A trust company in Hong Kong is more than just a financial service; it’s a professional guardian for the assets you’ve worked a lifetime to build. For entrepreneurs and families, it represents a powerful strategy for asset protection, succession planning, and wealth management, all anchored in one of the world's most stable financial centres.

Why Hong Kong Is a Global Hub for Trusts

Imagine this: you've spent years, maybe decades, pouring your heart and soul into building a successful business. Now, you’re looking at the horizon and thinking about what comes next—not just for the company, but for your family. How do you shield the wealth you’ve created from unforeseen risks? How do you ensure your children are provided for, without simply handing over a lump sum they might not be ready to manage?

This is a crossroads many founders face, and it’s precisely where Hong Kong’s unique strengths come into play.

Hong Kong’s stellar reputation as a top-tier destination for trusts isn’t a happy accident. It’s the result of a powerful combination of factors that create an exceptionally secure and reliable environment for managing wealth. It's a jurisdiction that genuinely understands the needs of international business and private clients, offering a sophisticated ecosystem built for long-term stability.

The Bedrock of English Common Law

At the very core of Hong Kong’s appeal is its legal system. Grounded in English common law, it provides a familiar, predictable, and incredibly robust framework for trusts. This legal tradition, built on centuries of precedent, offers you genuine clarity and ironclad protections for property rights.

For an entrepreneur, this is a game-changer. It means the rules governing your trust aren't going to shift unexpectedly. The duties of your trustee are clearly defined, and your rights—and those of your beneficiaries—are legally enforceable. That level of certainty is absolutely critical when you're planning for generations.

A Stable and Pro-Business Environment

Hong Kong consistently ranks as one of the world's freest economies. The city's low and simple tax regime—no capital gains tax, no inheritance tax, and a free flow of capital—makes it an incredibly efficient place to manage and grow assets. This isn’t just about saving on tax; it’s about simplicity and the freedom to build your wealth without unnecessary friction.

A trust established in Hong Kong creates a clear firewall between your personal and business assets. This shields your family's wealth from commercial risks, creditors, or legal disputes that might impact your company.

This pro-business mindset is backed by a stable political and economic climate that has proven its resilience time and again. Even in challenging times, the Hong Kong trust industry continues to thrive. By the end of 2023, assets held under trusts hit HK$5,188 billion (US$667 billion), a 4% increase from the previous year, highlighting its enduring strength. For a deeper dive, a recent KPMG report offers more data on this industry growth.

Gateway to Mainland China and Beyond

Hong Kong’s strategic location is another massive advantage. It acts as the primary bridge between Mainland China and the rest of the world, providing unparalleled access to opportunities in the Greater Bay Area and across Asia.

If you have operations or investments in the region, using a trust company in Hong Kong gives you the perfect command centre to manage those assets within a globally recognised and respected legal framework.

Ultimately, choosing Hong Kong is about building your family’s financial future on a foundation of strength, clarity, and strategic advantage.

Understanding What a Trust Company Actually Does

So, let's cut through the jargon. What does a trust company really do?

Imagine a trust as a special kind of safe deposit box. But instead of just holding your valuables, this box comes with a detailed rulebook that you write. The trust company is the professional, licensed guardian of that box, legally bound to follow your instructions to the letter.

Their job isn't just to hold assets passively. It’s to actively manage, protect, and distribute them precisely according to your wishes, often over many decades. This professional oversight is what makes a formal trust so powerful, and it's the core service you get from a reputable trust company in Hong Kong.

This entire structure hinges on three key players. Once you understand their roles, you’ll see exactly how a trust can work for you.

The Key Players in a Trust Relationship

Every trust is built around a simple yet powerful framework involving three parties.

-

The Settlor (That's You): As the entrepreneur or individual creating the trust, you are the settlor. You transfer assets into it—this could be anything from company shares and real estate to investment portfolios. Crucially, you also write the "rulebook," known as the trust deed, which spells out exactly how those assets should be managed and who benefits.

-

The Trustee (The Guardian): This is the trust company in Hong Kong you appoint. The trustee becomes the legal owner of the assets, but here’s the critical part: they cannot use them for their own gain. Their sole role is to protect and administer the assets as a neutral fiduciary, executing your instructions faithfully. Think of them as the professional steward of your legacy.

-

The Beneficiary (The Recipient): These are the people or organisations you've chosen to benefit from the trust. It could be your children, a spouse, a charity, or even yourself in certain circumstances. The beneficiaries are the entire reason the trust exists, and every action the trustee takes must be in their best interests.

This clean separation of legal ownership (the trustee) from beneficial enjoyment (the beneficiaries) is what makes a trust such a rock-solid vehicle for asset protection. The assets are no longer legally yours, yet they are managed strictly for the good of your chosen heirs.

The Cornerstone of Trust: Fiduciary Duty

If there's one concept to truly grasp, it's fiduciary duty. This isn't just a professional guideline; it's the highest legal standard of care that exists.

A trustee has an absolute, legally binding obligation to act only in the best interests of the beneficiaries.

This means the trust company must manage the assets prudently, scrupulously avoid any conflicts of interest, and remain loyal to the terms of your trust deed above all else. A breach of this duty can result in serious legal consequences for the trustee.

This legal backstop ensures the guardian of your assets is held to an exceptionally high standard. When you hire a trust company, you’re really hiring a professional fiduciary to ensure your legacy is managed exactly as you planned, giving you peace of mind and your beneficiaries long-term security.

Exploring Different Types of Hong Kong Trusts

When people hear "trust," they often picture a single, rigid document. But the reality is far more interesting. Think of a trust less like a fixed product and more like a versatile toolkit, with different instruments designed for very specific jobs. Which one you choose depends entirely on what you want to achieve.

A skilled trust company in Hong Kong won’t just hand you a standard template. Their expertise lies in helping you craft a structure that truly fits your personal goals, whether that’s protecting your business, planning for succession, or managing wealth across generations.

You wouldn't use a hammer to turn a screw. In the same way, the trust you set up to fund your grandchildren's education will look completely different from one designed to hold your company shares. Let’s break down the most common types you'll encounter.

The Discretionary Trust: The Ultimate in Flexibility

For most families and entrepreneurs, the discretionary trust is the go-to structure, and for good reason. Its defining feature is its incredible flexibility.

Here's the concept: as the settlor, you provide the trustee with a "letter of wishes." This document guides their decisions, but crucially, it isn't legally binding. This gives the trustee the discretion to adapt as life and family circumstances inevitably change over time.

Imagine you set up a trust for your three children. Ten years from now, one might need capital to start a business, another could face unexpected medical expenses, and the third might be financially independent. A discretionary trust empowers the trustee to assess their individual needs and distribute funds where they're needed most—something a rigid, fixed structure simply can't do.

Real-World Application: A business founder transfers shares of their company into a discretionary trust. The trustee manages those shares. Each year, they can distribute the dividend income differently among family members based on who needs support, their tax situations, and the founder's original wishes. This keeps the business intact while providing tailored financial support.

This ability to adapt makes it an incredibly powerful tool for navigating the unpredictable nature of family life for decades to come.

The Fixed Interest Trust: Predictability and Certainty

On the other end of the spectrum is the fixed interest trust. If the discretionary trust is about flexibility, this one is about precision. The rules are set in stone from day one.

In this arrangement, the trust deed spells out exactly who the beneficiaries are and what they are entitled to receive. The trustee has no room for interpretation; their job is simply to follow your instructions to the letter.

This type of trust is often used when you want to provide a reliable income stream for one person (like a surviving spouse) while ensuring the core assets are preserved for the next generation.

- Income Beneficiary: This person receives the regular income the trust assets generate, like dividends or rent.

- Capital Beneficiary: This person (or group) inherits the actual assets after a specific event, such as the death of the income beneficiary.

It provides clear boundaries and predictable outcomes, making it perfect for straightforward succession plans. Trusts are a cornerstone of comprehensive strategies for Legacy Planning and Wealth Transfer, ensuring your wishes are carried out exactly as intended.

Choosing the Right Trust Structure in Hong Kong

Selecting the right trust isn't just a legal formality; it's a strategic decision that will impact your family and assets for years. The key is to match the structure to your long-term objectives.

| Trust Type | Primary Purpose | Flexibility Level | Ideal Scenario |

|---|---|---|---|

| Discretionary Trust | Protecting assets and providing for beneficiaries with changing needs. | High | A family with young children, a business owner planning for succession, or when future needs are uncertain. |

| Fixed Interest Trust | Guaranteeing a specific income stream for one beneficiary while preserving capital for another. | Low | Providing for a surviving spouse for their lifetime, with the remaining assets passing to children upon their death. |

| Charitable Trust | Dedicating assets to philanthropic causes and creating a lasting social impact. | Varies | An individual wanting to create a formal, long-term structure for their charitable giving. |

Ultimately, the best choice depends on a deep understanding of your goals. A conversation with an experienced professional can help you navigate these options and select the structure that will serve you and your beneficiaries most effectively.

The Charitable Trust: A Lasting Legacy

For those who want their success to have a positive impact on the community, a charitable trust is a powerful option. It allows you to formally dedicate assets to causes you're passionate about, creating a legacy of giving that can continue for generations.

You can set up a trust to support specific organisations or a broader field, such as medical research or education. A professional trust company in Hong Kong will handle the investment management and ensure distributions are made correctly and in line with all legal requirements. This structure ensures your philanthropic vision is managed professionally and continues long after you are gone.

Getting to Grips with the TCSP Licence and Local Regulations

Before you entrust your life's work to a company, you need absolute certainty that they are held to the highest professional standards. In Hong Kong, that certainty is built on one critical credential: the Trust or Company Service Provider (TCSP) Licence. This isn't just paperwork; it's your primary guarantee that a provider is legitimate, secure, and operating by the book.

Think of the TCSP licence as a seal of approval from the Hong Kong government. It’s only granted to firms that meet strict criteria for financial health, integrity, and professional expertise. For anyone serious about setting up a trust, working exclusively with a licensed trust company in Hong Kong is non-negotiable.

The entire system is overseen by the Companies Registry, which acts as the official regulator. Their job is to ensure every licensed provider adheres to a robust set of rules designed to protect clients and uphold the integrity of Hong Kong’s financial sector.

The Role of the Companies Registry

The Companies Registry is more than a filing office; it’s an active supervisor. It holds the power to grant, renew, suspend, or even revoke a TCSP licence. To obtain and keep this licence, a trust company must demonstrate strong internal controls and prove its key personnel are "fit and proper"—meaning they have clean records and good professional standing.

This constant oversight adds a crucial layer of accountability. The system is designed to filter out unreliable operators and give you confidence in the trustee you select.

The Importance of Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) Rules

A major part of the TCSP framework is the strict enforcement of global anti-money laundering (AML) and counter-financing of terrorism (CFT) regulations. This is where the deep diligence happens.

By law, licensed trust companies must conduct thorough background checks on their clients. This typically involves:

- Customer Due Diligence (CDD): Properly identifying the settlors, beneficiaries, and anyone else with control over the trust.

- Source of Funds Checks: Understanding and documenting where the assets being placed into the trust originated.

- Ongoing Monitoring: Keeping an eye on the trust’s activities over time to spot any unusual or suspicious transactions.

These steps might feel a bit invasive, but they are absolutely essential for maintaining Hong Kong's reputation as a clean and transparent financial hub. They ensure that trust structures are used for their proper, legitimate purpose. Before creating any new entity, it’s wise to know what’s allowed; our guide on operations that are restricted in Hong Kong offers useful pointers.

This tough regulatory framework isn't a burden; it's a core feature. It guarantees that your assets are managed by a professional firm that respects the rule of law, protecting both your legacy and the integrity of Hong Kong's financial system.

This strong regulatory environment has been a massive driver of growth. Between 2021 and 2023, assets under trust in Hong Kong jumped by 10%, reaching HK$5,188 billion (US$667 billion). That kind of growth is fueled by the deep investor confidence that credible oversight creates. You can discover more insights about the Hong Kong trust industry's growth on Hubbis.com.

At the end of the day, the TCSP licence is your best line of defence. It transforms the abstract idea of "trust" into a concrete, legally backed standard, ensuring the trust company in Hong Kong you partner with is a worthy steward for your future.

How to Select the Right Trust Company

Choosing a trust company is one of the most critical decisions you'll make for your family's financial future. This isn't like picking a software provider; you're appointing a long-term guardian for your legacy. The right partner will bring decades of stability and peace of mind. The wrong one can create unimaginable headaches.

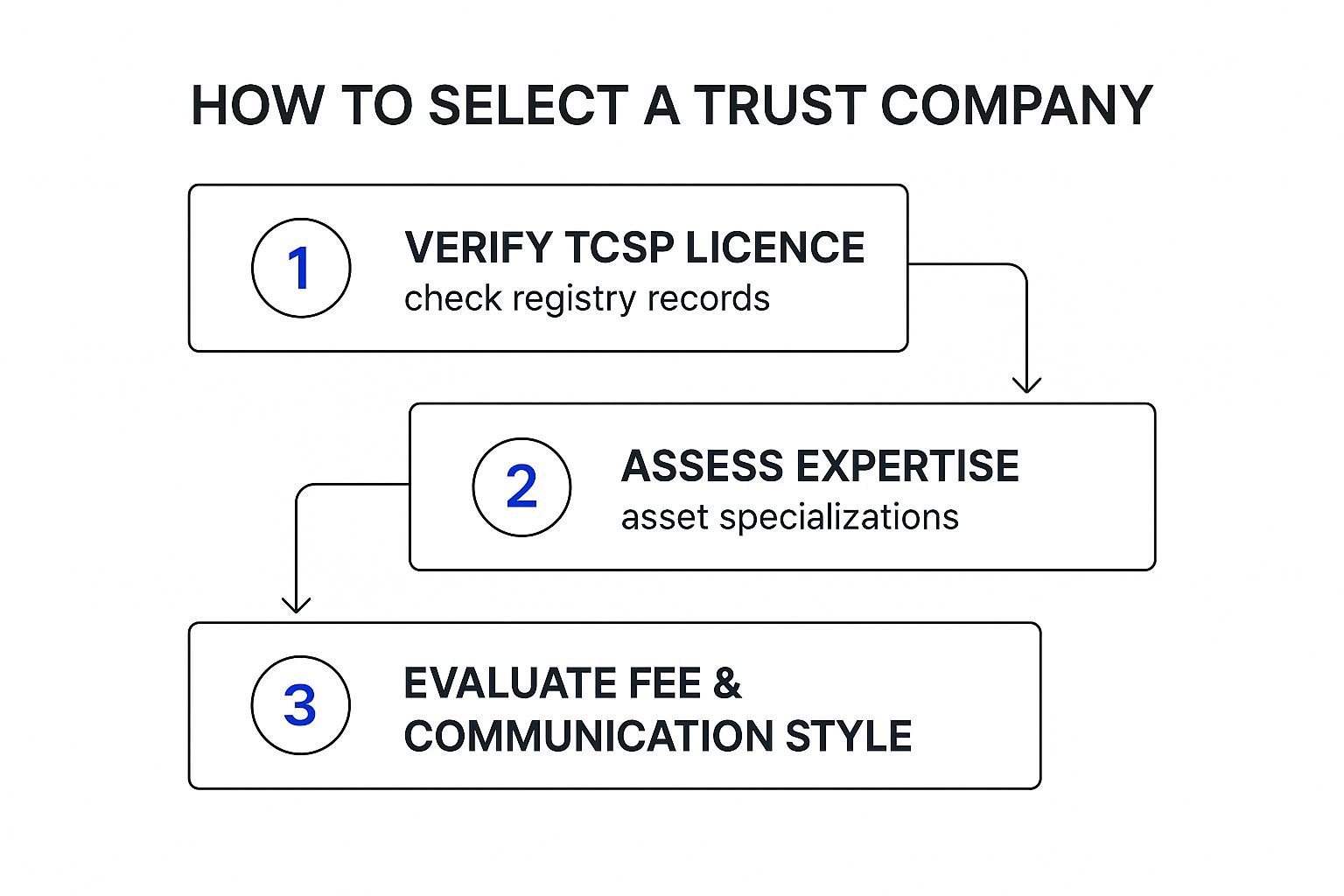

To make a confident choice, you need a clear framework for evaluation. It’s about looking beyond the glossy brochures and asking the tough questions that reveal a company's true competence, character, and compatibility with your goals.

Start with the Non-Negotiables

Before you even discuss services or fees, there are two fundamental checks you must perform.

-

Verify Their TCSP Licence: As we've covered, this is your primary seal of approval. Always check the official Companies Registry online to confirm their licence is active. An unlicensed operator isn't just a risk; it's a red flag.

-

Assess Their Reputation and Longevity: How long has this trust company in Hong Kong been in business? A long track record often signals stability and experience in navigating different economic climates. Look for client testimonials, case studies, and professional endorsements.

These first steps will help you build a shortlist of credible, regulated providers worth a closer look.

Digging Deeper into Expertise and Specialisation

Not all trust companies are created equal. Some excel at managing liquid financial assets, while others have deep expertise in handling complex holdings like business shares, real estate, or digital assets. Your job is to find a trustee whose skills align with the assets you intend to protect.

For an entrepreneur, this is especially critical. If your primary asset is your business, you need a trustee who understands corporate governance, shareholder agreements, and the delicate dynamics of succession.

A trustee unfamiliar with managing an active business could make decisions that inadvertently harm its value or disrupt operations. Ask them directly about their hands-on experience with assets like yours.

Also, think about the future. Do you have international assets or beneficiaries living abroad? If so, your chosen trustee must have proven cross-border experience. Their ability to handle global compliance and tax implications will be vital.

Understanding the Financial Commitment

Fee structures can vary widely, and any lack of transparency here should be a warning sign. You need a crystal-clear breakdown of all potential costs.

Typically, fees for a trust company in Hong Kong fall into a few main categories:

- Setup Fee: A one-time charge for establishing the trust and drafting the legal documents.

- Annual Administration Fee: An ongoing fee for managing the trust and handling compliance. This could be a flat rate or a percentage of the trust's asset value.

- Activity-Based Fees: Charges for specific actions, like making a distribution, selling an asset, or preparing complex tax reports.

Ask every potential provider for a detailed fee schedule. Run a few "what-if" scenarios to see how the costs would stack up. Getting this clarity is also vital for banking; a solid understanding of these outgoings is key when opening a corporate bank account in Hong Kong.

To help with your due diligence, here's a practical checklist to guide your evaluation.

Key Factors for Evaluating a Hong Kong Trust Company

| Evaluation Criteria | What to Look For | Why It Matters |

|---|---|---|

| Licensing and Regulation | Active and valid TCSP Licence from the Companies Registry. | Confirms they are legally authorised and subject to regulatory oversight. |

| Experience and Track Record | 10+ years in business; stable leadership; positive client testimonials. | Longevity indicates stability and a history of successful trust management. |

| Asset Specialisation | Proven experience managing the specific assets you hold (e.g., business shares, real estate). | Ensures your assets are managed by experts who understand their unique complexities. |

| Cross-Border Capability | In-house expertise or a strong network for international tax and legal matters. | Critical if you have international assets or beneficiaries. |

| Fee Transparency | A clear, comprehensive, and upfront fee schedule with no hidden charges. | Allows for accurate cost forecasting and prevents unexpected financial burdens. |

| Succession and Continuity | A clear plan for who takes over if your primary contact leaves the firm. | Guarantees seamless management for your trust over many decades. |

| Communication and Reporting | Regular, clear reporting; a dedicated and responsive point of contact. | A strong relationship is built on trust and clear communication. |

This table provides a solid foundation for comparing firms and making an informed decision.

Evaluating the Human Element

Finally, remember you're entering into a long-term relationship. The "soft skills" of communication and responsiveness are just as vital as technical expertise. During your initial meetings, pay close attention to how the team interacts with you.

Do they explain complex topics in a way you can easily grasp? Are they patient with your questions? Who will be your day-to-day contact? You're entrusting this company with your life's work. You need to feel confident that you can build a strong, collaborative partnership with the people behind the brand.

Your Roadmap to Setting Up a Hong Kong Trust

Turning the idea of a trust into a working reality might feel complex, but it's a structured process with clear, logical steps. A professional trust company in Hong Kong will guide you through everything, from the initial discovery session to a fully functioning trust that safeguards your assets.

The journey always starts with one simple question: What are you trying to achieve? This first conversation is the most important part of the process. It's where you and your advisor get crystal clear on your goals. Are you planning for business succession? Setting aside funds for your children's education? Or shielding assets from potential creditors? Defining these objectives ensures the entire structure is built on a solid foundation.

The Core Stages of Trust Formation

Once your goals are set, you move into the legal and administrative setup.

-

Drafting the Trust Deed: This is the legal heart of your trust—its constitution. Your advisors will help craft a detailed document that names the beneficiaries, outlines the trustee's powers, and dictates how and when assets should be distributed. It’s the blueprint for your legacy.

-

Transferring the Assets: Next, you formally move ownership of the assets—be it property, company shares, or investment portfolios—to the trustee. This legal transfer is the key action that places your assets under the protective umbrella of the trust. If a business is involved, it’s a good time to review the guidelines to incorporate a company in Hong Kong to ensure every corporate detail is handled correctly.

-

Ongoing Administration and Reporting: Once the trust is live, your trustee's job is to manage it actively. This means overseeing investments, making distributions, filing any required tax documents, and providing you with regular, clear reports.

This infographic breaks down the essential steps for choosing the right trust partner.

A methodical approach is key. Verifying credentials, checking expertise, and understanding the costs are fundamental to getting it right. While rules can vary between jurisdictions, the basic principles are often similar. For a different perspective, this a practical guide to setting up a family trust from Australia offers a useful comparison.

A good trustee will make this entire process feel straightforward and manageable, helping you turn a complex decision into a confident step toward securing your future.

Common Questions About Hong Kong Trusts

Even with a clear understanding of the benefits, it's normal to have a few questions. Setting up a trust is a significant step, and getting straight answers is crucial for your peace of mind. Let’s tackle some of the practical questions that entrepreneurs and families often ask when considering a trust company in Hong Kong.

What’s the Minimum Asset Value to Set Up a Trust?

This is a common first question, and the honest answer is: it depends. There's no legal minimum set by Hong Kong law, so each trust company sets its own threshold based on its business model and the costs of professional administration.

As a general guideline, many providers look for initial assets starting around the US$1 million mark for a professionally managed trust. However, this isn't a hard rule. You'll find boutique firms that may work with smaller setups, while the trust arms of private banks often focus on ultra-high-net-worth clients with substantially more. The best approach is to speak directly with potential trustees to find one whose service model fits your situation.

Can My Beneficiaries Live Outside of Hong Kong?

Yes, absolutely. This is one of the key advantages of a Hong Kong trust—its global reach. You can name beneficiaries anywhere in the world, whether they're family spread across continents or international charities.

A professional trust company in Hong Kong is experienced in navigating the complexities of cross-border payments and compliance. They handle the administrative burden, ensuring your beneficiaries receive what they're entitled to legally and efficiently, no matter where they call home. For international families, this is a game-changer.

The ability to structure a trust with international beneficiaries makes it a powerful tool for global estate planning, allowing you to centralise asset management in a stable hub while providing for loved ones across the globe.

How Are the Assets in a Hong Kong Trust Actually Protected?

The protection you get from a Hong Kong trust is multi-layered.

-

Legal Separation: The moment you place assets into the trust, they legally belong to the trustee, not you. This is the core of asset protection. It means those assets are no longer part of your personal estate, putting them out of reach of personal liabilities or business creditors.

-

A Solid Legal System: Hong Kong’s legal system is based on English common law, which has a centuries-long history of upholding the integrity of trusts. This provides a stable and predictable environment where the structure will be respected by the courts.

-

Regulatory Oversight: When you work with a TCSP-licensed provider, you gain an extra layer of security. The trustee is accountable to the Companies Registry and must meet strict professional and fiduciary standards, ensuring everything is done by the book.

At Lion Business Consultancy Limited, we specialise in creating secure, compliant, and tax-efficient structures that protect your assets and support your global ambitions. If you’re ready to build a lasting financial legacy, let's start the conversation. https://lionbusinessco.com