Are you tired of seeing currency conversion fees nibble away at your profits while international payments move at a crawl? For a growing business, the decision to open an offshore account isn't some secretive manoeuvre pulled from a spy movie. It's a savvy, strategic play to manage global trade, protect your assets, and boost operational efficiency.

Moving Your Business Beyond Local Banking

Picture this: you're running a thriving e-commerce business. Your products are a hit in Europe, which is fantastic news. The challenge? Every single sale comes with a side of logistical friction.

You're losing a surprising amount of money to currency conversion fees, and sluggish payment gateways are creating a real bottleneck in your cash flow. Your local bank, which has been perfect for domestic transactions, just isn't built for your international ambitions.

This isn't a hypothetical. It’s the daily reality for countless entrepreneurs and small to medium-sized enterprises (SMEs). The moment your business crosses borders, the limitations of traditional, local banking start to show. Suddenly, you're juggling receivables in multiple currencies, navigating frustrating wire transfer delays, and struggling to pay overseas suppliers on time. It can quickly spiral into a logistical nightmare.

Why Your Local Bank Might Be Holding You Back

For many business owners, the thought of looking beyond their familiar local bank can feel a bit daunting. I get it. But as your operations expand, you’ll likely notice a few recurring pain points—clear signals that it’s time to think bigger.

- High Currency Conversion Costs: Constantly swapping Euros, US Dollars, and Pounds back into your home currency is a guaranteed way to erode your profit margins.

- Payment Processing Delays: Waiting days for international payments to clear can stall your supply chain and leave customers frustrated.

- Limited Multi-Currency Support: Juggling multiple bank accounts in different countries is a recipe for complexity and inefficiency.

- Operational Inefficiencies: Your team ends up sinking valuable hours into financial admin instead of focusing on what really matters—growing the business.

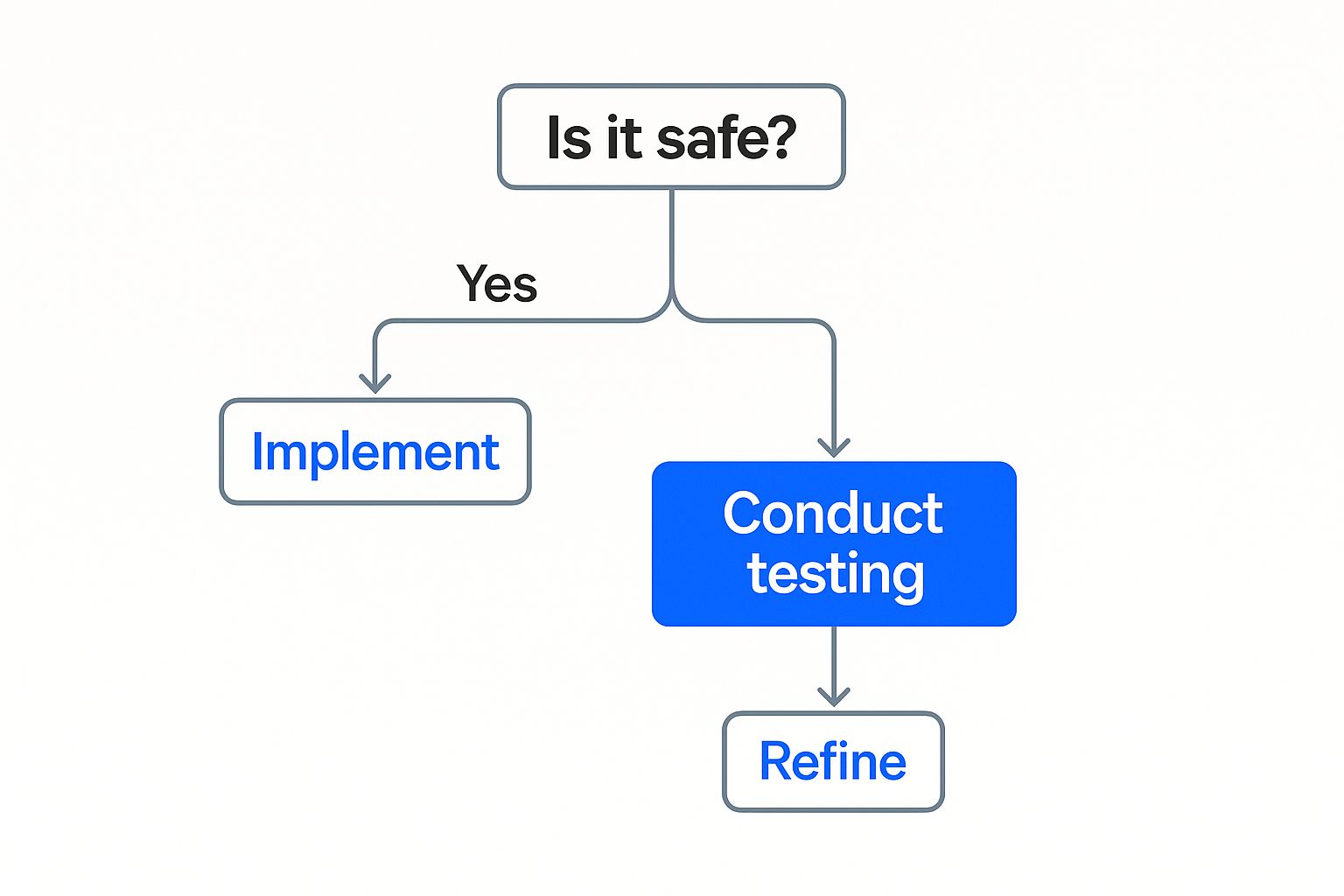

This visual guide breaks down the key decision points for entrepreneurs weighing the next steps in their global expansion.

As the infographic highlights, the more complex your international payments become, the more crucial a centralized, global banking solution is for your growth strategy.

To really see the difference, let's put them side-by-side.

Offshore vs. Local Accounts at a Glance

| Feature | Local Business Account | Offshore Business Account |

|---|---|---|

| Primary Use | Domestic transactions, payroll, local supplier payments. | International trade, multi-currency management, asset protection. |

| Currency Handling | Strong in local currency; often high fees for conversion/holding foreign currencies. | Designed to hold and transact in multiple major currencies efficiently. |

| International Payments | Can be slow and costly (SWIFT fees, correspondent bank charges). | Faster, more cost-effective international transfers. |

| Financial Privacy | Subject to local jurisdiction's reporting standards. | Located in a stable jurisdiction, offering a layer of financial privacy and asset protection. |

| Best For | Start-ups and businesses operating solely within their home country. | SMEs, e-commerce stores, and consultants with international clients or suppliers. |

The table makes it clear: an offshore account isn't a replacement for your local one. It's a powerful complement designed for a specific purpose—global business.

A Strategic Tool for Global Ambitions

This is precisely where offshore banking comes in. It's not some obscure tactic reserved for the ultra-wealthy. Think of it as a practical, powerful strategy for any business with international dealings. The main goal here is efficiency—unifying all your international finances into a single, robust hub.

Hong Kong itself is a perfect example of a jurisdiction built for this purpose. Its financial system is engineered to support global trade. The numbers speak for themselves. In June 2025, the total renminbi remittance for cross-border trade settlement hit a staggering RMB 1,223.5 billion. On top of that, foreign currency deposits grew by 2.4% during the same period. These aren't just statistics; they represent the immense volume of international funds flowing through the city, reflecting a stable and reliable environment for international business.

For any business ready to move beyond the constraints of purely local banking, the first step is to explore different corporate business banking services. It’s about finding a partner who truly understands the nuances of global commerce.

When you start viewing an offshore account as a core part of your business infrastructure, you stop reacting to financial problems. Instead, you're proactively designing a system that supports your expansion goals. You’re building a financial foundation that is as borderless as your vision.

Choosing the Right Jurisdiction for Your Account

Deciding where to open an offshore account can feel like spinning a globe and hoping your finger lands on the right spot. It’s easy to get lost in a sea of options. But the truth is, making the right choice isn't about picking the most famous financial center; it's about finding the one that truly aligns with your business model, risk tolerance, and future ambitions.

Think of it like choosing a foundational partner for your company. You wouldn't just pick one at random. You'd want to understand their background, reputation, and how they operate. The same rigorous thinking applies here. Let's move beyond simple lists and build a practical framework for making a smart, informed decision.

The Four Pillars of a Strong Jurisdiction

When you start evaluating potential locations, four key factors should always be at the top of your mind. These pillars will help you cut through the marketing noise and focus on what actually matters for the security and efficiency of your international finances.

-

Political and Economic Stability: This is absolutely non-negotiable. You’re looking for a country with a long, boring history of stability, a predictable legal system, and a government that respects the rule of law. Volatility is the enemy of asset protection.

-

Privacy and Information Sharing: While the era of complete banking secrecy is over, the level of financial privacy still varies significantly. It's crucial to understand how frameworks like the Common Reporting Standard (CRS) work in each jurisdiction. CRS automates the exchange of financial account information between tax authorities, so you need to be clear on how your data will be handled.

-

Taxation Policies: Let's be honest, a major draw for opening an offshore account is tax efficiency. Look for jurisdictions with low or zero corporate tax rates for foreign-owned companies, no capital gains tax, and no withholding taxes on dividends or interest.

-

Reputation and Banking Sophistication: A jurisdiction’s global reputation matters—a lot. A well-respected financial center ensures your business is seen as credible and reduces friction when you're transacting with partners and clients worldwide. You also need a mature banking sector with modern online platforms and services designed for international businesses.

Putting Theory into Practice: Mini Case Studies

Let's see how this framework plays out in the real world. Imagine three different entrepreneurs, each needing to open an offshore account, and see how their unique circumstances point them to very different jurisdictions.

Scenario 1: The Tech Start-up

A founder with a new SaaS platform is raising capital from international investors and serving a global customer base. For them, a jurisdiction like Singapore is a top contender. Its world-class reputation, robust intellectual property laws, and thriving venture capital ecosystem make it a natural hub for innovation. Critically, its banking system is technologically advanced, a must for any digital-native business.

Scenario 2: The International Trading Company

An entrepreneur in Hong Kong sources goods from mainland China and sells them to clients in Europe and the US. Here, proximity and trade relationships are everything. For this type of business, Hong Kong remains an unparalleled choice. Its strategic location, free-port status, and deep integration into global trade routes make it a powerhouse for import-export operations. The entire financial infrastructure is built to handle massive cross-border flows.

The scale of Hong Kong's offshore operations is immense. By the end of Q2 2025, its gross external debt reached HKD 15,463.6 billion—a figure roughly 4.8 times its GDP. With over half of this held by the banking sector, it underscores the city's central role in global finance and the deep experience its institutions have in managing offshore capital.

Scenario 3: The Asset Protection Seeker

An established consultant wants to protect their hard-earned savings and diversify their wealth outside of their home country’s volatile political and economic climate. For centuries, Switzerland has been the gold standard for asset protection. Its long-standing political neutrality, currency stability (the Swiss Franc), and legendary reputation for discreet, high-quality private banking make it an obvious choice for pure wealth preservation.

The best jurisdiction for your business isn’t a one-size-fits-all answer. It’s the one where the regulatory environment, banking infrastructure, and economic focus create the perfect ecosystem for your specific operations to thrive.

Creating Your Own Scorecard

Now, it's your turn. Instead of passively reading lists, it’s time to actively score potential jurisdictions against what matters most to you. This methodical approach transforms a confusing choice into a clear business decision.

- Identify Your Top Priorities: What’s the number one goal? Is it tax optimization, seamless global trade, asset protection, or access to new investment opportunities? Get specific.

- Research and Rate: Create a simple table. List your top 3-5 potential jurisdictions. Then, rate each one on a scale of 1-5 across the four pillars: stability, privacy, taxation, and reputation.

- Factor in the Practicalities: Don't forget the day-to-day details. What are the minimum deposit requirements? Can you open the account remotely? What are the ongoing maintenance fees? These small things can make a big difference.

By using this kind of structured evaluation, you can confidently select a jurisdiction that not only meets your current needs but also supports your long-term vision. To help narrow down your options, our guide on the best countries to open an offshore bank account offers a more detailed comparison. This process ensures you're not just opening an account; you're making a strategic investment in your company's future.

A Practical Checklist for Your Application Documents

So, you've pinpointed a jurisdiction that fits your business model. Great. Now comes the part that trips up so many people: gathering the paperwork.

Think of this not as red tape, but as a formal introduction of your business to a new financial partner. Banks have a duty to know who they're working with—it’s how they maintain the integrity of the financial system. They need to understand who you are, what your company does, and where the money comes from.

Let's walk through exactly what you'll need. Getting this right from the start will save you from the back-and-forth emails and frustrating delays I see all the time.

Core Personal Identification

First things first: you need to prove you are who you say you are. This is the bedrock of any bank's Know Your Customer (KYC) process. Nail this part, and the rest becomes much easier.

- Certified Passport Copy: This is more than a quick photocopy. Offshore banks almost always require a copy of your passport certified by a notary public, lawyer, or accountant. That official stamp is their proof of authenticity. I’ve seen applications rejected on the spot for this one simple mistake.

- Proof of Residential Address: You'll need a recent utility bill (electricity, water) or a bank statement from the last three months. It must clearly show your full name and current home address. The date is critical—anything older than 90 days will likely be sent back.

- A Professional Reference Letter: Some banks, especially in traditional hubs like Switzerland, might ask for this. It’s a letter from your current bank or a professional like a lawyer or accountant you've worked with for a while. It serves as a financial and character reference, adding a layer of credibility that can really strengthen your case.

Business and Corporate Documents

Next, the bank needs to see that your company is a legitimate, legally structured entity. This is where meticulous organization is your best friend. Forgetting a single one of these documents can bring the whole process to a dead stop.

Generally, you'll need to have these ready:

- Certificate of Incorporation: The birth certificate of your company.

- Memorandum and Articles of Association: The rulebook that governs your company's purpose and operations.

- Register of Directors and Shareholders: A clear list showing who owns and runs the business.

- Certificate of Good Standing: Proof that your company is up-to-date with all its local corporate filings.

A common pitfall I see is submitting outdated corporate documents. Before you send anything, double-check that all your filings are current. A bank's compliance team will notice, and it can raise a red flag about how organized your business is.

Proving Your Business Legitimacy

This is the make-or-break part of your application. The bank needs to understand the story of your business. If your descriptions are vague or your business plan is unclear, you’re creating major headaches for the compliance officer reviewing your file.

Your business plan doesn't need to be a 50-page novel, but it absolutely must detail:

- What your company actually does.

- Who your target customers are.

- Your key markets (where you sell to and source from).

- Your projected annual turnover and the expected volume of transactions.

Just as important is showing your Source of Funds (SOF) and Source of Wealth (SOW). You have to clearly explain where the initial capital came from—personal savings, an investor, profits from a previous venture—and back it up with evidence like bank statements or investment contracts. Transparency is not optional here.

As you pull all this together, questions are bound to come up. For a deeper dive, our guide on common questions about offshore business bank account opening can offer more specific answers.

By methodically preparing these documents, you shift the application from a stressful chore into a clear, manageable step towards taking your business global.

Navigating the Bank Application and Compliance Maze

You’ve organized your documents, double-checked every detail, and finally hit ‘submit’ on your application. It can feel like a huge weight has been lifted, but in many ways, this is where the real work begins. Your application has just landed on the desk of a compliance officer, and now it’s their job to understand your business inside and out.

This stage often feels like a black box for entrepreneurs. It’s where your carefully prepared business plan and supporting documents are put under the microscope. The bank’s primary goal is to manage its risk by carrying out rigorous due diligence, which boils down to Anti-Money Laundering (AML) and Know Your Customer (KYC) checks.

These aren’t just box-ticking exercises; they are strict legal requirements designed to protect the bank and the integrity of the global financial system. The compliance team is essentially building a detailed profile of your business to ensure it's legitimate, understand its expected transaction patterns, and confirm the source of its funds is clean.

The Great Debate: Direct Application vs. Professional Service

One of the biggest decisions you'll face is whether to approach the bank directly or use a professional service. There’s no single right answer, but understanding the trade-offs is absolutely critical.

Applying directly can seem more straightforward and cheaper at first glance. However, if your business model has some complexity or you’re aiming for a jurisdiction with very stringent rules, going it alone can easily lead to rejection over minor mistakes or a business case that isn't framed quite right.

A professional service, on the other hand, acts as your guide and advocate through this whole process. They know what specific banks are looking for, help you frame your business activities in a way compliance officers will immediately understand, and can often spot potential red flags before they ever become a problem. Think of them as a translator between your entrepreneurial vision and the bank's naturally risk-averse language.

The real value of a professional service isn't just in filling out forms. It's in their ability to tell your business's story in a way that builds trust and confidence with the bank from day one.

Setting Realistic Timelines and Expectations

Forget any idea of instant approval. The timeline to open an offshore account can vary dramatically, from a few weeks to several months. A major factor is whether the bank will require an in-person visit or if it allows for remote account opening.

While some modern, fintech-oriented banks are embracing fully remote onboarding, many traditional private banks—especially in premier jurisdictions—still insist on a face-to-face meeting. For them, this is the final and most important KYC step. They want to meet the person behind the paperwork.

Hong Kong’s banking sector is a great real-world example of this balance. Its total assets expanded by 4.5% in 2024, partly driven by capital from offshore clients. Major players like HSBC, which saw an 8% rise in net interest income in the first half of 2025, are keen to welcome foreign businesses. But they maintain incredibly strict standards, especially for non-residents who often need to bring substantial deposits to the table, showing the jurisdiction’s deep commitment to financial integrity. You can review the full report to see how Hong Kong's banking sector maintains this balance.

Presenting a Compelling Business Case

Your application is your business's first impression. A vague or incomplete business plan is the fastest way to get a 'no'. You have to clearly and concisely explain your need for the account.

Here’s what your business case absolutely must cover:

- The ‘Why’: Don't be shy—explicitly state why you need an account in this specific jurisdiction. Are you paying local suppliers? Receiving payments from clients in the region? Managing multiple currencies for your operations?

- Transaction Profile: Give the bank a clear picture of what to expect. What is your anticipated annual turnover? How many incoming and outgoing transfers will you make each month? What are the average transaction sizes? Be specific.

- Geographic Footprint: Detail the main countries you will be sending money to and receiving money from. This is crucial for the bank to assess your geopolitical risk profile.

As you navigate the complexities of international banking, understanding and adhering to all regulations, including international sanctions enforcement, is non-negotiable. A well-prepared application shows the bank that you are a serious, organized, and low-risk client they want to do business with.

This compliance maze can feel daunting, but with the right preparation, it’s entirely manageable. For more insights on overcoming these hurdles, check out our guide on navigating key challenges in offshore financial services. By understanding the bank’s perspective and presenting your case with clarity and honesty, you dramatically improve your chances of a smooth and successful account opening.

Managing Your Account for Long-Term Success

So, you've received the approval. It’s easy to feel like you’ve crossed the finish line, but really, you’re just at the starting gate. The true power of an offshore account isn't in just getting it open; it's in how well you manage it day-to-day and for the years ahead.

Think of it like being handed the keys to a high-performance car. The real work begins now—learning how to drive it skillfully, keeping it maintained, and, most importantly, following the rules of the road to stay out of trouble. Your focus needs to shift from the application grind to smart, ongoing account management.

Building a Strong Banker Relationship

Forget what you know about your local high-street bank where you never see the same face twice. In the world of offshore banking, your relationship manager is your most critical partner. Building a solid, transparent relationship with them is absolutely fundamental.

Keep them in the loop. Are you about to expand into a new country? Got a big payment coming in from a new client? A simple heads-up email can prevent your account from being flagged for suspicious activity. This proactive communication demonstrates that you're a reliable client, which is exactly what they want to see.

Navigating Fees and Online Security

Offshore accounts have their own unique fee structures, and it’s on you to understand them. Get familiar with everything from monthly maintenance fees to the cost of international wire transfers. You need to review your statements regularly so there are no nasty surprises.

On a similar note, take the security of your online banking platform seriously. This is non-negotiable. Always use two-factor authentication (2FA), create genuinely strong passwords, and stay vigilant against phishing scams. The convenience of digital access brings with it the responsibility to protect it.

"Your offshore account is a strategic tool, not a passive savings box. Active management, clear communication, and ongoing compliance are the cornerstones of turning a bank account into a genuine global growth engine."

Understanding Ongoing Compliance Obligations

Just because the account is open doesn't mean the compliance paperwork is over. There are two acronyms you absolutely need to live by: FATCA (the Foreign Account Tax Compliance Act) and CRS (the Common Reporting Standard).

These aren’t optional guidelines; they are global information-sharing frameworks built to fight tax evasion. In simple terms, your offshore bank will automatically report details of your account to the tax authorities where you reside.

- FATCA: This is a US law that requires foreign banks to report on the accounts of their American clients.

- CRS: This is the global version, a standard for the automatic exchange of financial account information that over 100 countries have signed up to.

What this means for you is simple: you must declare your offshore account and any income it earns on your domestic tax returns. Trying to hide it can lead to massive penalties. Complete transparency is the only viable strategy.

Leveraging Your Account for Growth

Once you’ve got the basics of management down, you can start using the account to its full potential. This is where the real strategic benefits come into play.

- Streamline International Payments: Start paying overseas suppliers and receiving funds from clients in their own currencies. This will drastically cut down on conversion fees and annoying delays.

- Manage Foreign Exchange (FX) Risk: Hold balances in multiple major currencies like USD, EUR, and GBP. This acts as a natural hedge against currency fluctuations, protecting your profit margins from market volatility.

- Access New Financial Products: A well-maintained account with a good history can be a gateway to other banking services. You might find yourself eligible for international credit lines, trade finance solutions, or investment products that your local bank could never offer.

By mastering these management practices, your decision to open offshore account shifts from being a one-off task to a powerful, lasting advantage that fuels your business’s global ambitions.

A Few Lingering Questions About Offshore Accounts

Even with a solid plan, taking that final step to open an offshore account can feel a bit daunting. That's perfectly normal. Most entrepreneurs I talk to tend to have the same few questions pop up right before they commit, so let's clear the air and tackle them head-on.

Think of this as our final chat before you get started, just to make sure you're moving forward with complete confidence.

Is This Actually Legal?

Let's get this one out of the way first. Yes, opening an offshore account is 100% legal for any legitimate business or individual. The whole "shady" reputation comes from a small minority who misuse these accounts for illegal purposes like tax evasion or money laundering. For the rest of us, it's just a smart financial tool for managing global business and protecting assets.

The golden rule here is transparency. You simply have to play by the rules, which means following the tax reporting laws in your home country. For most, this involves declaring the account's existence and any income it generates. As long as you're compliant and using the account for lawful reasons, you're on solid legal ground.

What’s the Minimum I Need to Get Started?

This is easily the most common question I get, and the honest answer is: it depends. There’s no single figure that applies everywhere. The minimum deposit is set entirely by the bank and its jurisdiction.

- Up-and-coming Hubs: You'll find some banks, particularly in jurisdictions trying to attract new business, that will let you open an account with just a few thousand dollars.

- Established Centers: On the flip side, prestigious private banks in places like Switzerland or Singapore will expect a much higher initial deposit. For their premium services, you could be looking at anywhere from $100,000 to over $1,000,000.

My advice is to do your homework on specific banks. Some are willing to lower that initial deposit if you bundle it with their wealth management or investment services, so it never hurts to explore their fee-based packages.

The key thing to realize is that the initial deposit often signals the level of service you can expect and the bank's own risk tolerance. A higher barrier to entry usually means you're dealing with a deeply established institution with a long history in private wealth and corporate banking.

Can I Do This All From My Laptop?

While nearly everything else in business has gone digital, remote account opening still isn't a given in the offshore world. Whether you can do it entirely online comes down to two things: the bank's internal policies and the jurisdiction's specific regulations.

Many of the more traditional, reputable banks will still insist on at least one in-person visit. For them, it's a non-negotiable part of their risk management and "Know Your Customer" (KYC) process to verify your identity face-to-face.

That said, a new wave of digitally-native banks is making a fully remote process possible. This usually involves a stack of notarized documents and a thorough video verification call. If you go down this route, just be extra careful. Always triple-check the institution's credentials to avoid sophisticated scams that target people looking for an easy, convenient setup.

Ready to navigate the complexities of international banking with a trusted partner? At Lion Business Consultancy Limited, we provide the private, 1:1 advisory needed to secure your assets and structure your business for global success. We don't just open accounts; we build compliant, tax-efficient frameworks that protect you for the long term.