What is an offshore banking unit? An offshore banking unit, or OBU, is a specialized department within a bank that exclusively handles international financial transactions in foreign currencies for non-resident clients. Think of it as a financial 'fast lane' designed to attract global business by offering a more efficient and often tax-advantaged environment for international trade and investment.

What Exactly Is an Offshore Banking Unit?

To understand the concept of an offshore banking unit, it's best not to picture a separate building. Instead, imagine it as a legally distinct set of accounting books within a bank, firewalled from its standard domestic operations. This special designation allows the OBU to operate under a different set of rules tailored specifically for the world of international finance.

This unique structure acts as a vital bridge, connecting global capital with international opportunities. For example, if you have a business in Europe trading with a supplier in Asia, an OBU in a financial hub like Hong Kong could make the transaction smoother and more cost-effective. This is because it operates outside the typical constraints of the local currency and domestic banking regulations, focusing entirely on foreign currency deals.

The Core Function of an OBU

At its heart, an offshore banking unit exists to serve a specific type of client: non-residents with international financial needs. It is not intended for everyday local banking. Its entire purpose is to manage financial activities for clients who live and operate outside the country where the bank is located.

This sharp focus allows an OBU to specialize in services that are critical for international business and investment. These typically include:

- Foreign Currency Deposits: Holding funds in major currencies like USD, EUR, or JPY without being required to convert them into the local currency.

- International Trade Financing: Providing essential tools such as letters of credit, trade loans, and other financial instruments that facilitate cross-border commerce.

- Global Investment Management: Offering a stable and secure platform for investors to manage a diverse portfolio of international assets.

- Corporate Treasury Services: Helping multinational companies manage their cash flow, foreign exchange risks, and international payments more efficiently.

In short, an offshore banking unit centralizes complex international financial operations into one streamlined, expert unit.

An OBU creates a dedicated ecosystem for international finance within a country's borders. It operates under global rules, not local ones, making it an efficient conduit for foreign capital flowing between non-resident entities.

Why Do Offshore Banking Units Exist?

Governments establish frameworks for OBUs primarily to attract foreign capital and enhance their status as international financial centers. By offering powerful incentives, such as tax exemptions on profits earned from offshore activities, they encourage global banks to set up these specialized units.

This strategy creates a win-win situation. The host country, like Hong Kong, benefits from increased financial activity, the creation of high-skilled jobs, and a stronger global reputation. Simultaneously, international businesses and investors gain access to a sophisticated, efficient, and often more favorable banking environment. Therefore, an offshore banking unit is a strategic tool for both public policy and private financial management.

How Hong Kong Became a Global OBU Leader

Hong Kong's transformation into a titan of global finance was a deliberate evolution, not an accident. Its emergence as a premier hub for the offshore banking unit (OBU) was fueled by a powerful combination of intelligent policy, a prime geographic location, and a deep-seated respect for the rule of law. This strategic development turned the city into a powerful magnet for international capital.

The foundation of this success is its reliable legal system, based on English common law. For international investors and multinational businesses, this offers certainty: contracts are honored, property rights are secure, and disputes are handled within a transparent and familiar framework. This built the trust essential for attracting the trillions of dollars that now flow through its financial system.

This legal stability was complemented by a strong commitment to economic freedom. For decades, Hong Kong has championed low taxes, the free flow of capital, and minimal government intervention. This "light touch" philosophy made it an appealing place for companies wanting to operate smoothly across Asia. An offshore banking unit could thrive here, free from the cumbersome regulations and capital controls found elsewhere.

The Unmatched China Connection

A key factor that accelerated Hong Kong’s rise is its unique relationship with Mainland China. As China’s economy opened to the world, it needed a trusted bridge for global trade and investment. Hong Kong was perfectly positioned to be that bridge, creating massive demand for sophisticated cross-border financial services.

Hong Kong's OBUs quickly became the essential pipelines for this enormous flow of capital, providing the financial plumbing for everything from settling trade payments to channeling foreign direct investment into the Mainland. This symbiotic relationship put the city’s banking sector into overdrive.

The data illustrates this growth. Hong Kong's development as a top-tier offshore banking unit jurisdiction is directly linked to its banking ties with Mainland China. Between 2005 and 2012, Hong Kong's external bank positions—a key measure of cross-border financial activity—more than doubled, rocketing from approximately $1.7 trillion to nearly $3.9 trillion. This expansion coincided with strengthening trade ties, as China's trade-to-GDP ratio consistently hovered above 65% during those years. You can explore this data further on the St. Louis Fed's economic research site.

Pillars of Leadership in Offshore Banking

Hong Kong’s dominance is the result of several core strengths working in harmony to create a resilient ecosystem for offshore finance.

- Legal Certainty: Its common law system provides a predictable and reliable environment for complex deals.

- Economic Freedom: A pro-business policy of low taxes and unrestricted capital movement removes financial friction.

- Strategic Geography: Its location at the heart of Asia and as the gateway to Mainland China provides an unbeatable edge.

- Financial Infrastructure: Hong Kong boasts a world-class banking system, vast capital markets, and a pool of talented financial professionals.

Hong Kong’s leadership is built on a carefully constructed ecosystem. The city masterfully combined a Western-style legal and financial system with exclusive access to an Eastern economic giant, creating the perfect environment for an offshore banking unit to thrive.

This powerful combination of stability, freedom, and strategic positioning is what catapulted Hong Kong to the top. It became an active, vibrant center for making global trade and investment happen, with its OBUs at the very core.

The Strategic Advantages of a Hong Kong OBU

Using an offshore banking unit (OBU) in Hong Kong is a deliberate, strategic move. Global businesses and savvy investors choose the city for a potent mix of benefits that directly boost financial efficiency, security, and growth.

A primary attraction is the potential for intelligent tax planning. Hong Kong's tax system is territorial, meaning that profits earned outside its borders are generally not subject to local profits tax. For a company engaged in international trade, this is transformative. If your Hong Kong OBU handles a transaction between a supplier in Vietnam and a buyer in Germany, the profits from that deal may not be taxed in Hong Kong at all.

This is about efficiency, not evasion. This structure allows a business to retain more of its earnings, which can then be reinvested into the company for expansion or to build a healthier balance sheet. The OBU becomes a powerful financial management tool.

Core Advantages of Offshore Banking Units

An OBU offers a suite of benefits that create a robust platform for international finance. Here is a breakdown of the key advantages and their practical implications for a business.

| Benefit | Description | Practical Example for a Corporation |

|---|---|---|

| Tax Optimisation | Operating under a territorial tax regime where profits sourced outside the jurisdiction are often exempt from local taxes, significantly lowering the overall corporate tax burden. | An e-commerce company uses its Hong Kong OBU to process payments from European customers for goods shipped from China, avoiding Hong Kong profits tax. |

| Asset Protection | Assets are held within a jurisdiction with a stable political environment and a strong, independent legal system (Common Law), shielding them from home country instability or unjust seizure. | An investor from a country with volatile politics holds their investment portfolio in a Hong Kong OBU to protect it from potential capital controls. |

| Global Market Access | Provides a gateway to international markets, enabling seamless multi-currency transactions, access to global investment products, and efficient trade finance facilities. | A trading firm holds USD, EUR, and JPY in its OBU to pay international suppliers and receive payments without incurring constant conversion fees. |

| Enhanced Privacy | Legitimate financial confidentiality is maintained, with strict banking secrecy laws protecting account holder information from public disclosure, while remaining compliant with international standards. | A high-net-worth individual keeps their family wealth in an OBU to manage it discreetly and prevent unsolicited attention. |

These benefits compound, creating a highly effective structure for managing and growing international wealth and business operations.

Fortifying Assets with Legal Certainty

Beyond tax benefits, a significant reason businesses turn to Hong Kong is for robust asset protection. In a world of changing economic and political situations, holding assets in a jurisdiction with a predictable, independent legal system is a necessity. Hong Kong's common law framework provides exactly that.

This legal foundation acts as a shield, protecting assets from risks like arbitrary government seizure, sudden foreign exchange controls, or the fallout from political turmoil in one's home country.

Think of a Hong Kong OBU as a financial safe harbor. It segregates your assets inside a globally respected legal system, insulating them from regional volatility and adding a layer of security that's tough to find elsewhere.

This legal clarity also brings confidence to business dealings, ensuring that contracts are upheld and commercial disputes are settled based on established legal precedent.

Unlocking Access to Global Markets

A Hong Kong OBU is more than a secure vault—it is a launchpad to the world's most dynamic economies. Its position as a gateway to Mainland China is legendary, but its reach extends across Asia and the globe. The city's world-class financial infrastructure makes international business smooth and efficient.

This market access translates into real-world advantages:

- Smarter Currency Management: Hold and transact in multiple currencies directly from your OBU, helping you avoid hefty conversion fees and mitigate risks from exchange rate fluctuations.

- Frictionless Transactions: Hong Kong's banking system is built for speed and reliability, ensuring international payments and trade finance are processed quickly.

- Broader Investment Horizons: An OBU opens the door to a vast array of international investment products and capital markets that might otherwise be inaccessible.

An offshore banking unit in Hong Kong simplifies the complexities of global finance. To further streamline operations, many businesses integrate top cross-border payment solutions with their OBU. If you are considering this route, learn more about opening a Hong Kong offshore bank account in our guide. In summary, a Hong Kong OBU provides a strategic command center for managing global financial operations.

Dominating the Offshore RMB Market

While many financial centers offer offshore banking, Hong Kong holds a unique advantage: its absolute dominance as the world's offshore Renminbi (RMB) hub. An offshore banking unit here is not just for holding foreign currency; it is the main engine driving the RMB's global expansion through an unmatched volume of trade settlement, deposits, and investment products.

For any international company doing business with Mainland China, this makes Hong Kong the default choice. Its OBUs became the essential plumbing that allowed the historically restricted RMB to flow freely around the world. This was a deliberate, strategic development that cemented the city's role as the epicenter for all offshore RMB activities.

The Birth of the CNH Market

To grasp Hong Kong's special role, it's essential to understand the concept of CNH. The RMB has two versions: the onshore version (CNY), used within Mainland China and heavily controlled by Beijing, and the offshore version (CNH), which trades freely in markets like Hong Kong. An offshore banking unit in the city operates almost exclusively in this CNH space.

This two-currency system allowed China to internationalize the RMB gradually without disrupting its domestic economy. Hong Kong was chosen as the primary hub for this experiment, giving its financial institutions a significant head start in building deep pools of liquidity and expertise in managing CNH.

In simple terms, Hong Kong became the world's clearinghouse for the offshore RMB. If a company in Brazil needed to pay a supplier in China using RMB, that transaction would almost certainly be routed through an OBU in Hong Kong to tap into its unique CNH infrastructure.

The numbers confirm this leadership. By 2011, Hong Kong's banks were already handling a staggering RMB 1,915 billion in offshore Renminbi trade settlement. In the same year, offshore RMB deposits soared to nearly RMB 600 billion, with about 70% held by corporate clients. You can find specifics on this growth in the Hong Kong Monetary Authority's official report.

Financial Innovations That Cemented Leadership

Hong Kong actively innovated to fuel global demand for the offshore RMB. The most famous of these innovations is the "dim sum bond". These are bonds denominated in RMB but issued and traded outside Mainland China, primarily in Hong Kong.

They were a game-changer, offering a breakthrough for two key groups:

- International Investors: For the first time, investors worldwide could gain exposure to the RMB and China’s growth without needing direct access to mainland markets.

- Multinational Corporations: Companies could raise funds directly in RMB to finance their Chinese operations or manage currency risk more effectively.

Dim sum bonds were a massive success and one of many financial products developed in Hong Kong. This creative spirit sparked a self-reinforcing cycle: more innovation led to more demand for CNH, which deepened liquidity in Hong Kong's OBUs, making it an even more attractive hub for RMB business.

Why It Matters for Your Business

What does this mean for you? If your business buys from, sells to, or invests in China, a Hong Kong OBU offers unmatched efficiency. It is the most connected and liquid channel for managing your RMB.

Here is what that looks like in practice:

- Better Exchange Rates: The massive pool of CNH liquidity in Hong Kong often translates into more favorable exchange rates.

- Faster Settlement: As the primary clearing hub, transactions are processed quickly and smoothly, reducing supply chain delays.

- Greater Access to Finance: Your business can tap into a wide range of RMB-denominated financing and investment products unavailable elsewhere.

Choosing an offshore banking unit in Hong Kong plugs your business directly into the world's most important RMB financial artery, providing a competitive advantage by streamlining payments, cutting costs, and opening new growth opportunities tied to the Chinese economy.

Why Hong Kong Stands Out Among OBU Jurisdictions

While many financial hubs offer offshore banking, they are not all equal. When global corporations and high-net-worth individuals search for the right base, Hong Kong consistently emerges as a top choice due to a powerful combination of strengths that other jurisdictions struggle to replicate.

The city's competitive advantage rests on three pillars: its unwavering commitment to a common law framework, a world-class financial infrastructure, and its unmatched position as the primary gateway to Mainland China. While other hubs offer stability, Hong Kong provides stability plus direct access to one of the world's largest economies. A comparison with other well-known offshore financial centers like Jersey highlights its unique position.

The Bedrock of Common Law

One of Hong Kong's most significant assets is its legal system, built on English common law. This provides a level of legal predictability and transparency essential for international business.

Unlike civil law systems, common law relies on judicial precedent, ensuring that legal interpretations are consistent and well-documented. This creates an environment where contracts are fiercely protected, and disputes are settled within a familiar framework. This legal certainty is a major draw for companies needing absolute confidence in the security of their assets and agreements.

Think of the common law system as a corporate insurance policy. It guarantees a stable and predictable legal landscape, giving international businesses the confidence they need to commit significant capital and manage complex cross-border operations.

This contrasts with jurisdictions where legal frameworks may be opaque or subject to political influence. The reliability of Hong Kong's judiciary gives any offshore banking unit operating there a badge of credibility and security.

A Look at the Leading Jurisdictions

A direct comparison with other top-tier hubs like Singapore and Switzerland reveals where Hong Kong truly pulls ahead. Each has its strengths, but Hong Kong’s blend of features gives it a potent edge, particularly for businesses focused on Asia.

OBU Jurisdiction Feature Comparison

This snapshot shows how the three leading jurisdictions stack up. While all are excellent choices, Hong Kong’s specific strengths make it the premier option for China-focused enterprises.

| Feature | Hong Kong | Singapore | Switzerland |

|---|---|---|---|

| Primary Market Focus | Mainland China and North Asia. It is the dominant offshore RMB hub, facilitating massive trade flows. | Southeast Asia (ASEAN). A strong hub for regional wealth management and commodity trading. | Europe and Global Wealth. A historic centre for private banking, asset protection, and European capital. |

| Legal System | English Common Law. Offers high predictability and robust contract enforcement. | English Common Law. Provides a similar level of legal stability and corporate governance. | Civil Law. A very stable but structurally different legal system based on codified statutes. |

| Financial Infrastructure | World-class. Deep capital markets, advanced digital banking, and extensive trade finance expertise. | Excellent. Strong in wealth management technology and a major foreign exchange trading centre. | Highly developed. Famous for its private banking expertise and long-standing financial discretion. |

| Tax Regime | Territorial. Profits sourced outside Hong Kong are generally not subject to local profits tax. | Territorial. Similar to Hong Kong, with specific exemptions for foreign-sourced income. | Favourable. Low corporate tax rates, but the system is more complex with cantonal and federal taxes. |

This table highlights that while each jurisdiction excels in its niche, Hong Kong’s focus on Mainland China, backed by a common law system and a simple tax regime, creates a uniquely compelling proposition.

The Unbeatable China Gateway

The bottom line is clear. While Singapore provides phenomenal access to Southeast Asia and Switzerland remains the gold standard for European private wealth, neither can match Hong Kong's deep, intricate integration with the Mainland Chinese economy.

This is not just about geography. It is about decades of established trust, specific regulatory agreements, and financial plumbing built to streamline capital flow in and out of China. For any international business that trades with, invests in, or raises capital for operations in China, a Hong Kong offshore banking unit is the most efficient channel. It offers direct access to the offshore RMB (CNH) market, enormous liquidity pools, and a regulatory environment purpose-built for the job. For many China-centric businesses, this makes Hong Kong the only strategic choice.

Navigating OBU Regulations and Compliance

A common misconception is that offshore banking is an unregulated financial frontier. This is far from the truth, especially in a world-class jurisdiction like Hong Kong. An offshore banking unit here operates within a sophisticated and strict regulatory system designed for financial integrity.

These units are overseen by powerful bodies, most notably the Hong Kong Monetary Authority (HKMA), which enforces a robust compliance framework aligned with the highest international standards. The goal is to offer the legitimate benefits of offshore finance while preventing illegal activities, creating a secure and trusted environment for international business.

The Pillars of OBU Compliance

Operating a successful offshore banking unit requires adherence to a strict set of rules, particularly protocols for Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT). These are not just local guidelines but Hong Kong’s commitment to global standards set by groups like the Financial Action Task Force (FATF).

Every legitimate OBU must follow a rigorous checklist, which includes:

- Customer Due Diligence (CDD): The first line of defense, involving thorough verification of a client's identity and business activities.

- Know Your Customer (KYC): A deeper process that requires the bank to understand a client's risk profile and the source of their wealth and funds.

- Ongoing Transaction Monitoring: Continuous monitoring of account activity for red flags or unusual patterns that might indicate financial crime.

- Reporting Obligations: Suspicious activities must be reported to the authorities, ensuring transparency and accountability.

Compliance isn't just an add-on; it's the very foundation that gives a Hong Kong OBU its legitimacy. These strict rules are precisely what separate a premier financial hub from a secretive, high-risk tax haven.

These measures ensure that while you gain the financial advantages of an OBU, you are operating within a framework of legal and ethical responsibility.

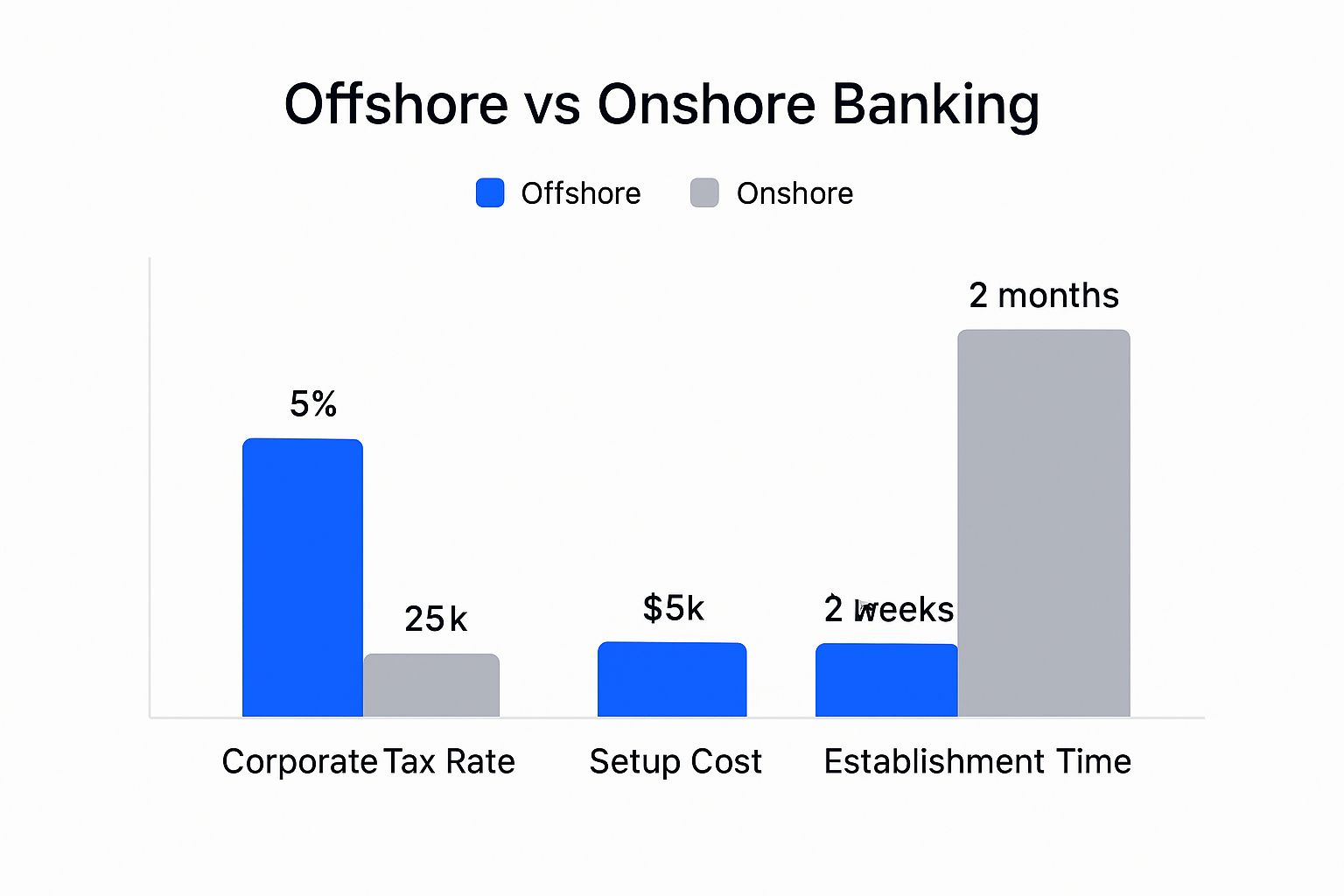

The graphic below illustrates why well-regulated offshore structures are appealing compared to their onshore counterparts.

As shown, differences in tax rates, setup costs, and establishment time often steer businesses towards offshore jurisdictions that strike the right regulatory balance.

Transparency and Global Cooperation

Hong Kong's reputation for robust oversight is central to its success. The growth of its offshore banking sector demonstrates this. For example, between 2009 and 2019, RMB bank deposits in Hong Kong skyrocketed from around $33 billion to roughly $909 billion—a nearly 27-fold increase. This explosive growth is impossible without a trusted regulatory environment.

An offshore banking unit offers significant advantages but does so within a system that is transparent, cooperative, and closely regulated.

Common Questions We Hear About OBUs

Navigating the world of international finance can raise many questions. Here are clear, direct answers to some of the most common queries about using an offshore banking unit (OBU) in Hong Kong.

Are Offshore Banking Units a Legal Loophole?

No, a properly established offshore banking unit in a premier financial center like Hong Kong is not a shady workaround for tax evasion. It is a legitimate financial structure operating within a strict legal framework designed to make lawful international trade and investment more efficient. Regulators like the Hong Kong Monetary Authority (HKMA) enforce rigorous rules, including:

- Anti-Money Laundering (AML): Strict protocols to prevent illicit funds from entering the system.

- Know Your Customer (KYC): In-depth identity and business verification for all clients.

These measures ensure that the benefits of an OBU are reserved for genuine, legitimate global businesses.

Who Should Consider Using an OBU?

A wide range of businesses and individuals can benefit from an OBU. The most common users are:

- Multinational Corporations: To centralize treasury functions, manage multiple currencies, and reduce administrative costs.

- International Investors: To protect assets, diversify portfolios, and access global markets.

- High-Net-Worth Individuals: For sophisticated wealth management and estate planning within a stable and expert jurisdiction.

- E-commerce and Trading Companies: To efficiently process international payments and optimize profits from cross-border sales.

How Does a Hong Kong OBU Differ From One in Singapore?

Both Hong Kong and Singapore are financial titans, but they have different primary strengths. Hong Kong’s key advantage is its unparalleled status as the world’s largest offshore Renminbi (RMB) hub.

For any business with deep ties to the Chinese economy, Hong Kong is the clear choice. Its massive RMB liquidity pools and unique regulatory connection to the Mainland mean its entire financial infrastructure is built to handle RMB-denominated trade and investment seamlessly.

Singapore is also a financial powerhouse but has historically focused on serving Southeast Asian (ASEAN) markets and offering wealth management to a more globally diverse client base. The decision often depends on your core market. If China is your focus, the offshore banking unit ecosystem in Hong Kong offers a distinct and powerful advantage.

Making sense of global finance is complex, and it pays to have an expert in your corner. At Lion Business Consultancy Limited, we specialise in setting up international corporate structures and opening the bank accounts businesses need to go global. To see how our hands-on experience can help your venture, find out more at https://lionbusinessco.com.