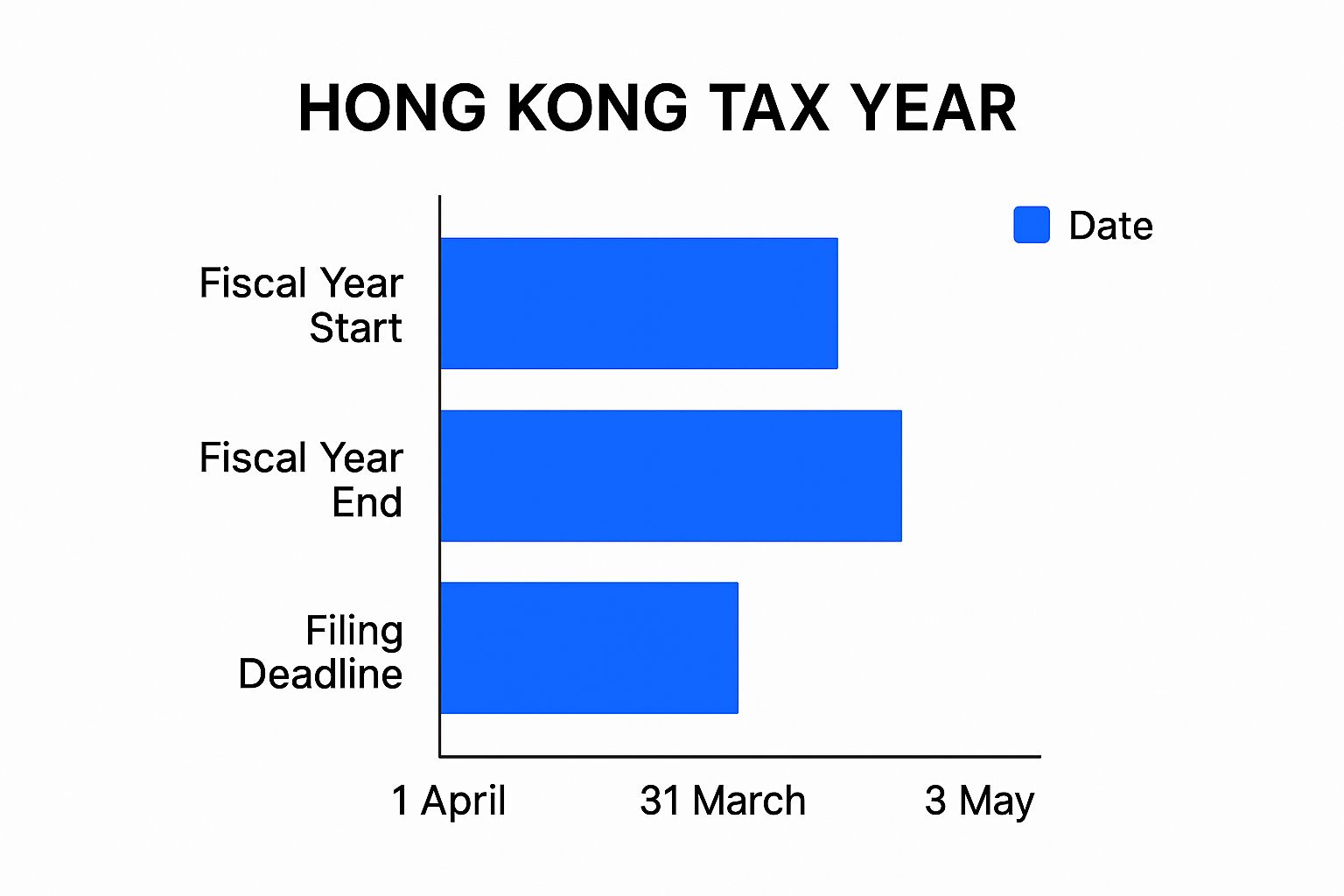

For any entrepreneur or SME setting up in Hong Kong, getting a handle on the tax year is the first crucial step toward smart financial management. The government's official tax year runs from 1 April to 31 March, a timeline that sets the rhythm for all tax filings and payments. But here's the secret: that's just the starting point of the story.

Decoding the Rhythm of Hong Kong’s Tax Year

Think of the official Hong Kong tax year as the financial heartbeat of your business, at least in the eyes of the Inland Revenue Department (IRD). While this 1 April to 31 March period is the government's default calendar for assessing tax, it's not the only timeline you need to know.

One of the most important concepts to get right is the difference between the government's tax year and your company's own accounting period—what the IRD calls your "basis period." Many businesses find it simpler to align their financial year-end with 31 March, but you're not locked into this. You have the flexibility to choose a date that makes more sense for your business cycle.

Why This Matters For Your Business

This isn't just a minor detail; it directly impacts your financial reporting and when your taxes are due. The accounting period you choose determines the window for calculating your profits, which in turn sets your tax return deadlines. A company that closes its books on 31 December, for example, will have a completely different filing schedule from one that uses a 31 March year-end.

The key takeaway is this: mastering your tax timeline starts with understanding how your company's financial story fits into the IRD's official calendar. Getting this right is the foundation for stress-free compliance.

Hong Kong’s tax system is famously business-friendly. Profits tax rates can be as low as 8.25% on the first HK$2 million of assessable profits for corporations, rising to 16.5% after that. Understanding the correct corporate tax rate in Hong Kong is crucial for accurate financial forecasting. For individuals, salaries tax follows a progressive scale, starting from 2% and going up to 17%.

To help you keep track, here is a quick summary.

Hong Kong Tax Year at a Glance

| Concept | Key Detail |

|---|---|

| Official Tax Year | The government's standard period, running from 1 April to 31 March. |

| Your Basis Period | Your company's own 12-month accounting period. |

| Flexibility | You have the freedom to choose your own financial year-end. |

| Impact | Your basis period dictates your specific filing deadlines. |

As you can see, while the official tax year provides the framework, your company's basis period truly sets your personal tax calendar.

Choosing Your Basis Period to Tell Your Financial Story

Think of the government's tax year as the official timeline. Your company's basis period, however, is the chapter of your business's financial story that you submit to the Inland Revenue Department (IRD). It’s the specific 12-month accounting window you choose for calculating your profits.

Many new businesses find it easiest to just match the government’s fiscal year, closing their books on 31 March. There’s nothing wrong with this—it's a clean, straightforward approach. But you’re not locked into that date. Hong Kong’s tax system gives you the freedom to pick a year-end that actually makes sense for your business, and that can be a savvy move.

Take international companies, for instance. A lot of them, especially those with parent companies in Europe or the US, opt for a 31 December year-end. This syncs their Hong Kong reporting with global operations, making life much easier when consolidating accounts and comparing performance. It can also help sidestep the mad rush for auditors that always happens around March and April.

Selecting the Right Financial Year-End

Picking your basis period is more than just circling a date on the calendar. It’s about fitting your tax reporting into the natural rhythm of your business. The right year-end can smooth out your cash flow and turn tax season from a stressful scramble into a predictable part of your annual cycle.

The right basis period allows you to present your financial results in the most coherent way for your specific industry. It’s about choosing the timeline that best reflects your business's natural ebb and flow.

Of course, no matter which date you choose, keeping your books in order is non-negotiable. This is where solid, consistent bookkeeping really proves its worth. To stay on top of it all, many businesses lean on our expert accounting services in Hong Kong to ensure they’re compliant and making smart financial decisions.

If you're managing this in-house, focusing on efficiency is key. You can find some great advice on streamlining month-end closing processes, which can make a huge difference in keeping your records accurate and ready for tax time.

Mapping Out Critical Filing Deadlines

Missing a tax deadline in Hong Kong isn't just a minor administrative slip-up. It can be a costly mistake that attracts unnecessary penalties, so getting the dates right is crucial. The key thing to understand is that your company's tax deadline isn't a single, fixed date for everyone; it’s directly linked to your company's own financial year-end.

Every year, on the first working day of April, the Inland Revenue Department (IRD) starts sending out Profits Tax Returns. This is the starting gun for the tax season, and from that moment, the clock is ticking. Your specific due date depends entirely on when you close your books.

How Your Accounting Year-End Sets the Deadline

The IRD has a straightforward system that groups businesses into three main categories based on their financial year-end. You'll often hear these referred to by their form codes: 'N', 'D', and 'M'. Think of them as different lanes on the highway, each with its own timeline.

-

'N' Code: Does your company's financial year end sometime between 1 April and 30 November? If so, you're in this group. Your tax return is generally due by 2 May of the next year.

-

'D' Code: If you wrap up your books between 1 December and 31 December, you get a bit more breathing room. The IRD sets your filing deadline for 15 August.

-

'M' Code: This category is for businesses with a year-end between 1 January and 31 March. These companies get the longest extension, with a deadline of 15 November. The IRD recognises that this is a hectic period for auditors, so they provide this extra time.

To help visualise this, the infographic below shows the standard government fiscal year and the key dates that anchor the tax calendar.

While the infographic outlines the government's cycle, remember that your company's basis period is what really matters. Matching your year-end to these dates is the first step to staying on top of your obligations.

Profits Tax Filing Deadlines by Accounting Year-End

To make it even clearer, here's a simple table that lays out the standard deadlines set by the IRD, before any extensions are applied.

| Accounting Year-End | Filing Deadline (Without Extension) |

|---|---|

| 1 April – 30 November | 2 May (of the following year) |

| 1 December – 31 December | 15 August (of the following year) |

| 1 January – 31 March | 15 November (of the same year) |

Knowing where your company fits in this schedule is fundamental to good tax planning and avoiding any last-minute scramble.

Understanding Provisional Tax Payments

One of the biggest head-scratchers for anyone new to the tax year in Hong Kong is the idea of provisional tax. It often catches business owners by surprise, so let’s break it down with a simple analogy.

Think of it as a pre-payment for the tax you're expected to owe in the current year. The Inland Revenue Department (IRD) doesn’t want to wait until everything is finalised to collect what’s due. So, they look at your profits from the year that just ended and use that figure to estimate what you'll likely earn this year. You then pay tax on that estimate in advance. It's the government's way of managing its cash flow, and it’s a standard part of the system here.

How Provisional Tax Works in Practice

Let’s imagine you've just wrapped up your company's first year and are filing your first Profits Tax Return. When the IRD assesses it, they'll calculate the final tax you owe for that completed year. At the exact same time, they'll also issue a demand for provisional tax for the next year.

This means your first tax bill can feel like a double hit. It includes:

- Final Tax: The tax you owe for the year you just finished.

- Provisional Tax: An estimated payment for the year you're currently operating in.

For many new entrepreneurs, this can be a serious jolt to the company’s finances if it wasn't anticipated. It’s like paying for last year's dinner and putting down a deposit for next year's all in one go. Proper cash flow planning is absolutely essential to handle this without stress.

The key is to see provisional tax not as an extra tax, but as a prepayment. The amount you pay is credited against your final tax bill for that year when it's eventually calculated. If you overpaid, you get a refund; if you underpaid, you settle the difference.

Getting your head around this system is crucial. It’s not just a minor detail; it’s fundamental to managing your business finances within the rhythm of the tax year Hong Kong requires. Being prepared prevents a nasty surprise and keeps your cash flow healthy.

What to Do When You Can't Meet a Deadline

Even the best-laid plans can go awry. You might be waiting on a crucial financial statement, or some other unexpected issue pops up. When meeting your tax deadline feels impossible, don't panic. The Inland Revenue Department (IRD) has a system for this.

The most straightforward way to get more time is through the Block Extension Scheme. Think of this as an automatic, pre-approved extension for businesses that have appointed a tax representative. It’s a major perk of hiring a professional, as it gives your advisor a standard amount of extra time to prepare and file your Profits Tax Return without you having to lift a finger.

What if You're Filing on Your Own?

If you don't have a tax agent and aren't covered by the Block Extension Scheme, you can still ask for an extension directly. But you can't just ask for one without a good reason. The IRD can be accommodating, but you have to be upfront and explain your situation in writing before the deadline hits.

So, what counts as a valid reason? Generally, it's something truly outside of your control. For instance:

- The person who handles your accounts is seriously ill.

- Your accounting records were lost or destroyed in a fire or theft.

- You're facing major delays getting essential information from a third party.

The golden rule here is simple: never just let a deadline pass in silence. A quick, clear communication with the IRD shows you're acting in good faith and is much more likely to get you a positive result. Remember, an extension is for filing the paperwork, not for paying the tax—your payment is still due by the original date.

To apply, you'll need to send a written request to the IRD. Clearly explain why you need the extension and propose a new, reasonable filing date. This small act of professional courtesy can go a long way.

The Origins of Hong Kong's Unique Tax System

To really appreciate Hong Kong's refreshingly straightforward tax system, you have to look back at how it all started. It wasn't meticulously designed in a quiet boardroom; it was forged out of necessity during a time of global crisis.

The story kicks off during the Second World War. The government needed a way to support Britain's war effort, and in 1940, they introduced the War Revenue Ordinance. This was the city's first-ever income tax regime, and it was only ever meant to be temporary.

Once the war was over, that temporary measure needed to evolve. In 1947, it was replaced by the Inland Revenue Ordinance (IRO), the very same legislation that lays the groundwork for the tax year Hong Kong operates on today.

This history is the key to understanding why Hong Kong’s tax regime is so different from most others. It cemented the two principles that define it: low tax rates and a territorial source-based system.

This core idea—that you only pay tax on profits earned in Hong Kong—is fundamental to concepts like the Hong Kong's offshore profits exemption claim. It’s a legacy that has created the efficient, business-friendly environment the city is famous for.

Common Questions About Hong Kong's Tax Year

We've walked through the fundamentals, but let's be honest, tax always brings up more questions. Here are quick answers to the queries we hear most often from business owners navigating the tax year in Hong Kong.

Can I Change My Company's Financial Year-End?

Absolutely, but it's a significant move. You can't just switch on a whim. To change your basis period, you need to formally notify the Inland Revenue Department (IRD) in writing.

More importantly, you'll need a solid business reason—for instance, aligning with a new parent company's reporting cycle. The IRD has the final say and must approve your request before it becomes official.

What Happens if I Miss a Tax Filing Deadline?

Missing a deadline is not something you want to do. The IRD can issue an estimated assessment of your profits and send you a tax bill based on their own figures, which you'll have to deal with.

On top of that, you could be looking at fines and, in more serious cases, even court action. If you think you might be late, it’s always best to apply for an extension ahead of time.

The IRD much prefers you talk to them than go silent. A quick heads-up about a potential delay shows good faith and can stop a small hiccup from turning into a major headache. Communication is everything.

For entrepreneurs looking at how tax systems work elsewhere, this guide on how to register for corporate tax in the UAE provides a useful comparison with another major business hub.

Is My First Tax Year a Full 12 Months?

Not necessarily. Your first basis period is unique. It kicks off the day your business officially starts and can run for up to 18 months, ending on your chosen accounting date.

For example, say your business commences on 1 June and you decide your year-end will be 31 March. Your first basis period would only be ten months long, not a full year.

Juggling the complexities of global tax and banking is no small feat. At Lion Business Consultancy Limited, we step in as your private financial manager, crafting compliant, low-tax structures that safeguard your business and set the stage for growth. Secure your confidential consultation today and let's build a strategic partnership for your international ambitions.