need to understand who owns and controls it. This is a critical part of their anti-money laundering (AML) and counter-terrorist financing (CTF) duties.

This is where you’ll need to clearly lay out the Ultimate Beneficial Owner (UBO) structure. A UBO is the actual person who ultimately benefits from the company's activities, even if there are other companies layered in between. For a simple startup, the UBO is likely just the founder. But for more complex structures, you need to be transparent.

Banks need absolute clarity on who owns the business. If your company is owned by another company (or several), draw up a simple organisation chart. It should visually trace the ownership all the way to the real individuals who hold 25% or more of the shares or voting rights. Taking this extra step yourself will save you an enormous amount of back-and-forth later.

You’ll need to provide identification for every director, major shareholder, and UBO, which typically includes:

- A certified copy of their passport.

- Proof of residential address, like a utility bill or bank statement from the last three months.

If you're managing this process from overseas, it's worth getting familiar with the specific Hong Kong bank account requirements for non-residents, as the documentation standards can be even stricter.

Telling Your Business Story

This is where you go beyond just submitting forms and actually build a compelling case for your business. The bank needs to see proof of "business substance"—real, tangible evidence that you're running a genuine commercial operation.

Don’t just throw a generic business plan at them. Instead, craft a short, clear narrative that answers a few key questions:

- What do you actually do? Be specific. "International trade" is too vague. "Sourcing and exporting consumer electronics from Shenzhen to clients in the UK" is what they need to hear.

- Why Hong Kong? What's your connection to the city? Do you have suppliers here? Are you targeting the Asian market? Give them a solid reason for needing an account in this jurisdiction.

- What will your account activity look like? Give the bank a realistic forecast. Mention the expected number of incoming and outgoing transfers each month, the main currencies you’ll use, and the key countries you'll be sending money to or receiving it from.

The best way to back this up is with hard evidence. This could be signed contracts, purchase orders, or detailed invoices. If you're a startup with no trading history yet, even a letter of intent from a potential major client can make a huge difference. You're trying to paint a picture of a legitimate, low-risk business that a bank would be confident to have as a customer.

Navigating the KYC Process with Confidence

If you've got all your paperwork sorted, the Know Your Customer (KYC) interview is the final hurdle. I've seen countless entrepreneurs get nervous about this step, and it's easy to see why. It can feel like an interrogation where one slip-up might derail your entire bank account opening application.

But here’s how you should really think about it: the KYC meeting, whether it's across a desk or over a video call, is just a conversation. The bank has seen your documents; now they just want to put a face to the name and hear the story behind the business. They’re confirming you are who you say you are and that your company does what you claim it does.

This is your chance to build a real relationship with your banker. Being prepared is what breeds confidence here. It’s not just about having the right documents in your folder; it’s about knowing your business inside and out and being able to explain it clearly.

What Banks Really Want to Know

At the end of the day, bankers are trained to spot and manage risk. Your job during the KYC process is to make theirs easy by providing clarity and consistency. They’ll be focusing on three main areas, and if you can nail these, you're in a great position.

-

Your Business Model, Plain and Simple: How does your company actually make money? Be ready to explain this without falling back on industry jargon. If you run a tech startup, don't just say you have a "SaaS platform." Instead, explain who your customers are, the specific problem your product solves for them, and the mechanics of how they pay you.

-

Your Source of Funds: Where did the initial money to start the business come from? It could be from your personal savings, a loan from your parents, or an angel investor. Whatever the origin, you need to be transparent and ready to explain it logically. This isn't a place for vague answers.

-

Your Expected Transaction Patterns: Who are you going to be paying, and where is money coming from? Get specific about the countries involved and give a realistic estimate of the volume and value of these transactions. This helps the bank understand your global footprint and make sure it aligns with their internal risk policies.

A huge part of KYC is the bank's own background checks. For a much deeper dive into what goes on behind the scenes from a legal and compliance perspective, check out this guide on understanding due diligence.

This sharp focus on risk is pushing major changes across the industry. As banks grapple with economic pressures, they're pouring resources into digital systems to streamline these very processes. The good news for you is that these upgrades often make the KYC and onboarding experience much faster and less of a headache.

Case Study: A Tech Startup's KYC Success

Let me give you a real-world example. I recently worked with a fintech startup whose business model looked tricky on paper. They were set up to receive payments from freelance developers based in Eastern Europe and then pay out to their corporate clients in North America. For any traditional bank, this kind of international, multi-currency flow is an immediate red flag.

Sure enough, during their video KYC call, the bank manager drilled down with some tough questions. They wanted to know about the startup's due diligence process for the freelancers and the exact nature of their clients' businesses.

Instead of getting defensive, the founders were ready. They calmly walked the manager through their platform's multi-step verification system for every freelancer they onboarded. They presented anonymised—but very real—client contracts and a clear financial forecast. They successfully framed their business not as a high-risk money transfer service, but as a legitimate tech solution for the modern global workforce.

They passed with flying colours because they anticipated the bank's biggest concerns and addressed them head-on with proof. They took control of the narrative, positioning themselves as a credible, transparent, and low-risk partner who takes compliance seriously. That's precisely what you should aim for.

This story shows that even if your business model is complex, you can succeed. The key is to turn potential red flags into demonstrations of your professionalism and foresight. By preparing your talking points and having the evidence to back them up, you can walk into that KYC meeting with the confidence you need to get your business bank account approved.

Navigating Bank Accounts for High-Risk Industries and Startups

If your business operates in an industry that makes traditional banks nervous, you’ve probably felt that frustrating shift in tone. The moment you mention "crypto," "global consulting," or "international trade," the friendly conversation can turn into a cautious interrogation. This isn't just in your head; it’s a reality for countless entrepreneurs trying to open a simple corporate bank account.

The good news? Being labelled ‘high-risk’ isn’t a dead end. It just means you need a much smarter, more proactive strategy than everyone else.

Think of it this way: a standard application is like handing in a basic CV. For a high-risk business, you need to submit a full portfolio. One that doesn’t just showcase your business model but also anticipates and answers every single question a compliance officer could possibly have. You have to do their due diligence for them.

From Red Flag to Green Light

I’ve worked with entrepreneurs in international commodities trading who were flatly rejected by three banks in a row, only to be accepted by the fourth. The business model didn't change—but their presentation did. They stopped just filling out forms and started building a compelling case.

Their winning move was creating a dedicated "Risk Mitigation & Compliance Summary." This wasn't a long, complicated document; it was a simple two-pager submitted alongside their standard application. It did three crucial things:

- It Acknowledged the Risk: They were upfront, stating they understood why international trade could be perceived as high-risk due to complex supply chains and cross-border payments. No hiding.

- It Detailed Their Controls: They clearly outlined their internal due diligence process for vetting every new supplier and customer, even listing the specific checks they performed.

- It Provided Proof: They backed it all up by attaching anonymised examples of their due diligence reports and supplier agreements.

This one document completely changed the narrative. It transformed their application from a potential problem into a masterclass in professionalism. It proved to the bank they weren't just aware of the risks—they were already on top of them.

Choosing the Right Banking Partner

Let's be clear: not all banks have the same appetite for risk. A major retail bank that focuses on local SMEs will likely run for the hills if your business deals in digital assets. On the other hand, a specialised financial institution or a modern digital bank might have dedicated compliance teams who actually understand your industry's nuances.

Your first job is to do your homework. Don't waste your time applying to banks whose risk tolerance obviously doesn’t align with your business. Instead, look for institutions that openly cater to international businesses or have a known track record of working with companies in your specific sector. Navigating this landscape is a specialised skill, and understanding the ins and outs of high-risk banking can make all the difference between repeated rejections and a successful partnership.

A classic mistake is applying to the biggest, most famous banks first. In my experience, it’s often the smaller, more agile banks or specialised fintechs that are far better equipped to understand and serve businesses with complex or international models. They've built their entire compliance framework for this exact purpose.

The Startup Dilemma: Proving Yourself with No Revenue

Startups face a unique hurdle. Banks want to see contracts and invoices to prove you’re a legitimate business, but you need the bank account to even get those contracts signed in the first place. It’s the ultimate chicken-and-egg problem.

This is where you have to get creative with forward-looking documents. Your business plan is essential, of course, but on its own, it’s just a story. You need to back that story up with concrete evidence of your future potential.

Here are a few of the most powerful documents I’ve seen startups use to get approved:

- Letters of Intent (LOIs): A signed LOI from a potential key client is pure gold. It’s third-party validation that a real market exists for what you're building.

- Funding Agreements: If you’ve secured investment, the signed term sheet or shareholder agreement is rock-solid proof. It shows that sophisticated investors have already done their due diligence on you and believe in the venture.

- Supplier Agreements: You might have agreements in place with key suppliers or technology partners even before you make your first sale. These demonstrate that you’re building a real operational structure.

To help you get ahead of the game, I’ve put together a quick guide to some common red flags and how you can proactively address them in your application, turning potential weaknesses into strengths.

Common Red Flags for Banks and How to Address Them

Here’s a look at what triggers alarms for compliance teams and, more importantly, what you can do about it before you even submit your application.

| Potential Red Flag | Why It's a Concern | Proactive Solution |

|---|---|---|

| Complex Ownership Structure | Obscures the Ultimate Beneficial Owner (UBO), raising anti-money laundering (AML) concerns. | Provide a clear, visual organisation chart mapping all entities right down to the individual UBOs. Add a short note explaining the reason for the structure. |

| High Volume of International Transfers | Can be a sign of money laundering or sanctions evasion if the business purpose isn't crystal clear. | In your business plan, detail the key countries you'll transact with and explicitly state the commercial reason for doing so. |

| No Trading History (Startups) | The bank has no past evidence to verify that the business model is legitimate and viable. | Don't just rely on your business plan. Supplement it with LOIs from clients, investor funding documents, and detailed financial projections. |

| "High-Risk" Industry | Certain sectors (e.g., Crypto, Consulting) are automatically flagged due to regulatory uncertainty or past abuse by bad actors. | Submit a voluntary "Risk Mitigation Summary" that details your internal compliance, KYC, and AML procedures. Show them you're a serious operator. |

Ultimately, success in a high-risk category comes down to two things: transparency and over-preparation. When you anticipate a bank’s concerns and provide clear, documented answers before they even have to ask, you build the trust needed to get your account open and your business moving forward.

Understanding the Costs of Banking in Hong Kong

Getting your bank account approved is a huge milestone, but honestly, that’s just the starting line. Now comes the real work: understanding what it actually costs to run that account. It’s a detail many new entrepreneurs skim over, but getting a handle on the fee structure from day one is essential for managing your cash flow and avoiding nasty surprises down the road.

Don’t think of banking fees as a punishment. They're simply what you pay for the services you need—things like secure transactions, global payment processing, and access to financial tools. The trick is to find a banking partner whose fees make sense for what your specific business does.

A classic mistake I see is people getting fixated on the initial deposit while completely ignoring the small, regular charges that nibble away at their balance. An account that looks cheap to open might end up costing you a fortune in high per-transaction fees.

Deconstructing the Fee Structure

So, let's pull back the curtain on the most common charges you'll run into. Hong Kong banks are generally pretty upfront with their fee schedules, but you have to know what to look for.

-

Initial Deposit: This can be anything from a token amount at a digital bank to HK$50,000 or more at one of the big traditional players. It's less of a fee and more of a "show of good faith" that you have the capital to operate a legitimate business.

-

Monthly Maintenance or Fall-Below Fees: This is a big one. Many accounts demand you keep a minimum average balance. If your funds dip below that threshold (say, HK$100,000), you’ll get hit with a monthly fee. It's the bank's way of making sure the account is worth their while.

-

International Transfer Fees (Telegraphic Transfers): For any business dealing with overseas clients or suppliers, this is critical. Banks charge for both sending and receiving money internationally, and the costs can vary wildly from one institution to the next.

For anyone in import/export or consulting, getting these numbers straight is non-negotiable. A difference of just HK$100 per transfer can easily add up to thousands of dollars in lost profit over a year.

The Hidden Costs of Transactions

Beyond the basic account maintenance, the way you move money has its own set of costs. And in a place like Hong Kong, where card payments are king, you really need an account with favourable transaction terms.

The city’s economy runs on plastic. The Hong Kong Monetary Authority’s data tells the story: by the end of Q2 2025, there were about 22.8 million credit cards in circulation here. In that single quarter, the transaction volume hit 360.1 million for a total value of HK$268.4 billion. This just hammers home how crucial a good card-linked business account is. You can dig into the numbers yourself in the official HKMA payment card statistics.

This heavy reliance on card payments means you absolutely have to scrutinise merchant service fees if you plan to accept them. On top of that, things like fees for corporate debit cards, FX conversion rates, and even ATM withdrawals can all chip away at your bottom line.

A common pitfall for new businesses is underestimating foreign exchange (FX) conversion costs. Banks often build a significant margin into their exchange rates on top of any stated transfer fee. For a business dealing in multiple currencies, a seemingly small difference of 0.5% in the FX rate can be one of your single biggest banking costs over time.

Aligning Costs with Your Business Needs

So, how do you pick the right account? It’s not about finding the cheapest option. It’s about finding the most cost-effective one for how your business actually operates.

If you’re a local startup serving mostly Hong Kong-based clients, an account with no fall-below fee but higher international transfer costs could be a perfect fit. But if you’re running an e-commerce store with suppliers in Mainland China and customers in Europe, you'd be much better off paying a higher monthly fee for an account that gives you great FX rates and cheap global payments. You'd save a fortune in the long run.

The key is to map out your expected transaction activity before you commit to a bank. When you know your needs, you can find a financial partner whose fees actually support your business model instead of working against it. That way, more of your hard-earned cash stays right where it belongs: in your company.

Common Questions About Opening a Bank Account

After walking through the main steps—from gathering your documents to sitting down for the interview—you probably still have a few questions buzzing around. That’s completely normal. The journey to opening a corporate bank account in Hong Kong can feel a bit tangled, but most of the uncertainty boils down to the same handful of concerns.

Let's tackle those lingering questions head-on. These are the things people ask me all the time, and the answers come directly from years of getting businesses like yours through the process.

Can I Open a Hong Kong Business Bank Account Remotely?

This is easily the number one question I get, especially from international founders. While the world is definitely moving online, the real answer here is: it depends entirely on the bank.

Plenty of the big, traditional banks in Hong Kong still insist that at least one director shows up in person to sign the final papers and get their identity verified. It’s their long-standing policy. On the other hand, a new wave of digital banks and fintech platforms are now offering fully remote setups, which can be a brilliant fit for startups or smaller businesses with a simple, straightforward structure.

If you’re a non-resident or your company has a more complex ownership tree, you should expect a video call with a bank manager as the bare minimum.

My best piece of advice: Before you fill out a single form, confirm the bank's current policy on remote opening. A quick email or call can save you weeks of wasted time and effort. Policies change, so always check first.

What Are the Most Common Reasons for Rejection?

Here’s the frustrating—and encouraging—truth: most rejections are totally avoidable. It’s almost never because your business idea is bad. It’s because the application didn't tell a clear, credible story to the bank's compliance team.

From what I’ve seen over the years, these are the top culprits that get applications denied:

- Sloppy Paperwork: This is the biggest one, hands down. If the address on your business registration certificate is even slightly different from your proof of address document, a compliance officer will flag it immediately.

- No Clear "Business Substance": You have to prove you have a real reason to be in Hong Kong. If you can’t show a connection—local suppliers, clients in the region, a specific market you’re targeting from here—they'll wonder why you're applying.

- A Tangled Ownership Structure: If the bank can’t quickly figure out who the Ultimate Beneficial Owner (UBO) is, they’ll just assume the worst and say no. For any company with multiple layers, a crystal-clear organisation chart is non-negotiable.

- Wrong Fit for the Bank's Risk Appetite: Your business might be perfectly legal and legitimate, but it could fall into a high-risk category the bank has decided to avoid, like certain cryptocurrency ventures or high-volume international trade.

- Vague Interview Answers: Saying "we do consulting" is a recipe for rejection. You need to be specific, confident, and ready to explain exactly what you do, who you do it for, and why.

Being meticulous from the start is your best defence against every single one of these pitfalls.

How Long Does the Entire Process Usually Take?

This is where you really need to manage your expectations, because the timeline can vary wildly. A simple, locally-owned business applying to a modern digital bank might get their account number and be up and running in just a few days.

But for a non-resident founder with an international trading company applying to one of the major traditional banks? You could be looking at a timeframe of four weeks to several months.

So what causes the hold-ups? It’s almost always the back-and-forth for more documents, deep-dive background checks on international directors, and the bank’s own internal workload. To keep things moving, your job is to respond to their requests instantly and have everything organised before you even start.

Do I Need a Local Hong Kong Director to Open an Account?

No, you absolutely do not need a Hong Kong resident director to open a corporate bank account. This is a very common myth.

However, having one can sometimes make the process a little smoother. From the bank’s point of view, a local director shows a stronger, more tangible connection to Hong Kong, which helps tick their "business substance" box. If all your directors are based overseas, the bank will just do a more thorough check to understand your reasons for banking here.

Ultimately, the key factor isn't your director's passport or residency status. It’s your ability to confidently explain your business case for Hong Kong. Whether your team is in London, Singapore, or Dubai, you need a solid answer when they ask, "Why here?"

At Lion Business Consultancy Limited, we specialise in cutting through this complexity. We help entrepreneurs and SMEs navigate the entire bank account opening process, from choosing the right institution to preparing a rejection-proof application package. If you want to get it right the first time, visit us at https://lionbusinessco.com to see how we can help.