Thinking about setting up a company in Hong Kong? You're positioning your venture in a location renowned for its resilience and dynamism. For decades, Hong Kong has served as a premier global business hub, offering a strategic launchpad for businesses aiming to penetrate Asian markets and expand globally. Its strategic location, straightforward tax system, and robust legal framework are key reasons for its enduring appeal.

Why Hong Kong Is Still a Global Business Hub

Despite recent global economic shifts, Hong Kong maintains its status as a top-tier international financial centre. This is not by chance but the result of deliberate, pro-business policies and a unique geographical advantage that continues to attract entrepreneurs worldwide.

A significant part of its appeal is its prime location in the heart of Asia. Hong Kong acts as the ultimate gateway to Mainland China, especially the thriving Greater Bay Area (GBA)—an economic powerhouse. This proximity provides businesses with unparalleled access to a vast consumer market and some of the world's most significant manufacturing hubs.

A Tax and Legal System Built for Business

Let's discuss the tax system, which is famously simple and business-friendly. Hong Kong operates on a territorial source principle. In simple terms, this means you are only taxed on profits generated within Hong Kong. The profits tax rates are low, and a two-tiered system offers even greater benefits to small and medium-sized enterprises (SMEs).

Hong Kong’s tax structure is designed for simplicity and growth. There's no capital gains tax, no VAT or GST, and no withholding tax on dividends or interest. This lets you reinvest more of your profits right back into the business.

Beyond taxation, the city’s legal system is based on English Common Law. For international business owners, this is a significant advantage as it provides a familiar and predictable legal landscape. The system is known for its impartiality, transparency, and robust protection of contracts and intellectual property, giving investors genuine peace of mind.

The Pro-Business Environment in Action

The Hong Kong government has consistently maintained a pro-business stance, reflected in its policies and operational efficiency. The regulations for corporate governance are clear and sensible, making compliance less burdensome compared to many other jurisdictions. This environment allows you to focus your energy on growing your business rather than navigating complex bureaucracy.

The city's commitment to free trade and the absence of foreign exchange controls make international capital movement seamless. This is a critical advantage for businesses involved in import-export or global trade. The free flow of capital, goods, and information is what keeps Hong Kong at the forefront of global commerce.

The statistics support this. In the first half of 2025, there was a significant surge in new company registrations, with 84,293 new local companies being established. This brought the total number of registered companies to a new record of 1,494,806, demonstrating sustained confidence in the city. You can explore more data on Hong Kong's company registration trends at BastillePost.com.

When you combine the strategic location, simple tax system, strong legal protections, and a genuinely pro-business culture, it becomes clear why Hong Kong remains a top choice for entrepreneurs. It's the perfect foundation as we delve into the practical steps of forming your company.

Choosing Your Hong Kong Business Structure

Selecting the right business structure is arguably the most critical decision you'll make when setting up a company in Hong Kong. This choice extends beyond mere paperwork; it directly influences your personal liability, taxation, and your capacity to attract investors in the future. Each option presents a different balance of protection, simplicity, and regulatory requirements.

Your choice should align with your business ambitions. For a freelance consultant, the simplicity of a Sole Proprietorship might suffice. However, if you're launching a tech startup with plans to raise capital, the robust framework of a Private Limited Company is essential. Making the right decision from the outset prevents future complications and costly restructuring.

The Private Limited Company: The Go-To for Growth

For the vast majority of entrepreneurs establishing a business in Hong Kong, the Private Limited Company (PLC) is the preferred option, and for good reason. A PLC is a distinct legal entity, separate from its owners. This separation provides limited liability, which shields your personal assets from business debts and legal issues.

This structure is designed for scalability. It is the only entity type that allows you to raise capital by selling shares to investors, making it a prerequisite for securing venture capital. A PLC also benefits from "perpetual succession," meaning the company can exist beyond the involvement of its founders. This stability and professionalism are highly valued by serious investors, partners, and top talent.

Key Takeaway: If your business plan involves seeking investment, hiring employees, or entering into significant contracts where liability is a concern, the Private Limited Company is the optimal choice. It provides the necessary legal protection and corporate structure for confident growth.

Sole Proprietorship and Partnership: For Simpler Ventures

Not every business requires the comprehensive framework of a PLC. For solo entrepreneurs or small collaborations, simpler alternatives exist.

A Sole Proprietorship is the most straightforward business structure. The business is not a separate legal entity from the owner, which simplifies setup and tax reporting. The primary drawback is unlimited personal liability, meaning your personal assets are at risk if the business incurs debt.

- Real-World Scenario: An artist selling their work online with low overheads and minimal risk of debt would find a Sole Proprietorship ideal—it's fast, affordable, and easy to manage.

A Partnership is essentially a Sole Proprietorship for two or more individuals. It allows partners to pool resources and expertise, but the unlimited liability issue persists. Generally, all partners are personally responsible for business debts, including those incurred by other partners.

Comparing Hong Kong Business Structures

To help you understand the trade-offs, here is a side-by-side comparison of the key features of common business structures in Hong Kong.

| Feature | Limited Company | Sole Proprietorship | Partnership |

|---|---|---|---|

| Legal Liability | Limited – Your personal assets are safe. | Unlimited – Your personal assets are at risk. | Unlimited – All partners are personally liable. |

| Legal Status | A separate legal entity from its owners. | Not a separate legal entity. | Not a separate legal entity. |

| Ability to Raise Capital | High. You can issue shares to investors. | Low. Relies on personal funds and loans. | Low. Relies on partner funds and loans. |

| Taxation | Taxed at the corporate profits tax rate. | Profits are taxed at your personal income rate. | Profits are taxed at partners' personal income rates. |

| Continuity | Has perpetual succession; outlives the owners. | Ends if the owner retires or passes away. | Dissolves if a partner leaves or passes away. |

| Compliance Burden | Higher (requires annual audits and filings). | Lower (simple annual renewal). | Lower (simple annual renewal). |

Ultimately, while the simplicity of a Sole Proprietorship is appealing for solo ventures, the Private Limited Company offers the essential liability protection and scalability required for any serious business to grow and succeed in Hong Kong's competitive landscape.

Your Guide to the Company Incorporation Process

After selecting your business structure, the next step is the official incorporation process. This is when your business idea transforms into a legal entity recognized by the Hong Kong government. While it may seem daunting, the process is quite straightforward once you understand the key steps.

We will guide you through the major milestones, from choosing a compliant company name and appointing key personnel to preparing the necessary documents. This process is about building a solid, compliant foundation for your new venture.

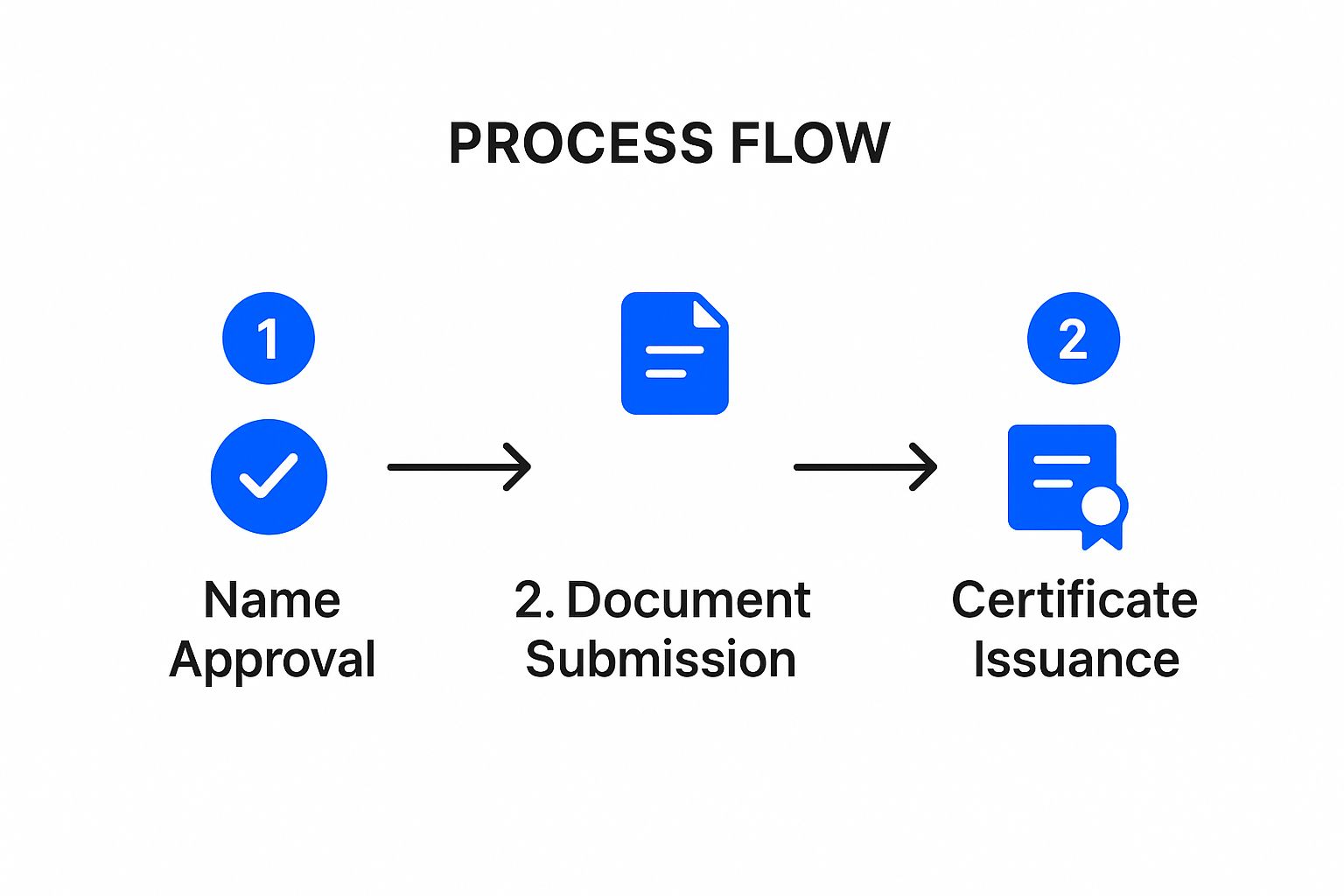

This flow chart provides a high-level overview of the entire journey.

As illustrated, the process begins with securing your company name, moves into the critical documentation phase, and concludes with receiving the official certificates that authorize you to operate.

Securing Your Company Name

The first practical step is choosing a unique name for your company that complies with the Companies Registry guidelines. The name cannot be identical to an existing company name on the register, and certain restricted words suggesting a government affiliation require special approval.

The Companies Registry offers a free online search tool, which you should use extensively. It is wise to prepare a few alternative names in case your first choice is unavailable. A common mistake is selecting a name that is too similar to an existing one, which can lead to application rejection and delays. For example, "Global Trading HK Limited" might be deemed too close to "Global Trade Limited."

Assembling Your Company's Core Roles

Every limited company in Hong Kong must have a few key positions filled from its inception. These roles form the basic governance structure of your business.

- Director(s): A minimum of one individual director is required. There are no residency restrictions, meaning your director can be of any nationality and reside anywhere in the world.

- Shareholder(s): At least one shareholder is necessary. This can be an individual or another company (a corporate body). The director and shareholder can be the same person, which is a common setup for solo founders.

- Company Secretary: This is a mandatory and critical role. The Company Secretary must be a Hong Kong resident or a Hong Kong-based corporation. They are responsible for maintaining official records and ensuring compliance with all administrative deadlines.

Expert Tip: For overseas entrepreneurs, it is standard practice to engage a professional corporate secretarial service. This fulfils the residency requirement and manages ongoing compliance, allowing you to focus on running your business.

The Registered Office Address Requirement

Your company must have a physical registered office address in Hong Kong. This is where all official government correspondence will be sent and must be a physical location, not a P.O. box.

This does not mean you need to lease a physical office immediately. Many startups and international businesses utilize virtual office services from corporate service providers. This provides a compliant address for registration and mail handling while you work from another location.

Preparing and Submitting Your Incorporation Documents

The core of the incorporation process involves preparing and submitting specific documents to the Companies Registry. Understanding the essential legal documents for startups can help you build a stronger legal foundation.

The two primary documents required are:

- Incorporation Form (NNC1): This form provides a snapshot of your new company, including the proposed name, registered address, details of directors and shareholders, and the share capital structure.

- Articles of Association: This document serves as your company's internal rulebook. It outlines the regulations governing the company's operations, such as shareholder rights, director appointments, and meeting procedures. A standard template is available, but it can be customized to suit specific needs.

Once these documents are completed and submitted, the Hong Kong Companies Registry processes them efficiently. Upon successful review, the Registry issues the Certificate of Incorporation. Simultaneously, your application for a Business Registration Certificate is automatically forwarded to the Inland Revenue Department. This integrated, one-stop-shop service means you typically receive both crucial documents together, often within 24 hours if filed electronically.

For a more detailed breakdown, you might want to learn how to set up a company in Hong Kong with our in-depth guide.

Opening Your Corporate Bank Account: The Real Challenge Begins

Congratulations on incorporating your Hong Kong company! Now comes what many founders consider the most challenging step: opening a corporate bank account.

This is not a simple administrative task. Hong Kong banks are under significant pressure to comply with strict anti-money laundering (AML) and know-your-customer (KYC) regulations. A successful application hinges on meticulous preparation and a clear understanding of what banks require.

Simply having a Hong Kong company no longer guarantees banking privileges. Banks need to see evidence of "economic substance"—a genuine business with a clear, logical reason for banking in the city. They want to ensure you are running a real operation, not merely a shell company.

What Banks Really Want to See

At their core, banks are risk-averse. Your primary goal during the application process is to present a clear, compelling, and low-risk profile of your business. This involves more than just submitting your incorporation documents; you must prove your company's legitimacy.

Bankers will scrutinize your business plan, looking for a sound revenue model and a tangible connection to Hong Kong, Asia, or international trade that justifies a local account. For example, if your business trades extensively with Mainland China, a Hong Kong account is a logical choice. However, if you are a European startup serving only European clients, expect probing questions about your need for a Hong Kong account.

Key Insight: Treat the bank meeting as a serious due diligence interview, not a formality. The relationship manager is assessing your risk profile. Be prepared to confidently explain your business model, customer base, and how you intend to use the account.

This emphasis on regional business ties is significant. It is reflected in broader investment trends, where 60.4% of capital for new company registrations recently originated from Mainland China. This highlights the deep economic links that banks understand and tend to favour in new applicants.

Getting Your Document Checklist in Order

While each bank has its own specific requirements, a core set of documents is always needed. Having these organized will streamline the process and demonstrate your professionalism.

- Your Corporate Papers: Prepare your Certificate of Incorporation, Business Registration Certificate, and Articles of Association.

- Director and Shareholder IDs: You will need certified true copies of passports and recent proof of address (e.g., a utility bill or bank statement) for every director, shareholder, and beneficial owner.

- Proof of Business Activity: This is your opportunity to build a strong case. Collect existing contracts, client invoices, shipping documents, or a professional website. For a new venture, a detailed business plan with realistic financial projections is crucial.

For a more comprehensive checklist, our guide on the process of opening a corporate bank account in Hong Kong can be very helpful.

Traditional Banks vs. Digital Alternatives: Which is Right for You?

The banking landscape has evolved. You are no longer limited to major high-street banks like HSBC or Standard Chartered. A new wave of digital banks and fintech platforms offers a different experience.

Traditional Banks (e.g., HSBC, Bank of China)

- The Upside: They offer a full range of services, including trade finance, business loans, global reach, and a long-standing reputation.

- The Downside: The application process can be slow and bureaucratic. They often require in-person meetings and have high requirements for initial deposits and minimum balances.

Digital Banks & Fintechs (e.g., Airwallex, Statrys)

- The Upside: The account opening process is typically much faster and can often be completed entirely online. Their platforms are modern and usually offer lower fees on international payments.

- The Downside: They may not provide the complex financial instruments that traditional banks do. Some business owners also prefer the perceived security of a physical bank.

The right choice depends on your specific business needs. A large-scale import/export business might require the robust trade finance facilities that only a traditional bank can offer. Conversely, a digital marketing agency with international clients would likely find the low-cost, fast transfers from a fintech platform more valuable.

If you are considering options in other business hubs, this guide on opening a corporate bank account provides a useful comparative perspective.

Keeping Your Company in Good Standing

Registering your company is a major milestone, but the work of maintaining it starts now. Ongoing compliance is essential for keeping your business healthy, avoiding penalties, and operating within Hong Kong's legal framework.

Think of it as maintaining a high-performance vehicle. Regular upkeep is necessary to ensure long-term success and prevent costly issues. The same principle applies to your company.

Your Annual Compliance Checklist

Each year, you must complete several non-negotiable tasks to keep your Hong Kong company in good standing. Failure to do so can result in fines and, in serious cases, legal action.

The two key annual requirements are:

- Filing the Annual Return: This update must be filed with the Companies Registry within 42 days of your company's incorporation anniversary. It confirms that key details such as directors, shareholders, and your registered address are current.

- Renewing the Business Registration Certificate: Issued by the Inland Revenue Department (IRD), this certificate legally permits you to conduct business. It must be renewed one month before its expiration each year.

Pro Tip: Set calendar reminders for these deadlines immediately. Missing them is a common and easily avoidable error for new business owners, and the penalties can accumulate quickly.

Navigating Hong Kong's Tax System

Understanding your tax obligations from day one is crucial. Hong Kong is known for its territorial tax system, a major advantage for businesses. You are only taxed on profits generated in or sourced from Hong Kong. Profits made outside the city are generally not subject to Hong Kong Profits Tax.

Your primary tax duty is filing the Profits Tax Return. The IRD will send this form to your company approximately 18 months after incorporation. You will need to complete it, have your accounts audited by a registered Hong Kong Certified Public Accountant (CPA), and file it on time.

Maintaining accurate and organized financial records is the foundation of a smooth tax season. For international operations, it can be beneficial to understand how specialized financial professionals can assist. You might want to consider why you need to hire offshore bookkeepers for your business.

The Crucial Role of the Company Secretary

In Hong Kong, the Company Secretary is more than an administrative role—they are your designated compliance officer. This individual or corporate body is legally responsible for ensuring your company adheres to all regulations under the Companies Ordinance.

Their responsibilities are extensive and vital for legal compliance.

They are responsible for tasks such as:

- Maintaining Statutory Books: This involves keeping all official company records in order, including the register of members and directors, and minutes of official meetings.

- Filing Statutory Returns: Your secretary handles the Annual Return and notifies the Companies Registry of any structural changes.

- Reporting Significant Changes: If you appoint a new director, change your registered office, or alter your share structure, the Company Secretary must notify the Companies Registry within 15 days.

- Advising on Governance: A good secretary provides guidance to the board on corporate governance, ensuring decisions are made in accordance with legal requirements.

Your Company Secretary serves as the primary liaison between your business and the government, managing the flow of information and ensuring all deadlines are met. This role is your first line of defense against compliance failures, making it one of your most important appointments.

Answering Your Key Questions About Setting Up in Hong Kong

When considering company formation in Hong Kong, several questions frequently arise. Here are direct answers to some of the most common queries to provide you with a clear understanding.

Can a Foreigner Really Own 100% of a Hong Kong Company?

Yes, absolutely. Hong Kong allows for 100% foreign ownership of a private limited company without requiring a local partner or shareholder. This is a major attraction for international entrepreneurs, as it provides complete control over the business.

Similarly, company directors can be of any nationality and reside anywhere in the world. The only local requirement is that the Company Secretary must be a Hong Kong resident or a licensed Hong Kong corporation. This structure is genuinely designed for global business.

Do I Have to Fly to Hong Kong to Get Incorporated?

No, you do not need to travel to Hong Kong for the company registration process. The entire procedure can be managed remotely. A reputable corporate services provider can handle all the paperwork and electronic submissions to the Companies Registry on your behalf.

However, opening a bank account is a different matter. While some newer digital banks offer remote onboarding, many traditional high-street banks still require at least one director to attend a face-to-face meeting as part of their compliance process.

A Practical Tip: If traveling to Hong Kong is not feasible, focus your efforts on digital banks and fintech platforms. Many are designed for international founders and can get you set up without the need for travel, saving significant time and expense.

What’s the Minimum Share Capital I Need?

Hong Kong is extremely flexible in this regard. There is no official minimum share capital requirement for a private limited company. It is very common for new companies to register with a nominal amount, such as HK$1, HK$1,000, or HK$10,000.

This low barrier to entry means you do not need to tie up significant capital to launch your business. You can always increase the capital later as the company grows.

How Quickly Can I Get Everything Set Up?

The company registration process itself is remarkably fast, a testament to Hong Kong's efficiency. Once all your documents are prepared and submitted correctly, you can receive your Certificate of Incorporation and Business Registration Certificate within 24 to 48 hours.

The main variable in the timeline is the bank account opening process. This step requires patience. With a digital bank, it could take a few days, but with a traditional institution, the process can extend from several weeks to a couple of months, depending on your business structure and their internal risk assessment procedures.

Is Hong Kong a Good Choice for a Tech or Crypto Company?

Yes, it is, and it is actively enhancing its position as a hub for fintech and digital assets. The Hong Kong government is creating clear regulations to support the industry.

New licensing regimes for virtual asset service providers demonstrate a commitment to building a stable and regulated environment. For startups in the crypto, Web3, or fintech sectors, this move towards regulatory clarity makes Hong Kong a highly strategic location.

Starting your business in Hong Kong is a significant step, and having an experienced partner can make all the difference. At Lion Business Consultancy Limited, we guide founders through the entire process, from initial registration to opening a bank account. Let our experience work for you. Start your Hong Kong company setup with us today.