Thinking about how to open a bank account in HK? Let's get one thing straight: this isn't just about ticking a box on your to-do list. It's a strategic move that can fundamentally change how you do business internationally. For any entrepreneur serious about tapping into Asian markets, Hong Kong offers a stable, low-tax home base with a financial system that's truly world-class.

Q: Why is opening a bank account in Hong Kong such a smart move?

A: Think of it as building your financial command center in Asia. Let's paint a picture. Your e-commerce business is finally gaining traction. You've got suppliers in mainland China and a growing customer base across Southeast Asia. But you're stuck in a financial maze—juggling different currencies, waiting on slow cross-border payments, and watching your profits get eaten up by conversion fees. Does that sound familiar? This is precisely the kind of operational friction a Hong Kong bank account is built to solve.

Hong Kong is far more than a city of skyscrapers; it’s a launchpad designed specifically for global trade. Its legal system is robust and based on English common law, which provides a sense of familiarity and security. On top of that, its currency, the Hong Kong Dollar (HKD), is famously stable, thanks to its peg to the US dollar.

The Ultimate Gateway to Mainland China and Beyond

For countless businesses, Hong Kong's killer feature is its unique role as the bridge to mainland China. It's the world's largest offshore Renminbi (RMB) hub, which makes any transaction with Chinese partners incredibly straightforward.

Here’s a real-world example: I worked with a tech SME that was paying developers in Shenzhen while invoicing clients in Singapore and Europe. By opening a multi-currency account here, they were able to hold and transact in RMB, USD, and EUR all from one place. The result? They slashed their foreign exchange costs by over 15%. That’s a real, tangible impact on the bottom line.

The numbers back this up. Total deposits in Hong Kong saw a 7.8% year-on-year increase, and Renminbi deposits hit a massive RMB 938.2 billion by July 2025. This isn't just a trend; it's a testament to its critical role in regional finance. For a deeper dive into these figures, the Hong Kong Monetary Authority is a great resource.

Takeaway: A Hong Kong bank account is more than a place to park your money. It’s a powerful financial tool that streamlines international payments, helps you manage multiple currencies, and gives you credible access to the enormous mainland China market.

Gain Instant Credibility and Financial Simplicity

There's an unspoken benefit, too: a Hong Kong bank account gives your business immediate credibility. The city's banks are known for their rigorous due diligence, so simply having an account signals to partners, suppliers, and clients that your business operates at a high international standard.

What does that look like in practice?

- Simple, Low Taxes: Hong Kong operates on a territorial tax system. That means you only pay tax on profits generated within Hong Kong. The corporate tax rate is a flat 16.5%, and the first HKD 2 million of profit is taxed at an even lower rate of 8.25%.

- No Capital Controls: You have the freedom to move your money in and out of the city without any restrictions. Your capital is your own to manage as you see fit.

- Global Recognition: An account with a major Hong Kong institution like HSBC or Standard Chartered is recognised and respected across the globe, making international transactions smoother.

To give you a clearer snapshot, here’s a quick breakdown of the core advantages.

Key Benefits of a Hong Kong Corporate Bank Account

| Advantage | What It Means for Your Business |

|---|---|

| Strategic Location | Unrivalled access to mainland China and serves as a central hub for the wider Asia-Pacific region. |

| Stable Banking System | High liquidity, robust regulation, and a currency pegged to the USD provide a secure financial environment. |

| Pro-Business Tax Regime | You only pay tax on Hong Kong-sourced profits, with low, competitive corporate tax rates. |

| No Foreign Exchange Controls | Freely move capital and profits in and out of Hong Kong without government restrictions. |

| Multi-Currency Accounts | Easily hold, manage, and transact in major world currencies (USD, EUR, RMB, etc.) from a single account. |

| Enhanced Credibility | Banking with a reputable Hong Kong institution enhances your company's global standing and trustworthiness. |

This powerful combination of a pro-business climate and a world-class banking infrastructure can turn the headache of international finance into a genuine competitive edge for your company.

Q: How do I choose the right bank for my startup in Hong Kong?

A: Great question. This decision isn't just about picking a name; it’s about finding a partner that understands your business model.

Think of it like this: are you a legacy airline with a massive global network, or a nimble, tech-first budget carrier? Each has its place, but the best choice depends entirely on your needs. Do you go with a traditional powerhouse like HSBC or Standard Chartered, known for their global reach and comprehensive trade services? Or do you opt for a modern digital bank offering a slick interface, faster setup, and lower fees? Let’s break it down.

Traditional Banks: The Global Powerhouses

The big, established names are often the first port of call. We're talking about HSBC, Standard Chartered, and Bank of China (Hong Kong). These institutions are giants for a reason. They offer an incredible range of services, from multi-currency accounts to complex trade financing and letters of credit. For any SME focused on international import/export, this is a massive advantage. But, this comes with trade-offs. The application process is notoriously tough and paperwork-heavy, and you'll almost certainly need a significant initial deposit.

Virtual Banks: The Agile Challengers

On the other side of the spectrum, you have Hong Kong's licensed virtual banks, like ZA Bank, Mox Bank, and WeLab Bank. These digital-first institutions were built from the ground up for the modern entrepreneur.

What does that mean in practice?

- Faster Onboarding: Applications are almost always online, and you can get an account opened in a fraction of the time.

- Lower Costs: Many have no minimum balance requirements and much lower monthly fees, a huge benefit for a lean startup.

- Slick Tech: Their mobile apps and online platforms are generally far more intuitive.

Picture a tech startup that primarily bills clients through online platforms. For them, a simple, low-cost account with excellent digital tools is far more valuable than the complex trade services offered by a legacy bank. It's worth noting that the Hong Kong banking market is highly concentrated, with the top banks heavily influencing service standards.

Takeaway: There's no single "best" bank. The right choice depends entirely on your business. An established trading company will likely favor a traditional bank's robust services, while a digital-native startup will benefit from a virtual bank's agility and lower costs.

As you weigh your options, think about your long-term financial strategy and be sure to explore various funding options for your startup. Your banking partner should align not just with your current operations, but also with your future growth plans.

Q: What paperwork do I need to open a bank account in HK?

A: Putting together your application feels a lot like building a pitch deck for an investor. Every single document you submit tells a part of your business's story. If that story isn't compelling, clear, and complete, you're likely to get a "no".

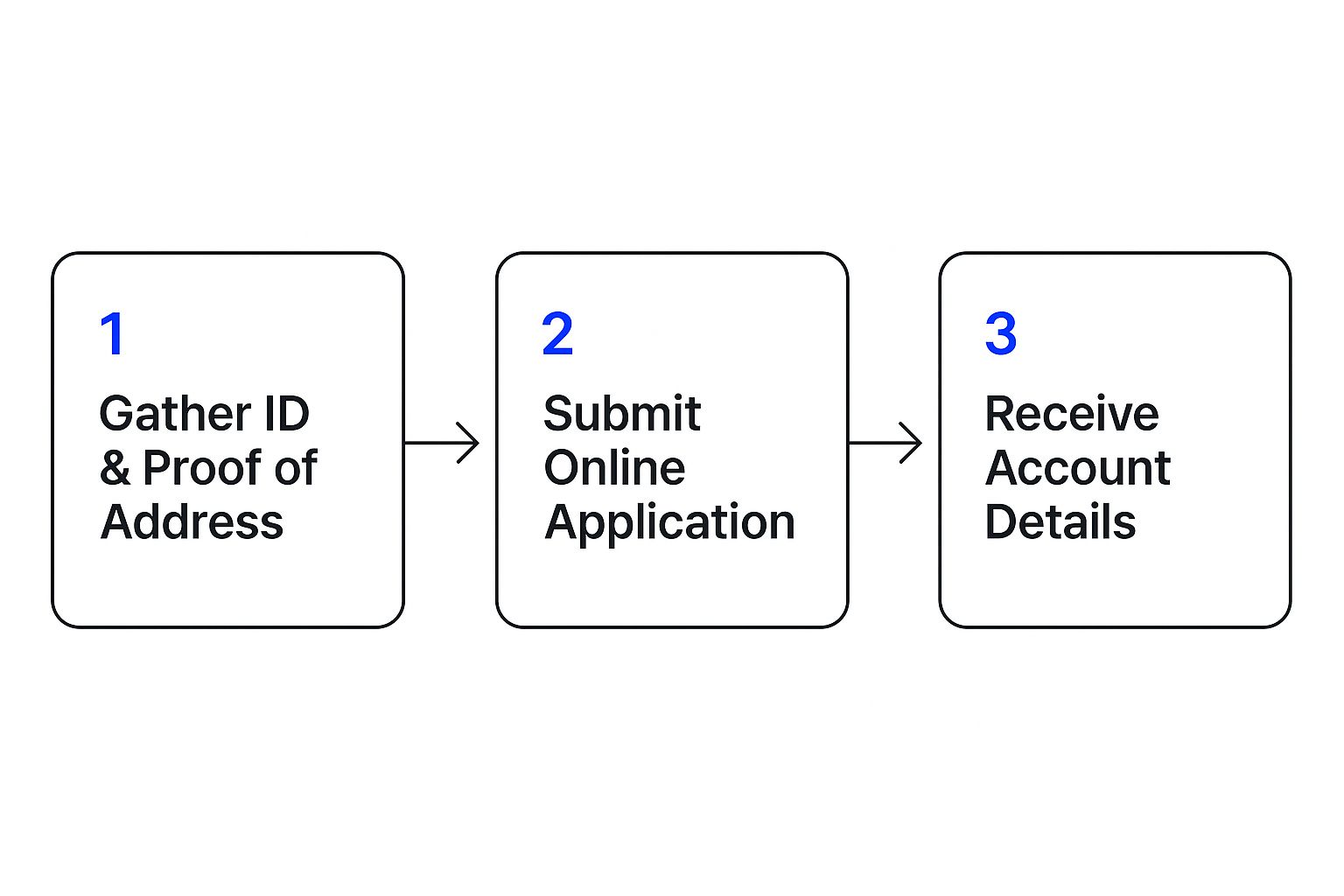

Think of it as a journey with clear stages, from gathering your documents to finally getting those account details.

The real work—the part that determines success or failure—is getting the documents for that very first step absolutely perfect. Let's break down exactly what the banks need and, more importantly, why they ask for it.

Required Documents Breakdown

| Document Category | Specific Documents Required | Pro Tip |

|---|---|---|

| Company Registration | • Certificate of Incorporation • Business Registration Certificate • Articles of Association |

These are non-negotiable. Have certified true copies ready to go. Banks need to see your company is a legitimate, registered entity in Hong Kong. |

| People & Ownership | • Passports for all directors, shareholders (>10%), and signatories • Proof of address (utility bill, bank statement, etc.) for everyone |

Banks are legally required to verify who is behind the company (KYC/AML). If your ownership is complex, include a simple chart to make it easy for them. |

| Business Substance | • Detailed business plan • Invoices from suppliers • Signed contracts with clients • E-commerce website URL |

This is critical. You must prove you have a real, operating business, not just a shell company. Show them the money trail. |

Gathering these documents is the most labor-intensive part of the process, but getting it right the first time saves you weeks of back-and-forth.

Core Company Documents

First up are the foundational papers that prove your business is a legitimate, registered entity. There's no way around these. You'll need your Certificate of Incorporation, Business Registration Certificate, and Articles of Association. A small tip that can save a huge headache: double-check if the bank requires "certified true copies."

Director and Shareholder Information

Next, the bank needs to know who is really behind the company. This is a crucial part of their Know Your Customer (KYC) compliance. You'll need to provide clear copies of passports and recent proof of residential address for every director, signatory, and significant shareholder (usually anyone with 10% or more). Don't just dump a pile of documents on them. Tell a story. If your ownership structure is complex, draw a simple organizational chart to provide clarity.

Proving Your Business Has "Substance"

This is, without a doubt, the most important part. The bank needs to see concrete evidence that you have a real, operational business, not just a paper company. So, what does "business substance" actually look like?

- A Solid Business Plan: Be specific. Instead of "we sell products online," write "we are an e-commerce brand sourcing electronics from Shenzhen to sell to customers in Australia via our Shopify store."

- Proof of Business Activity: This is your evidence. It could be invoices from suppliers, signed contracts with clients, or a link to your functional website. Anything that demonstrates your business is alive and kicking is incredibly powerful.

Before you finalize your package, consider other identifiers that add weight, such as applying for a DUNS number. Remember, preparing these documents isn't just about ticking boxes. It's about building a compelling case for why the bank should want you as a client.

Q: How do I handle the bank application and interview?

A: You’ve picked your bank and have a pristine stack of documents. Now for the main event: the interview. Think of it less as an interrogation and more as a conversation with a future business partner. The bank has seen your paperwork; now they want to hear the story behind it.

What are the bankers really looking for?

In short, they need to understand your business, how you make money, and exactly why you need to open a bank account in HK. This isn't just about compliance—it's about building genuine trust. A banker's biggest fear is an account that ends up being a compliance nightmare. You should be ready to confidently answer questions like:

- Who are your main suppliers and where are they based?

- Which countries will your incoming payments originate from?

- What’s your projected annual turnover for the first year?

- Why is a Hong Kong bank account critical for your business?

I once worked with a UK-based founder selling sustainable goods. During her interview, she clearly explained that her primary manufacturer was in Dongguan, and a Hong Kong account would massively simplify her RMB payments. She even brought a draft supplier contract. That’s the kind of detail that turns a "maybe" into a definite "yes."

Takeaway: The interview is your stage to bring your business plan to life. Clearly explain your business model, your connection to the region, and why Hong Kong is the only logical choice. Be specific, be confident, and be transparent.

Do I really need to fly to Hong Kong?

One of the most common questions I hear is, "Do I really have to fly all the way to Hong Kong for this?" The honest answer is… it depends. For many traditional banks, an in-person meeting is non-negotiable. But things are starting to change. Some modern, digital-first banks are now open to remote video interviews, a shift detailed in KPMG's analysis of the Hong Kong banking landscape. Even so, for most international businesses, you should probably plan for an in-person visit. After the interview, it's a waiting game of two to eight weeks. Respond to any queries immediately to keep the process moving.

Q: What common mistakes get my application rejected?

A: Most rejections are entirely avoidable. They almost always boil down to a few key red flags that make banks nervous. Let's be blunt: banks are risk-management machines. If you understand what makes them anxious, you can craft an application that sails right through.

An Unclear or Inconsistent Business Story

The number one application killer? A business model that’s fuzzy. If the relationship manager can't understand what you do and why you need a Hong Kong bank account, you're on shaky ground. Vague statements like "we are an international trading company" are an instant red flag. Specificity builds trust.

Lacking Real Business Substance

Hong Kong banks are on high alert for "shell" companies. You absolutely have to prove that your business has legitimate operations. This is what the industry calls business substance. Simply registering a company isn't enough. The bank needs to see tangible proof like signed contracts, invoices, or a professional website. An application with zero evidence of real commercial activity looks like a risk no bank will take. These requirements can be tricky, which is why we’ve put together a guide on overcoming challenges in opening a bank account in Hong Kong.

A Complicated Ownership Structure

Finally, an overly complex ownership structure will set off major Anti-Money Laundering (AML) alarm bells. If your company is owned by a tangled web of trusts and offshore entities, the bank’s compliance team will struggle to identify the ultimate beneficial owner (UBO). Be ready to explain your structure with crystal clarity, using a simple visual chart if necessary.

Q: What else should I know about Hong Kong banking?

A: We’ve covered the main steps, but there are always a few more questions. That’s perfectly normal. Let's tackle some of the most common queries we get from founders trying to open a bank account in HK.

Can a non-resident open a bank account in Hong Kong?

Yes, absolutely. Hong Kong’s banking system is open to international business. However, as a non-resident, the bar is set a little higher. You’ll need to prove a concrete, legitimate business reason for needing an account here. The biggest hurdle for most is the in-person meeting, though some digital banks are becoming more flexible.

How long does it really take?

This is the million-dollar question. With a modern digital bank, it could be as fast as one to three weeks. With traditional banks, a smooth process usually takes four to eight weeks after your meeting. However, it can drag on for months if your business is in a high-risk sector. Be patient but persistent.

What are the typical fees and initial deposits?

The costs can vary dramatically. Traditional banks like HSBC often require a hefty initial deposit, anywhere from HKD 50,000 to over HKD 1,000,000, plus monthly maintenance fees. In contrast, digital and virtual banks are far more friendly to startups, with many having no minimum deposit and lower (or zero) monthly fees. Always get a full schedule of fees before you sign anything.

Takeaway: Be patient but persistent. A well-prepared application for a business with a simple structure will always be processed faster. Delays almost always come from the bank’s compliance team needing more information, so your job is to give them a crystal-clear file from the very beginning.

Figuring out Hong Kong's banking maze doesn't have to be something you do alone. At Lion Business Consultancy Limited, we specialise in helping entrepreneurs and SMEs get the accounts they need to thrive. If you’d like an expert to guide you through it all, let's connect and build your financial foundation together.