If you're in the crypto business, you've likely looked at Hong Kong and Singapore for banking and hit a wall. As global trade hubs, they seem like a natural choice, but for any company touching digital assets, the experience often ends in frustration, frozen accounts, and outright rejection. This isn't just a rumour; it's a reality born from strict regulations and an institutional aversion to risk.

This forces entrepreneurs to look beyond these traditional powerhouses for reliable banking, exploring crypto-friendly jurisdictions like Liechtenstein, Lithuania, or specialised offshore financial centres that actually understand their business model.

The Reality in Hong Kong & Singapore

For decades, Hong Kong and Singapore have been the go-to choices for international business. Their efficiency, pro-business policies, and financial strength made opening a corporate account a logical step for any global company. But the moment you mention "crypto," that straightforward process grinds to a halt.

Regulatory Restrictions on Crypto

Both Hong Kong and Singapore operate under intense regulatory pressure, especially concerning Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT). Crypto’s decentralised and often pseudonymous nature clashes directly with these frameworks, which demand a clear paper trail for every transaction. Understanding the complexity of Anti-Money Laundering (AML) transaction monitoring systems makes it clear why traditional banks are so hesitant. For them, facilitating crypto-related transactions is a compliance nightmare that could lead to massive fines and reputational damage.

Banks’ Risk Appetite and Compliance Hurdles

From a bank's perspective, crypto is a high-risk, low-reward proposition. The cost of building a compliant framework to handle digital assets is immense, and it’s simply easier and safer to say no. Even as Hong Kong positions itself as a virtual asset hub, the reality on the ground hasn't changed. The gap between government ambition and banking practice remains wide. Our guide to cryptocurrencies in Hong Kong delves deeper into this disconnect. Similarly, while Singapore has a licensing framework, its AML/CFT rules are so stringent that most traditional banks refuse to engage with crypto firms.

Why Traditional Finance Is Cautious with Crypto Businesses

The core issue is a fundamental culture clash. Traditional finance is built on stability, control, and predictability. The crypto world thrives on innovation, decentralisation, and volatility. This mismatch creates a hostile environment where accounts are frozen without warning for a single "crypto-related" transaction. The system is fine-tuned for the world of fiat currency and physical goods, not for the dynamic nature of digital assets. For businesses needing dependable Hong Kong crypto banking or Singapore crypto banks, the hard truth is that these hubs are not the crypto-friendly havens they appear to be.

Client Insight: A Real-World Case Study

These regulatory hurdles aren't just theoretical; they have real-world consequences for entrepreneurs. A recent client of ours, who runs a general trading company, perfectly illustrates this struggle. His business was straightforward: moving goods globally. The only modern twist was that many of his customers preferred to pay their invoices in crypto. All he needed was a reliable corporate bank account to receive fiat funds after conversion.

His first stop was naturally Hong Kong and Singapore. He approached several top-tier banks, expecting a simple process. Instead, he faced months of frustrating rejections. Applications were either denied outright or stuck in an endless compliance loop. The moment he mentioned that a third-party payment processor would be converting crypto to fiat, the doors slammed shut.

Our client wasn't running a crypto exchange; he was a traditional trader adapting to his customers' payment preferences. But for the banks, the word "crypto" was an automatic red flag that ended the conversation.

Frustrated, he began exploring alternatives in Europe. He finally found his solution in Liechtenstein. This small but sophisticated financial centre has built a reputation for being crypto-progressive. The difference was night and day. The bank in Liechtenstein understood his business model immediately. They had well-defined, compliant procedures for onboarding businesses that handle funds originating from crypto. The due diligence was rigorous but fair. Within weeks, he had a fully functional corporate bank account ready for Liechtenstein crypto payments. His journey is a crucial lesson: stop trying to force a square peg into a round hole and go where your business is understood.

Alternatives for Crypto-Friendly Banking

With Hong Kong and Singapore off the table for most crypto businesses, where should you turn? Fortunately, several forward-thinking jurisdictions have stepped in to fill the void, offering welcoming environments for the digital asset industry. These alternatives fall into three main categories.

UK and EU Fintech Institutions

Europe has emerged as a hub for crypto-friendly jurisdictions, offering regulatory certainty and modern banking solutions.

- Lithuania: As an EU member, Lithuania has become a major fintech centre with a straightforward licensing process for virtual asset service providers, making it a prime destination for EU crypto banking.

- Liechtenstein: This financial powerhouse is a top choice for businesses needing reliable Liechtenstein crypto payments. Its banks understand complex crypto-related business models and have robust compliance systems in place.

Offshore Options

For global operations, offshore crypto banking in jurisdictions like the Cayman Islands, the British Virgin Islands (BVI), and Dominica offers significant flexibility and tax advantages. These financial centres are well-suited for holding companies or operational arms within a larger corporate structure. While an article on opening a Singapore business bank account highlights its benefits for traditional business, a multi-jurisdictional approach is often superior for crypto firms.

Other Emerging Hubs

A new wave of crypto hubs is actively competing for digital asset business with attractive incentives and regulatory sandboxes.

- United Arab Emirates (UAE): Dubai is making a strong push to become a global crypto capital, with dedicated free zones and a specialised regulator (VARA) providing clarity for businesses.

- Puerto Rico: Unique tax incentives under Act 60 have made Puerto Rico a magnet for crypto traders and entrepreneurs, offering significant tax breaks for residents and businesses.

Where to Trade Crypto Safely

Securing a crypto-friendly bank account is only half the battle. The key to long-term success is to structure your operations in a way that separates your business finances from your trading activities. Mixing them is a massive red flag for banks and a common reason for account closures. While knowing how to read crypto charts for smart trading is important, your operational setup is what ensures your survival.

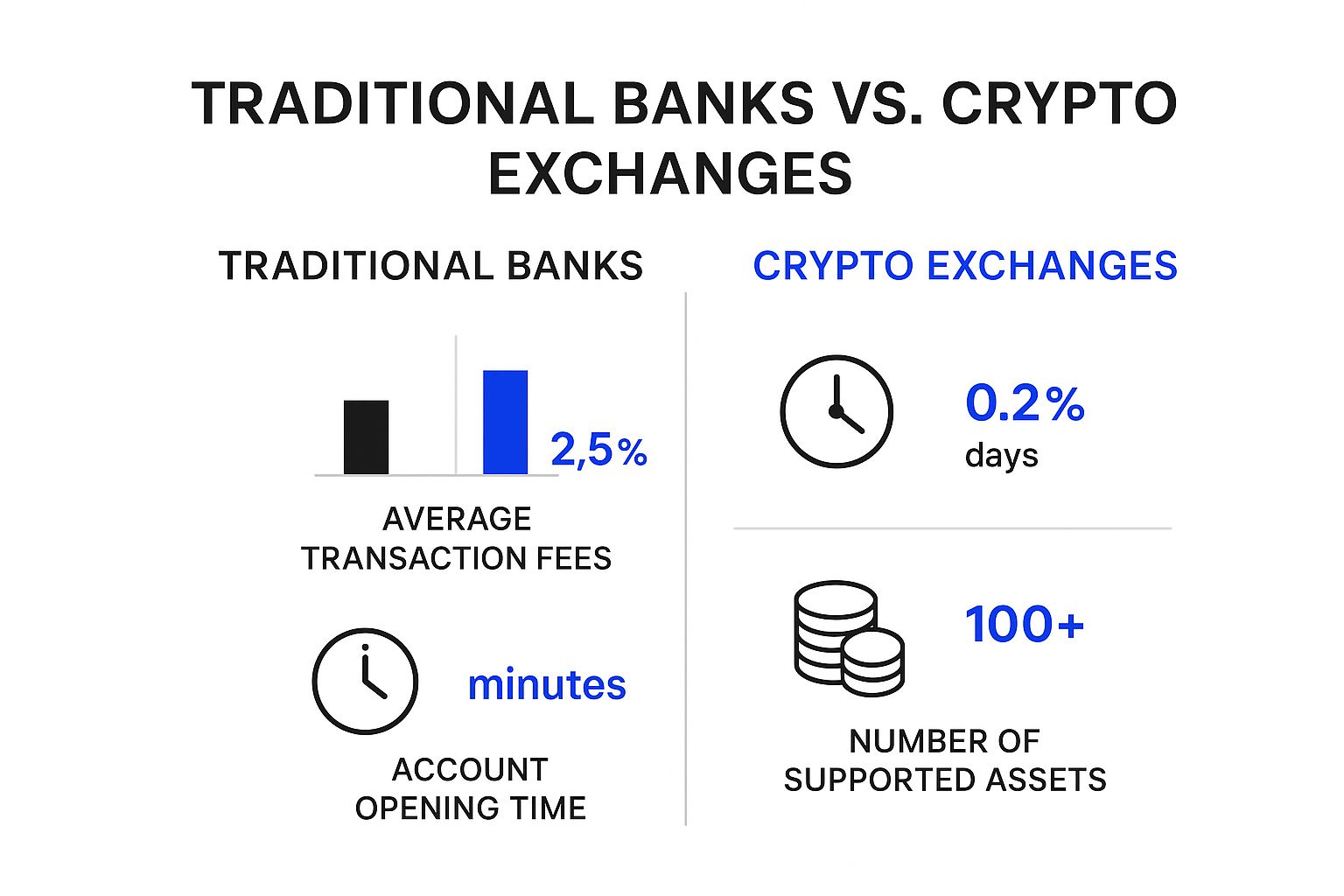

Regulated Exchanges vs. Offshore Platforms

Your choice of trading venue significantly impacts your risk profile.

- Regulated Exchanges: Licensed in major financial hubs (e.g., US, EU), these platforms offer greater investor protection, transparent operations, and strict KYC processes. They are the safest option for moving funds between fiat and crypto.

- Offshore Platforms: Based in jurisdictions with lighter regulations, they often provide a wider range of assets and higher leverage but come with lower investor protection and higher platform risk.

Why Separating Your Business Bank Account From Your Trading Activity Is a Smarter Approach

The golden rule is to maintain a clear line between your company's operational bank account and your trading funds. This signals to your bank that you are a professional who understands compliance, not a high-risk speculator.

The ideal setup is:

- Business Operations: Use a corporate bank account in a crypto-friendly jurisdiction (like Liechtenstein or Lithuania) exclusively for business expenses.

- Trading Capital: Keep your trading funds on one or more regulated exchanges, completely separate from your business account.

- Profit Off-Ramp: When taking profits, transfer funds from the exchange to your corporate account with clear documentation.

This clean separation demonstrates that you use your bank for legitimate business operations, which is crucial for maintaining a healthy banking relationship.

My Professional Advice

As someone who helps companies with this exact problem daily, my direct view is this: don’t waste time on Hong Kong and Singapore banks if your business is crypto-heavy. You will spend months navigating a maze of compliance questions only to be rejected. Their risk-averse culture is fundamentally incompatible with the digital asset world.

Instead, think globally from day one. A resilient financial strategy involves a multi-jurisdiction setup that leverages the strengths of different regions.

- Corporate Hub: Use Hong Kong or Singapore for your main company to benefit from their global reputation.

- Banking Hub: Look to fintechs in Europe for EU crypto banking or Liechtenstein crypto payments, where your business will be understood.

- Trading Hub: Conduct your trading on regulated exchanges in jurisdictions with strong investor protection.

This approach shields your business from regulatory risk and saves you from months of predictable frustration.

Conclusion & Call to Action

To summarize the reality: Hong Kong and Singapore are global trade hubs, but they are not crypto banking hubs. Their risk-averse culture and strict regulations make them a dead end for most businesses in the digital asset space. A winning strategy means looking beyond Asia to jurisdictions that embrace innovation, such as those offering UK crypto banks or robust EU crypto banking frameworks. For some, learning how to open a business bank account in Dubai might even be a practical next step.

If you are stuck in this banking maze, stop hitting a wall and get expert advice. We can help you navigate this complex landscape and find the right financial partners to support your growth.

Tired of wasting time with banks that don't get your crypto business? At Lion Business Consultancy Limited, we specialise in connecting companies like yours with accounts in genuinely crypto-friendly jurisdictions.

- Book a free consultation → zcal.co/i/F_oW1zF_

- WhatsApp/Call me directly → wa.me/message/IMUBSIYM7HA7A1