Yes, you absolutely can open an offshore bank account online, often without setting foot in the country. Think of it less as a complicated legal hurdle and more as a streamlined digital process. It typically involves choosing the right jurisdiction for your business, getting your documents in order, and completing an online application, which usually includes a video call to verify who you are. The whole system is designed to meet strict global compliance rules while making international banking accessible.

Why an Offshore Account is a Strategic Move

For any entrepreneur with an eye on the global market, your operational footprint is the world. Setting up an offshore bank account isn't some shady tactic you see in movies; it's a smart, foundational move for any small or medium-sized business looking to grow beyond its borders. Let's clear the air and talk about what this really means for you.

Imagine this: your e-commerce business is selling to customers in Europe, the UK, and North America. You're probably getting hammered by currency conversion fees and juggling several disconnected bank accounts. An offshore account changes that. It acts as your financial command center, letting you hold multiple currencies and pay suppliers worldwide from one central, efficient platform.

Beyond Banking Basics

But it’s not just about making life easier. It's about building a more resilient company.

When you place a portion of your business assets in a stable, international financial hub, you’re creating a buffer. This protects you from potential economic or political instability back home. It's like having a financial backup generator—you hope you never need it, but it's invaluable for keeping your business running if you do.

Plus, an offshore account can open doors that domestic banks simply can't. You get access to things like:

- Global Investment Markets: A chance to diversify your company's treasury with investment products your local bank has never even heard of.

- Asset Protection: When structured correctly, it can add a crucial layer of legal protection for your business's assets.

- Simplified Global Trade: It smooths out the process of paying international partners and getting paid, cutting down on both friction and fees.

A Hub for International Growth

Take a jurisdiction like Hong Kong, for example. It remains one of the world's top financial centers and a powerful gateway for international business, especially for companies trading with Asia. The banks there are set up for global trade, offering comprehensive multi-currency services in USD, EUR, and, most importantly, offshore Renminbi (RMB).

For any entrepreneur expanding into Asia, Hong Kong's status as the world's largest offshore RMB business hub is a massive advantage. It provides unmatched efficiency for transactions with mainland China, turning what could be a logistical nightmare into a straightforward transfer.

Even with tight global regulations like KYC (Know Your Customer) and CRS (Common Reporting Standard), financial hubs like Hong Kong thrive by offering secure, legal, and fully compliant solutions. In fact, as of early 2025, total RMB deposits in Hong Kong were around RMB 1,164.1 billion, which shows just how vital it is to global finance.

To give you a clearer picture, here’s a quick summary of how these benefits translate into real-world business outcomes.

Core Benefits of an Offshore Business Account at a Glance

This table summarises the key strategic advantages for entrepreneurs considering an offshore bank account, linking each benefit to a practical business outcome.

| Strategic Benefit | Business Impact | Example Scenario |

|---|---|---|

| Multi-Currency Management | Reduces currency conversion fees and simplifies international transactions. | An e-commerce store sells in EUR, USD, and GBP, holding all three currencies in one account to pay suppliers without costly FX conversions. |

| Asset Protection | Legally shields business assets from domestic economic or political risks. | A tech startup in an unstable region holds its investment capital in a stable jurisdiction like Switzerland, safeguarding it from local volatility. |

| Access to Global Markets | Unlocks investment opportunities and financial products unavailable locally. | A consulting firm invests surplus cash in international bonds through its offshore account, generating better returns than domestic savings accounts. |

| Simplified Trade Finance | Streamlines payments for international trade and reduces administrative burdens. | An import-export business uses its Hong Kong account to easily facilitate RMB payments to suppliers in mainland China. |

Thinking about the benefits of an offshore bank account is the first step toward building a truly international business. It’s not about hiding anything; it's about positioning your company strategically in a connected world. You can find out more about the advantages by checking out our guide on the benefits of an offshore bank account.

Choosing the Right Offshore Jurisdiction

This is the single most important decision you'll make when you decide to open an offshore bank account online. I can't stress this enough. We're not talking about chasing secrecy or some clichéd "tax haven." This is a purely strategic business move to align your company with a stable, reputable financial center that directly supports your growth.

Think of it like choosing the foundational tech for your startup. You wouldn't pick some obscure, unsupported programming language. You’d go for a robust framework with a strong community and a clear future. The exact same logic applies here. The right jurisdiction acts as a launchpad, not a liability.

Stability and Reputation Come First

Before you even think about specific banks, you need to vet the country itself. Political and economic stability are non-negotiable. What you're looking for is a long track record of consistent governance, a strong rule of law, and a resilient economy that isn't prone to sudden shocks.

A country's banking reputation is just as crucial. A jurisdiction known for tough compliance and transparency, like Switzerland or Singapore, automatically adds credibility to your business. Why? Because their banks are respected globally, which means your transactions will be processed smoothly without raising unnecessary red flags with correspondent banks.

Your choice of jurisdiction sends a message. Aligning with a high-quality financial center tells the world—and other financial institutions—that your business operates transparently and professionally.

Match the Jurisdiction to Your Business Model

There's no single "best" offshore location. The right answer is deeply personal to your business needs.

Let’s walk through a real-world scenario. Imagine you run a SaaS company with a growing customer base in Asia. Your main goal is to efficiently collect payments in multiple regional currencies, especially Chinese Renminbi (RMB).

- Hong Kong would be a powerful choice. It’s the world's leading offshore RMB clearing center, allowing you to receive and hold RMB without being forced to convert it. This simplifies your accounting and can save a fortune on exchange fees.

- Singapore offers incredible stability and a world-class banking sector. It's another excellent option for Asian trade, particularly if you're dealing with Southeast Asian markets.

- Switzerland is probably less ideal for this specific case. While its reputation for asset protection is second to none, it doesn't offer the same strategic advantages for RMB-denominated trade.

This is why mapping out your cash flow—where your money comes from and where it goes—is the very first step. For a deeper dive into top-tier locations, our guide on the best countries to open an offshore bank account offers a detailed comparison.

Key Factors for Your Analysis

When you're comparing potential jurisdictions, you need to zero in on these core pillars:

- Economic and Political Stability: Look for countries with a long history of stability and strong, independent institutions.

- Banking Sector Health: Choose jurisdictions with well-capitalised banks and a reputation for rigorous regulatory oversight.

- Currency and Trade Advantages: Does the jurisdiction offer specific currency benefits, like Hong Kong's dual access to both HKD and RMB?

- Non-Resident Account Opening Process: How easy is it for foreigners to open an offshore bank account online? The best jurisdictions have clear, efficient digital onboarding processes.

Hong Kong's infrastructure, for instance, is built for this. Its foreign exchange markets have seen explosive growth directly linked to the demand for robust offshore banking. The Bank for International Settlements reported that the average daily turnover of foreign exchange transactions in Hong Kong surged by 27.2% from April 2022 to April 2025. This growth highlights the massive volume of international financial flows managed through the city's offshore services, proving its central role in global trade.

Ultimately, your goal is to pick a jurisdiction that doesn’t just store your money but actively enhances your business operations. It should be a strategic asset that supports your global ambitions.

Getting Your Paperwork in Order for a Smooth Application

You’ve picked out a jurisdiction that looks promising. Great. Now comes the part where most people get bogged down: the paperwork.

Honestly, this is where your application will either fly through or get stuck in a frustrating loop of back-and-forth emails. Think of it like this: you're trying to convince a bank you've never met to trust you with their services. A perfectly organised, comprehensive set of documents is your best (and only) first impression. It’s not about just checking boxes; it’s about presenting a clear, credible picture of who you are and what your business does.

When you try to open an offshore bank account online, remember the compliance officer reviewing your file knows nothing about you. Your documents are their only window into your world. A messy, incomplete submission screams disorganisation. A professional, well-prepared package, on the other hand, builds instant trust.

Nailing Your Personal Documentation

First things first, let's get your personal ID sorted. This is the absolute foundation of your application, and there's no room for error here. Banks are legally required to verify your identity under strict global Know Your Customer (KYC) rules.

You'll almost always need to provide two key things:

- A Certified Copy of Your Passport: This isn't just a photocopy you run off at home. A "certified" or "notarised" copy means a professional—like a notary public, lawyer, or chartered accountant—has seen your original passport, copied it, and then signed and stamped the copy to confirm it's a true likeness.

- Proof of Residential Address: This one trips a lot of people up. The bank needs a recent, official document that clearly links your full name to your physical home address. The gold standard is a utility bill (electricity, water, gas) or a bank statement from the last three months. Mobile phone bills are almost universally rejected, so don't even try.

Pro Tip: Have a backup proof of address ready to go. I've seen applications delayed for a week simply because a bank's internal policy didn't accept the first document provided. A second option, like a government tax notice or a formal tenancy agreement, can be a lifesaver.

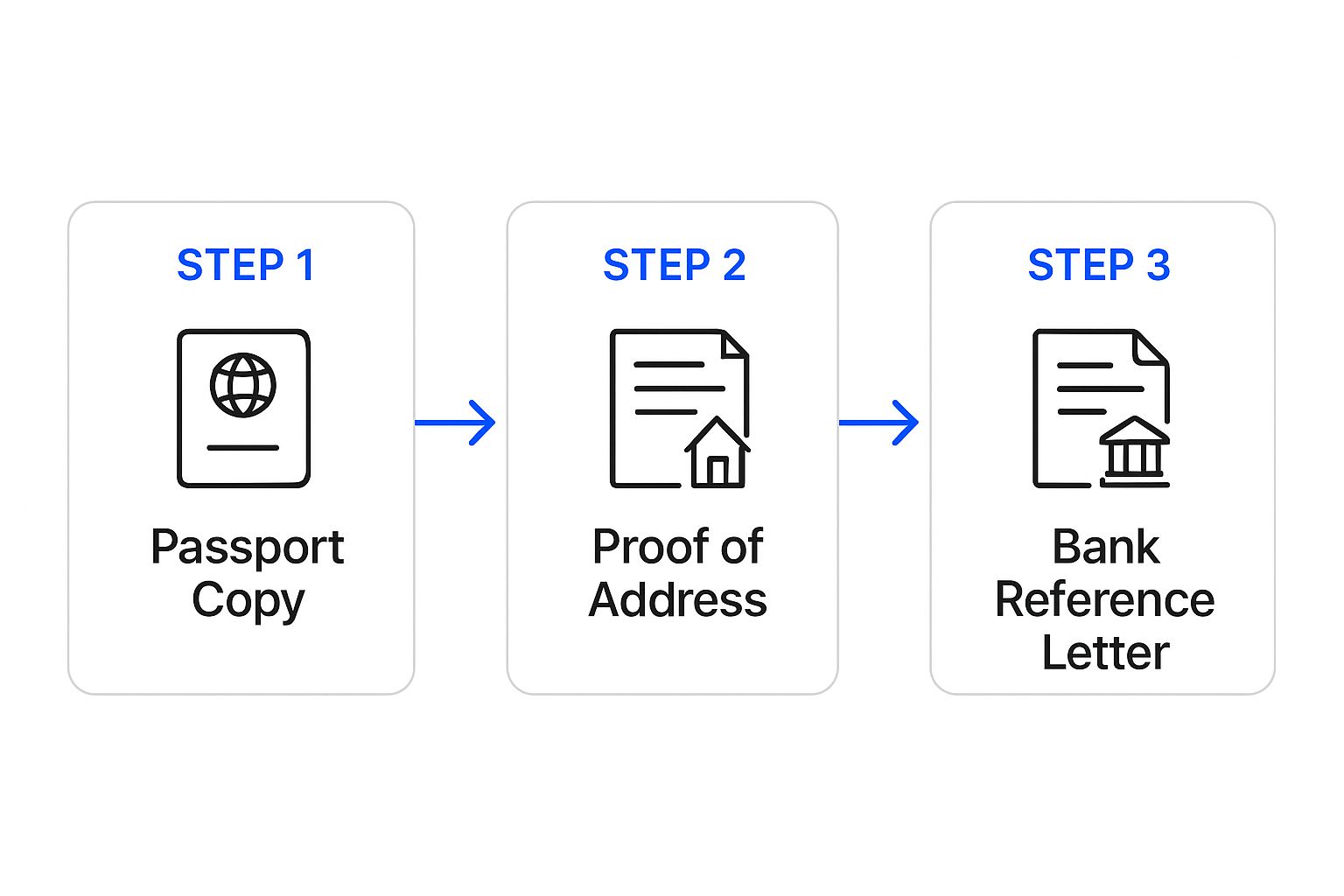

This infographic gives you a quick visual overview of the essential personal documents you’ll need.

Think of it as a sequence. Each document builds on the last to create the solid identity profile the bank needs to see.

Assembling Your Corporate Paperwork

If you're opening an account for a business, the document list gets longer. The bank needs to understand your company's legal structure, ownership, and legitimacy. Your goal is to prove you're running a genuine, operational business, not just a paper-thin shell company.

Here’s a rundown of what you'll typically need to gather:

- Certificate of Incorporation: The company’s "birth certificate," proving it was legally formed.

- Memorandum and Articles of Association: These are the company’s rulebooks, outlining its purpose, powers, and how it's governed internally.

- Register of Directors and Shareholders: A crucial list of who runs and owns the company. This is used to identify all ultimate beneficial owners (UBOs).

- Certificate of Good Standing: If your company is more than a year old, this document confirms it’s up-to-date with all its local registry filings and fees.

A word of warning: these documents must be recent. A Certificate of Good Standing that's six months old is useless. Order fresh copies from your corporate service provider before you start the application to avoid unnecessary delays. If you're targeting Asia, it's worth reviewing the specific Hong Kong bank account requirements for non-residents to get a sense of what's expected in a major financial hub.

To keep it all straight, here is a detailed checklist of what international banks typically require.

Essential Documentation Checklist for Offshore Account Opening

This table breaks down the common personal and corporate documents you'll need, along with some practical advice for getting them right the first time.

| Document Type | Specific Requirement | Pro Tip for Preparation |

|---|---|---|

| Passport Copy | Must be a high-quality colour copy, certified by a notary public, lawyer, or accountant. All pages may be required. | Contact the certifier beforehand to confirm they offer this service and ask about their specific stamp/wording. |

| Proof of Address | A utility bill or bank statement from the last 3 months. Must show your full name and current residential address. | Download the original PDF version from your online banking or utility portal. Printed-out versions are often better quality. |

| Bank Reference Letter | A letter from your current bank confirming you are a client in good standing. | Request this early, as it can take some banks a week or more to produce. Ensure it's on official bank letterhead. |

| Certificate of Incorporation | The official legal document proving your company exists. | Ensure you have a clear, high-resolution scan. If the original is not in English, you'll need a certified translation. |

| Register of Directors/Shareholders | A formal list of all directors and shareholders, showing their ownership percentages. | This must be signed and dated recently. An outdated register is a common reason for rejection. |

| Business Plan Summary | A concise (1-3 page) overview of your business model, target markets, and expected transactions. | Focus on clarity and transparency. Explain why you need an international account for your specific business activities. |

| Source of Wealth Statement | A declaration explaining the origin of your personal wealth and the funds you will be depositing. | Be specific. "Personal savings" is too vague. Better: "Savings from 15 years of employment as a software engineer." |

Having this full package ready before you even start filling out forms will make the entire process smoother and faster.

Telling the Story Behind the Paperwork

Finally, some documents are less about legal proof and more about providing context. This is your chance to get ahead of a compliance officer’s questions and tell a compelling story about your business.

You should prepare:

- A Business Plan: No need for a 50-page novel. A punchy 1-3 page summary is perfect. Explain what your business does, who your customers are, and the nature of the payments you expect to send and receive. Crucially, state clearly why you need this account in this jurisdiction.

- Source of Wealth/Funds Statement: This is a big one and it’s non-negotiable now. You must be able to explain where the money for the initial deposit and future transactions is coming from. Whether it's from salary savings, the sale of a previous company, or an inheritance, be specific and be ready to show proof if asked.

Getting this entire package prepared and organised before you hit "apply" is the single most important thing you can do. It elevates you from being just another applicant to being a credible, organised, and desirable client for the bank.

Navigating the Online Application and Due Diligence

Alright, you’ve gathered your documents and you're ready to go. This is the moment of truth in your journey to open an offshore bank account online. This isn't just about filling out a form; it's your first formal introduction to a potential financial partner, and your preparation is about to pay off in a big way.

Think of the online application as your opportunity to show the bank that your business is exactly the kind of transparent, low-risk client they want. Every field you fill in and every document you upload will be carefully reviewed by a compliance officer, so precision is absolutely key.

The Digital Handshake: Your First Interaction

Most online application forms are pretty straightforward, asking for the personal and corporate details you’ve already prepared. The real challenge is transferring that information without a single error. A simple typo in a director’s name or a transposed digit in your company registration number can trigger an immediate mismatch, leading to frustrating delays.

My best advice? Treat this like a final exam. Double-check every single entry against your source documents before you even think about hitting ‘submit’. This is no time to rush.

After you send off the initial application, you can almost always expect a video verification call. This has become the global standard, completely replacing the old need to fly halfway across the world to visit a branch in person. It’s a mandatory part of the bank’s due diligence.

During this call, you’ll likely need to:

- Confirm your identity by holding your passport or ID up to the camera.

- Answer questions about what your business does and why you need the account.

- Verify you understand the account’s terms and conditions.

Be ready to explain your business model clearly and concisely. If you sell software to clients in Germany, say that. If you import electronics from China, describe the transaction flow. Trust me, vague answers are a massive red flag for any compliance team.

Demystifying KYC and AML Procedures

This entire process is built on two fundamental regulatory pillars: Know Your Customer (KYC) and Anti-Money Laundering (AML). These aren’t just banking buzzwords; they're legally required frameworks created to stop financial crime. A deep dive into understanding AML and KYC requirements is well worth your time.

At its core, the bank is legally obligated to get clear answers to three questions about you:

- Who are you? (This is identity verification)

- What is your business? (This confirms the legitimacy of your operations)

- Where does your money come from? (This verifies your source of wealth and funds)

Your application must provide undeniable, verifiable answers to all three. The modern financial world, particularly in respected hubs like Hong Kong, is built on transparency. The Hong Kong Monetary Authority, for example, reported approximately 16.22 million electronic payment registrations by early 2025, showing a deep fusion of technology and regulatory oversight. Offshore accounts are now part of a compliant, convenient system.

Your job is to make the compliance officer's job easy. Present a clear, logical, and consistent narrative that’s fully supported by your documents. A clear story is a low-risk story.

Avoiding Common Delays and Red Flags

In my experience, I’ve seen applications get held up or outright rejected for the same handful of reasons. Knowing what these are ahead of time lets you steer clear of them entirely.

Common Red Flags to Watch Out For

| Red Flag | Why It's a Problem | How to Avoid It |

|---|---|---|

| Vague Business Description | Phrases like "international consulting" or "global trade" are far too generic and immediately raise suspicion. | Get specific. "Providing marketing strategy consulting for B2B tech firms in the UK and Germany." |

| Inconsistent Information | Your business plan talks about trading with Asia, but your application only mentions clients in the US. | Make sure every single document tells the exact same story. Your narrative has to be perfectly aligned. |

| High-Risk Jurisdictions | Your business or its owners have significant ties to countries on international sanctions lists. | Be upfront about any connections and provide context. Trying to hide it will result in an immediate rejection. |

| Unclear Source of Funds | Simply stating "personal savings" won’t cut it. The bank needs to know the origin of those savings. | Provide a clear money trail. "Savings accumulated from a 10-year career as a project manager at XYZ Corp." |

Proactive communication is your best defence. If you think something might raise a question—like a complicated ownership structure—address it head-on in a cover letter or a supplementary note with your application. Building that trust from the very first interaction will make the entire due diligence process faster and much more likely to succeed.

Making Your New Offshore Account Work for You

So, you’ve done it. You’ve navigated the paperwork, passed the compliance checks, and your new offshore account is officially open. Congratulations! Getting the account live is a huge step, but what comes next is what really matters.

Opening the account isn't the finish line. Think of it as being handed the keys to a powerful vehicle. Now, you need to learn how to drive it effectively to truly get ahead. Proper management turns this account from a simple necessity into a strategic asset that fuels your company’s growth, saves you money, and simplifies your global operations.

It's All About the Banking Relationship

Your relationship with your new bank is a two-way street. They've placed their trust in you by accepting you as a client, and now it's your turn to build and maintain that trust. The single most important thing they want from you is transparency.

Always keep your relationship manager in the loop. If your business is about to make a significant change—say, you're launching a new service or starting to work with suppliers in a new country—let them know beforehand. A quick email explaining the upcoming shift can prevent a lot of headaches. Otherwise, a sudden wave of payments from Vietnam, when you've only ever dealt with Europe, is going to raise an immediate red flag. A simple heads-up turns a suspicious activity into a predictable business move.

Here’s another practical tip I always give my clients: don’t let your account balance hover near zero. It can make the bank nervous and signal that the account isn't being used for legitimate, ongoing business. You don't need to keep a fortune in there, but maintaining a reasonable balance shows the account is an active part of your financial strategy.

Nailing the Day-to-Day Operations

This new account is far more than just a place to park cash. It's a financial toolkit designed for the international stage. The goal is to make every dollar, euro, or pound work smarter for your business.

A few habits will make a world of difference:

- Embrace Multi-Currency: This is one of the biggest perks. If you get paid in USD but pay your developers in EUR, don't convert the money back and forth every time. Hold balances in both currencies. You'll sidestep the bank's often-unfavourable exchange rates and save a small fortune over time.

- Be Smart About Transfers: Instant gratification is expensive. Unless it’s an absolute emergency, plan your international payments. A standard SWIFT transfer that takes a few days is almost always cheaper than an express one. Those small savings on fees really add up.

- Make Reconciliation Your Friend: The online banking portals for these accounts are incredibly powerful. Get into the habit of regularly downloading statements and feeding them directly into your accounting software. It transforms bookkeeping from a chore into a simple, streamlined task.

For businesses operating at the forefront of the digital economy, you might also want to explore how your offshore setup can integrate with digital assets. Understanding which banks that accept cryptocurrency deposits can be a crucial piece of the puzzle.

Staying on the Right Side of Compliance

Your compliance duties didn’t end when the account was approved. In fact, they’ve just begun. This is a non-negotiable part of the deal, and staying organised is the key to keeping your account in good standing.

The biggest thing you need to be aware of is the Common Reporting Standard (CRS). This is a global agreement where banks in one country automatically share financial account information with the tax authorities in another. Your offshore bank is legally obligated to report your account details back to your home country's tax office.

The old days of banking secrecy are long gone. Modern offshore banking is about strategic, compliant financial management, not hiding money. CRS makes everything transparent.

What does this mean for you? It's simple: you must declare the existence of your offshore account and report any income it generates on your local tax returns. I can't stress this enough—hire an accountant with genuine international experience. They will ensure you're ticking all the right boxes, filing correctly, and staying compliant, which is a small price to pay for peace of mind and global legitimacy.

Common Questions About Opening Offshore Accounts Online

When you start exploring international banking, a lot of questions pop up. It’s only natural. I’ve worked with countless entrepreneurs navigating this process, and I’ve found that the same worries tend to surface again and again. Let's clear the air and tackle those common concerns about how to open an offshore bank account online.

Is It Really Legal to Open an Offshore Bank Account?

Yes, absolutely. Holding an offshore bank account is 100% legal for both individuals and companies. These accounts are designed for legitimate purposes—things like facilitating international trade, diversifying your assets, or making global investments.

The legality hinges on one critical principle: transparency. You must declare the account and report any income it generates to the tax authorities in your home country, following your local laws. The problem isn't banking offshore; it's hiding assets or trying to evade taxes.

Top-tier financial hubs like Hong Kong and Singapore are built on a foundation of strict international regulations. They adhere to frameworks like AML (Anti-Money Laundering), KYC (Know Your Customer), and CRS (Common Reporting Standard) to ensure all financial activity is above board. This actually adds a powerful layer of security and legitimacy to your business.

How Long Does the Online Application Actually Take?

This is the big "it depends" question, but I can give you some realistic timeframes based on my experience. How long it takes really comes down to the jurisdiction you pick, the bank itself, and the complexity of your business structure.

If you have all your documents organised and you’re quick to respond to the bank's questions, the whole process can be over in anywhere from a few business days to a few weeks.

Here’s what you can generally expect:

- Modern Digital-First Banks: These newer banks are built for speed. They often cater to startups and SMEs, and it's not unusual to get an account approved and onboarded in under a week.

- Traditional International Banks: The big, established names can have more manual review steps. For these, you should budget for two to four weeks, and maybe longer if your business is in an industry they consider "high-risk."

Honestly, the biggest delays I see are almost always self-inflicted. They come from submitting incomplete paperwork or providing vague descriptions of the business. Be thorough and be responsive—it’s the best thing you can do to speed things up.

The speed of your application is directly in your control. A clean, complete file makes the compliance officer's job easy and moves to the top of the pile. An incomplete one just sits in a pending queue, waiting for you.

What Are the Minimum Deposit Requirements?

Minimum deposits vary wildly, so it’s vital to find a bank that fits your company's financial reality. The good news is there's an option for almost every stage of business.

Some of the newer digital-first banks have no minimum deposit requirement at all. Others might ask for a very low amount, like $1,000 USD. They’re actively trying to win over startups and small businesses, so they understand that preserving cash flow is crucial.

On the other end of the scale, elite private banks in places like Switzerland or Liechtenstein might require initial deposits starting at $250,000 and going well over $1 million USD. These are geared towards high-net-worth individuals and serious wealth management.

For a typical international business account in a major center like Hong Kong, you can expect to see minimum deposit and balance requirements somewhere in the $10,000 to $20,000 USD range. Always check this figure before you start an application so you don't waste your time.

Can I Really Open an Account Without Visiting the Country?

You certainly can. This is one of the biggest game-changers in modern finance. The vast majority of reputable international banks now offer a completely remote account opening process.

The identity verification step, which used to require an in-person meeting, is now done over a secure video call. A bank representative will simply verify your face against your passport and ask a few standard questions about your application.

All your certified or notarised documents are submitted through a secure online portal. This streamlined digital process means an entrepreneur anywhere in the world can access top-tier banking services without the cost and hassle of international travel.

At Lion Business Consultancy Limited, we do more than just help you open an account; we guide you through every step of building a robust global presence. Think of us as your private financial manager, designing compliant, low-tax structures and secure banking setups for long-term growth. If you’re ready for personalised, 1-on-1 advisory to protect and expand your business, let's start the conversation.