Thinking about how to open an offshore company can feel daunting, like you're trying to navigate a complex global puzzle. But for ambitious entrepreneurs, it's not about finding sketchy loopholes. It's a strategic move—a powerful tool for global growth, asset protection, and tax efficiency. Let me walk you through how it really works, from one entrepreneur to another.

Why Smart Entrepreneurs Look Beyond Their Borders

If you run a small or medium-sized business with a global vision, staying confined to your home country can feel like wearing a suit that’s two sizes too small. Going international isn’t just an item on a checklist; it’s a foundational strategy to unlock new markets, protect the wealth you’ve worked so hard to build, and create a more resilient business.

This is about making a deliberate choice that aligns with your long-term vision. The goal is to build a solid corporate structure that supports your international ambitions, not one that gets in the way.

The Strategic Advantages of Going Global

Choosing the right international jurisdiction gives you a serious competitive edge. I always advise my clients to think of it less as uprooting their company and more as expanding its operational DNA. In my experience, the core benefits almost always come down to three things:

- Improved Tax Efficiency: You can legally optimize your tax position by operating from a jurisdiction with a more favorable corporate tax system.

- Enhanced Asset Protection: It allows you to build a legal firewall between your business assets and personal wealth, placing them under a stable and protective legal system.

- Access to International Markets: A base in a global hub like Hong Kong or Singapore can open doors to new customers, partners, and world-class banking services.

A Real-World Example: Why Hong Kong Still Wins

Despite the headlines, Hong Kong's business climate remains incredibly energetic and resilient. It has a straightforward territorial tax system: you're taxed at 16.5% on profits generated within Hong Kong. Critically, any income you generate entirely outside its borders is taxed at 0%. That’s a game-changer.

When you couple that with its recent 3.1% year-on-year GDP growth, you can see why it’s such a powerful magnet for international business.

The decision to open an offshore company is fundamentally a strategic one. It's about positioning your business to thrive on a global stage, using legal structures to your advantage while staying completely above board.

For anyone looking to grasp the bigger picture of global business, exploring some high-quality business education resources is a brilliant next step.

How to Choose the Right Offshore Jurisdiction

Choosing a jurisdiction for your business isn't about throwing a dart at a map. It’s a foundational decision that must align perfectly with your specific business model. Too many founders get tunnel vision, chasing the lowest setup fee or a zero-tax promise without seeing the entire landscape. That's a mistake that can easily lead to banking nightmares and reputational damage down the line.

Think of it like choosing a physical headquarters. You wouldn't put a luxury retail store in an industrial park just because the rent is cheap. The same logic applies when you open an offshore company—the location must fit the business.

Matching the Jurisdiction to Your Business Model

The ideal jurisdiction for a global e-commerce seller will look very different from that of a consultant who primarily serves EU-based clients. Before you even start browsing country lists, you need to answer some core questions about your own operations. Getting this clarity first is the most critical part of the entire process.

A few non-negotiables should be at the very top of your checklist:

- Political and Economic Stability: You need a predictable environment where the rules of the game don't change overnight.

- Strong Legal Framework: Look for legal systems based on English Common Law, as they typically offer excellent clarity and robust asset protection.

- Reputable Banking Sector: A top-tier jurisdiction gives you access to reliable international banks that understand and welcome global business.

- International Reputation: Steer clear of blacklisted countries. A clean reputation is vital for building trust with clients, partners, and financial institutions.

Asking the Right Strategic Questions

With those fundamentals in mind, it's time to dig deeper. Hong Kong, for instance, is a premier choice for many because its territorial tax system is perfect for businesses earning income outside its borders. But is it right for your business?

The best jurisdiction isn’t the one with the lowest fees; it's the one that provides the most stability, credibility, and long-term value for your specific business activities. Your choice directly impacts your ability to operate smoothly on the world stage.

To help you think this through, I’ve put together a table comparing some key factors you'll need to weigh. I’ve used Hong Kong as a benchmark to give you a concrete example of what to look for.

Key Factors for Comparing Offshore Jurisdictions

| Factor | What to Look For | Hong Kong Example |

|---|---|---|

| Tax System | Is it territorial, residency-based, or zero-tax? Does it suit your income sources? | Territorial Tax: Only profits sourced in Hong Kong are taxed. Foreign-sourced income is 0% tax. |

| Reputation & Compliance | Is it on the OECD "white list"? Does it meet international standards like FATF and CRS? | High Reputation: A globally respected financial centre, fully compliant with international standards. |

| Legal Framework | Is the legal system stable and business-friendly? (e.g., based on English Common Law). | English Common Law: Provides a predictable and reliable legal environment for contracts and disputes. |

| Banking Access | Can you open a multi-currency business account with a reputable international bank? | Tier-1 Banking Hub: Home to major international banks like HSBC, Standard Chartered, and Bank of China. |

| Privacy & Confidentiality | What level of privacy is offered for directors and shareholders? Is the corporate registry public? | Balanced Privacy: Director details are public, but shareholder information is not, offering a good mix of transparency and privacy. |

| Ease of Administration | Are the annual reporting and compliance requirements straightforward and manageable? | Simple Compliance: Requires an annual audit and tax filing, which is straightforward with professional help. |

This table is just a starting point. Always consider where your customers and suppliers are located. Does the jurisdiction have favourable trade agreements or tax treaties that could benefit your operations? And critically, what level of financial privacy do you truly need versus what is practical?

Understanding these nuances is essential. A detailed comparison will help you find the best country to set up your offshore company based on your unique circumstances. Making an informed choice now is the best way to prevent costly problems later.

The Offshore Incorporation Process Demystified

So, you’ve picked your jurisdiction. Now comes the part that often feels like wading through a sea of paperwork and legal jargon. But I’ll let you in on a little secret: setting up an offshore company is far more straightforward than most people realize, especially if you partner with experts in a well-organized jurisdiction.

Think of it less as a legal battle and more as a project with a clear checklist.

Getting the Ball Rolling: Paperwork and People

First things first, you'll need to gather your core documents. This usually means certified copies of your passport and a recent proof of address (a utility bill or bank statement works perfectly). These are standard Know Your Customer (KYC) requirements, and they’re non-negotiable—they exist to keep the financial system transparent and legitimate.

Next, you'll need to decide on your company’s structure. Who are the directors? Who are the shareholders? You also need to come up with a unique company name that isn't already registered in that jurisdiction. Nailing down these foundational pieces from the start saves a world of headaches later on.

The Two Local Roles You Can't Do Without

Every offshore company needs to appoint two key local representatives: a registered agent and a company secretary. These aren't just empty titles; they are essential, legally mandated roles.

The agent acts as your company's official point of contact with the government, handling all formal correspondence. Meanwhile, the company secretary is responsible for maintaining all your corporate records and ensuring your annual compliance filings are done correctly and on time. You simply can't operate without them.

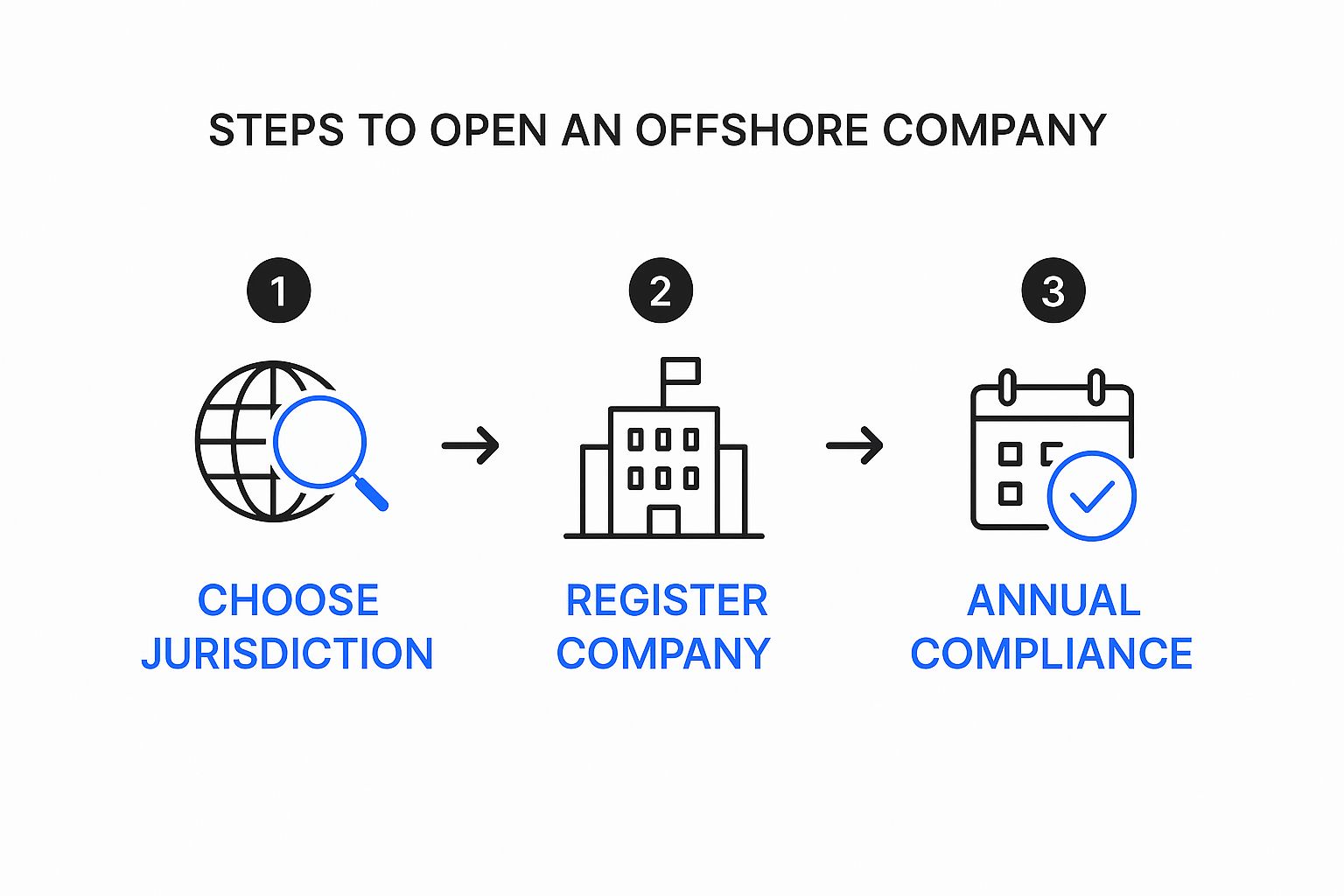

This infographic gives you a great visual breakdown of the core stages.

As you can see, the journey flows logically from strategic choices to the practical nuts and bolts of registration, and finally, into ongoing maintenance.

Take a place like Hong Kong, for example. It’s a perfect case study in efficiency. It consistently ranks high for ease of doing business—3rd globally, according to the World Bank—and its territorial tax system is a massive draw for international founders. The first audit report isn’t even due until 18 months after incorporation, and you can often get the entire registration done online in less than a week. It’s a prime example of a credible, well-oiled machine.

If you’re curious about the specifics, you can find more details about Hong Kong’s filing requirements on GlobalOffshoreCompany.com.

Opening Your Offshore Corporate Bank Account

Alright, let's talk about the real challenge. Forming the company is one thing, but securing a corporate bank account is often the single biggest hurdle you'll face when you open an offshore company.

Forget any old stories about walking into a bank and opening an account with just a passport. Those days are ancient history. Banks are now on the front lines of fighting financial crime, so their compliance and due diligence processes are more intense than ever.

You absolutely must be prepared to prove that your business is legitimate, transparent, and low-risk. Your certificate of incorporation is just the entry ticket; it won’t get you through the door on its own. Banks today will ask for a detailed business plan, proof of your professional background, and complete clarity on the ultimate beneficial owners (UBOs).

Preparing for the Bank's Scrutiny

Think of your bank application less like filling out paperwork and more like pitching to an investor. You need to convince the bank's compliance officer that your business is not only viable but also squeaky clean and fully compliant with international regulations. A vague or hastily prepared application is a one-way ticket to rejection.

Before you even start, make sure you have these essentials locked down:

- A Detailed Business Plan: Clearly explain what you do, who your customers are, where your revenue comes from, and your projected cash flows.

- Proof of Source of Funds: You must be able to document exactly where your initial capital and ongoing funds originate.

- UBO and Director Information: Be ready to provide certified IDs, recent proof of address, and professional résumés or CVs for every key person involved.

There’s a reason why jurisdictions like Hong Kong are so attractive—their world-class banking sector manages a staggering $4 trillion in assets. About two-thirds of that, roughly $2.67 trillion, belongs to international clients, which tells you everything about its status as a global financial hub. This reputation is built on stability and trust, which is precisely why its banks are so thorough.

Your primary goal is to build a compelling narrative that gives the bank's compliance officer total confidence in approving your application. Every document you submit should contribute to the story of a credible, well-run international business.

Getting this right is absolutely crucial for your company to function. For a deeper dive, our guide to offshore company bank accounts walks through even more of the practical steps involved.

Staying Compliant and Protecting Your Status

Getting your company incorporated is a fantastic milestone, but the real journey begins now. The ongoing work of keeping your company in good standing is what truly defines its long-term value. Think of it as the difference between a powerful business asset and a potential compliance nightmare.

It's a bit like owning a high-performance car. You wouldn't just buy it and forget about oil changes and tune-ups. When you open an offshore company, that annual maintenance is precisely what keeps it running smoothly and preserves its legal integrity. This isn’t about bureaucratic box-ticking; it's about responsible ownership.

The Essentials of Annual Maintenance

While every jurisdiction has its own quirks, a few core responsibilities are pretty much universal. Getting these right is crucial for avoiding expensive penalties and keeping your company’s reputation pristine.

You'll almost always need to handle:

- Annual Renewals: This typically covers your government registration fees and payments for your registered agent and company secretary. Missing this deadline can get your company struck off the register—a situation you definitely want to avoid.

- Tax Filings: Yes, even in a "zero-tax" jurisdiction or if your company was dormant, you often still need to file a nil tax return. It's a key part of demonstrating transparency and proving you're following the rules.

- Proper Accounting: Meticulous bookkeeping is non-negotiable. You must keep clean, organised financial records that accurately reflect every single transaction.

In credible jurisdictions like Hong Kong, for instance, an annual audit isn't just a regulatory burden—it's a badge of honor. An audited financial statement lends enormous credibility with banks, investors, and business partners. It proves your company is legitimate and managed professionally.

Staying Organised and Ahead of Deadlines

Juggling all these obligations can feel overwhelming, which is why a solid system is your best friend. A simple compliance calendar mapping out all your key deadlines can be a lifesaver.

To take it a step further, consider implementing a robust due diligence vault to manage all your critical documentation and verifications. This approach keeps your paperwork secure and easily accessible, showing banks and regulators that you're always prepared. Ultimately, being proactive is what ensures your offshore structure remains a powerful tool for global growth for years to come.

Answering Your Top Questions About Offshore Companies

Going international with your business is a big step, and it's natural to have a lot of questions. Let's tackle some of the most common things entrepreneurs ask when they're looking to open an offshore company.

Can I Actually Run the Company from My Home Country?

Yes, absolutely. In fact, that's one of the main attractions. Your company is legally based in its jurisdiction of incorporation, but you're free to manage everything—from operations to client relationships—from anywhere in the world.

The key is to avoid accidentally creating a "permanent establishment" in your home country. If you aren't careful, this can make your offshore profits subject to local taxes, completely defeating the purpose. This is exactly where getting professional structuring advice from the start is non-negotiable.

What Are the Real Costs I Should Expect?

The costs can vary significantly depending on the jurisdiction you choose. For the initial setup, you could be looking at anywhere from a few thousand dollars to well over ten thousand for more complex structures.

Don't forget the recurring costs. You’ll have annual fees for your registered agent, government renewals, and ongoing compliance. While it might be tempting to go for the cheapest option, a well-regarded jurisdiction often costs more for a reason. The credibility and access to better banking it provides is a far better long-term investment for a serious business.

The most common misconception is that "offshore" means illegal. In reality, it is 100% legal. Offshore companies are legitimate corporate structures used globally for international trade, investment, and asset protection. Illegality only enters the picture when these tools are used for illicit purposes like tax evasion.

Do I Need to Fly to the Jurisdiction?

For the company formation itself, no. Most reputable jurisdictions have modernized their processes, allowing you to register everything remotely. So, you can save on the airfare for that part.

Opening a bank account is another story. While some newer, digital-only banks might let you open an account online, most established international banks in top-tier financial centers will require at least one director to show up in person for a final compliance interview. It's always a good idea to check the bank's latest policy before you even start the application.

We dive deeper into these kinds of practical questions in our comprehensive offshore company formation FAQ, which is a great resource if you have more on your mind.

At Lion Business Consultancy Limited, we specialize in creating secure, compliant, and tax-efficient structures for ambitious entrepreneurs. We don’t just form companies; we build the financial frameworks that protect your business and prepare it for global expansion. Book a private consultation with us today.