Let’s be honest. When you hear the term ‘numbered bank account’, what’s the first thing that pops into your head? For most people, it’s a scene straight out of a spy thriller: a shadowy figure, untraceable funds, and a secret vault tucked away deep in the Swiss Alps. It’s a powerful image, one that Hollywood has sold us for decades.

But the reality of a numbered bank account in today's financial world? It’s far more practical, highly regulated, and, frankly, a lot less dramatic.

Here at Lion Business Co., we often have this exact conversation with entrepreneurs. Think of it less like a cloak of invisibility and more like a private entrance to a building. The doorman—the bank—knows exactly who you are. So do the financial regulators and your home country's tax authorities. In fact, the due diligence you’ll undergo to open one of these accounts is some of the strictest you will ever encounter.

So, What’s The Real Point?

If it's not about total anonymity, why even bother? The real value is operational discretion.

Imagine you’re a founder managing three companies across different borders. You're constantly moving capital—paying international suppliers, funding a quiet acquisition, or managing payroll for a global team. With a standard bank account, your personal name is attached to every single one of those routine transfers. It’s visible to countless employees, both at the bank and within your own companies.

A numbered account changes that dynamic. It swaps your name for a code on all the day-to-day paperwork and transaction slips. This simple substitution shields your identity from:

- Curious back-office staff at the bank who have no real need to know your personal details.

- The fallout from potential data leaks or minor security breaches.

- Prying eyes within your own organization who see financial statements and transaction records.

In our experience at Lion Business Co., privacy is about structure, not secrecy. It’s a strategic tool for protecting your assets and maintaining confidentiality in a world where your data is always at risk.

The goal isn't to evade legitimate authorities; it's to stop your personal financial affairs from becoming common knowledge. For any serious entrepreneur or family office managing assets across borders, understanding this distinction is the first step. It's where the real conversation about modern asset protection begins—a conversation based on compliance, not concealment.

The Origins of Financial Privacy

To really understand what a numbered bank account is all about, you need to look back at where it came from. This isn’t a story about hiding money from the law; it's a story about protecting it from chaos. The entire concept was forged in the political turmoil of 20th-century Europe, with Switzerland standing right at the center of it all.

Think about the climate back then. Political instability was the norm, and neighboring countries were descending into chaos. Wealthy families and business owners had a very real fear that their governments could be toppled overnight, leading to their assets being seized. For them, financial discretion wasn’t some shady tactic—it was a survival strategy.

A Shield, Not a Sword

The legendary Swiss Banking Act of 1934 wasn't designed to help criminals stash their cash. It was actually put in place to protect the assets of German Jews and others facing persecution by the Nazi regime. By making it a criminal offense for a Swiss bank to reveal a client's identity, the law created a powerful shield against authoritarian governments.

This history is absolutely critical. The numbered account was born from a genuine need to protect assets from unpredictable political forces. It cemented Switzerland, and later places like Liechtenstein, as safe havens where capital could be preserved. The core principle was always security, not secrecy for the sake of it.

This legacy of stability and discretion is what made other global financial centers so appealing over time. Hong Kong, for instance, grew into a major hub for international capital, attracting clients who needed a secure and private banking environment. While the classic numbered account wasn't as common there as in Switzerland, the demand for discreet banking services has always been huge. You can see this in the region's incredible financial growth. By early 2025, total deposits in Hong Kong’s banks had rocketed to approximately 2,260.48 billion USD. This staggering figure shows just how much it's trusted as a destination for private and offshore banking. You can learn more about Hong Kong's deposit growth on CEICdata.com.

From Protection to Regulation

Of course, over the decades, this protective shield was sometimes misused, which is where the negative reputation we see in spy movies comes from. But the original intent holds a powerful lesson for today's entrepreneurs.

In our experience at Lion Business Co., the smartest entrepreneurs understand that true financial privacy comes from robust legal structures and jurisdictional stability, not from trying to be invisible.

The world has changed dramatically since 1934. Global regulations now demand transparency for tax authorities, and the era of absolute, no-questions-asked banking secrecy is long gone.

However, the fundamental need for legitimate discretion—protecting your wealth from frivolous lawsuits, corporate espionage, or public volatility—is more relevant than ever. The story of the numbered account is a great reminder that privacy has always been a key part of smart asset protection.

How These Accounts Work in a Regulated World

So, how does a numbered bank account actually function in today's tightly controlled financial world? It’s simpler than you might think. Imagine you're a founder managing assets across several jurisdictions. At its core, the mechanism replaces your name with a unique code or pseudonym on day-to-day transaction slips and monthly statements.

This simple swap provides a powerful layer of operational discretion. What it means in practice is that within the bank, only a very small, select group of senior private bankers can access the master file connecting your identity to that code. For all routine processing, your name is kept out of sight. This dramatically reduces your exposure to general internal staff and minimises the risk of low-level data breaches.

But let's be crystal clear—that’s where the anonymity ends. The romanticized idea of a completely untraceable, anonymous account is a relic of spy movies, not modern finance.

The Modern Reality of Compliance

Getting a numbered account today involves one of the most rigorous identity verification processes you’ll find anywhere in the financial world. You can't just walk in with a briefcase of cash and a made-up name. Those days are long gone.

Every reputable bank is bound by a web of strict international regulations, primarily:

- Know Your Customer (KYC): Banks have to verify who you are, assess your suitability as a client, and understand the risks involved. You should expect to provide certified copies of passports, multiple proofs of address, and highly detailed information about your source of wealth and funds.

- Anti-Money Laundering (AML): Banks are legally required to monitor your account for any suspicious activity and report it directly to financial crime enforcement agencies.

These aren't just polite suggestions; they are legally binding rules with severe penalties for any bank that fails to comply. In a world of constantly shifting financial regulations, running a successful operation depends on a rock-solid approach to compliance. For both the banks and their clients, mastering regulatory change management isn't just a good idea—it's absolutely essential.

Global Transparency Trumps Secrecy

On top of KYC and AML, a wave of international agreements has made financial secrecy for tax purposes obsolete. The biggest game-changer is the Common Reporting Standard (CRS), an information-sharing agreement now active between over 100 countries.

Under the CRS framework, banks are required to automatically report financial account information to the tax authorities in the account holder’s country of residence. This means that while a numbered account can shield your identity from casual observation or a nosy bank clerk, your government's tax agency has full transparency. These accounts are tools for discretion and privacy, not for hiding assets from legitimate oversight.

This is particularly true in major financial hubs like Hong Kong, where stringent frameworks have completely reshaped the meaning of banking privacy. Banks there must rigorously verify every customer's identity, striking a careful balance between client confidentiality and unwavering regulatory compliance.

For international entrepreneurs, this new reality means that true financial privacy must be achieved through intelligent, compliant structuring. This often involves using tools like an https://lionbusinessco.com/offshore-banking-unit/ as one piece of a much broader, carefully planned strategy, rather than clinging to outdated notions of secrecy.

Real-World Scenarios for Entrepreneurs

Now that we’ve pulled back the curtain on the Hollywood version, let’s get down to brass tacks. What is the actual, practical value of a numbered bank account for a business owner or a family office? It’s not about hiding from the law; it's a strategic tool for maintaining discretion. Here at Lion Business Co., we frequently work with entrepreneurs who are in situations where privacy isn't just a preference—it’s essential for survival.

Think about it. You're a well-known founder in a hyper-competitive market, and you're about to make a quiet, strategic investment in a new startup. If that transaction becomes public knowledge with your name attached, things can go sideways fast. The market might overreact, inflating the startup's valuation, or worse, your competitors get tipped off to your next move. A numbered account lets the transaction happen under the radar, protecting your strategic edge.

Protecting Your Business and Your Family

It's not just about corporate manoeuvres, either. The personal side of things is just as important. High-profile entrepreneurs and their families often become targets, and managing significant wealth can bring all sorts of unwanted attention, from opportunistic lawsuits to serious security risks.

This is where a numbered account acts as a critical buffer. Here’s how:

- Asset Protection: By taking your name off standard bank statements, you lower your financial profile. You become a less obvious and less attractive target for anyone looking for a quick payday through a frivolous legal claim.

- Family Privacy: Discretion is non-negotiable when you’re managing a family trust or passing wealth down to your children. A numbered feature helps keep beneficiaries out of the public eye, protecting them from people who might try to exploit their inheritance.

- International Operations: If your business involves owning property or managing investments in politically volatile parts of the world, keeping your name off local financial documents is a powerful safety precaution.

Financial discretion is really about one thing: control. It's about you deciding who sees your financial activity, making sure sensitive information doesn't end up in the wrong hands—whether that’s a business rival or someone on the inside.

One Piece of a Bigger Puzzle

It's crucial to understand that a numbered account isn't a silver bullet. It’s one component of a much broader asset protection strategy. Real financial security comes from layering different tools and jurisdictions.

A numbered account in Switzerland might be paired with a holding company in Hong Kong and a family trust in another well-regarded jurisdiction. This creates a multi-layered, fully compliant structure that truly fortifies your wealth.

This approach is a world away from just parking money offshore without a coherent plan. For a deeper look into compliant international banking, understanding the benefits of an offshore bank account is a vital next step for any global entrepreneur. The endgame is always to build a resilient financial framework that supports your long-term goals for both your business and your family. For smart entrepreneurs, privacy is simply good risk management.

Numbered Accounts vs Private Banking vs Standard Accounts

To make the right call for your business, you've got to understand the whole playing field. I get asked about numbered bank accounts all the time, but it's vital to see where they actually sit in the world of finance. It's not something you just go out and get.

Think of it less as a separate type of account and more as an exclusive feature—an add-on, if you will—that you can only access once you're deep into a top-tier private banking relationship.

This distinction changes everything. A standard retail account handles your day-to-day. A private banking relationship brings in dedicated wealth management. The numbered account feature then adds a powerful layer of operational discretion on top of all that.

Let’s really get into how they stack up.

Comparing Banking Privacy and Service Levels

Choosing the right account really boils down to what you need: privacy, a certain level of service, or the ability to manage international complexity. For a global entrepreneur, this isn't just about picking a bank. It’s about building a financial architecture that protects your assets and supports your vision, quietly and effectively.

To help you visualize the differences, here's a direct comparison.

| Feature | Standard Account | Private Banking Account | Numbered Account Feature |

|---|---|---|---|

| Privacy Level | Low | High (Relationship-based) | Highest (Operational Discretion) |

| Onboarding Difficulty | Simple & quick | Complex & rigorous | Extremely rigorous |

| Minimum Deposit | Low or none | High (Typically $1M+) | Very high (within private banking) |

| Suitability for Entrepreneurs | Basic domestic needs | Complex wealth management | Strategic asset protection |

As you can see, each option offers a completely different experience. A standard account is fine for local business, but your name is attached to every single transaction. Privacy is minimal.

Private banking is a big step up. You get a dedicated relationship manager, which immediately reduces the number of eyes on your financial information. It’s a service built on trust and personal relationships.

A numbered account then takes this privacy to another level. It swaps your name for a code on day-to-day transactions, adding an extra shield for sensitive investments or strategic asset holdings. But let's be clear: this feature is reserved for a very small circle of clients who have already built a significant, long-term relationship with a private bank.

Ultimately, the choice comes down to your goals. For many international business owners, a well-managed private banking relationship, often paired with the right corporate structure, strikes the perfect balance of high-touch service and confidentiality.

To better understand how to structure your finances on a global scale, looking into the key points of offshore banking is a crucial next step. It's all about making a smart, strategic decision that fits your business's international footprint like a glove.

Finding Financial Discretion Today

So, where can an entrepreneur still find a numbered bank account in this day and age? The classic hubs remain the go-to places for this kind of service. You’ll find that jurisdictions like Switzerland, Monaco, and Liechtenstein still offer these accounts through their private banking arms, valued for their deep-rooted history of stability and financial expertise. The Caribbean also has private banks that may offer similar features.

But the world of financial privacy has moved on. True discretion today isn't just about hunting down a specific type of account; it’s about building a smart, fully compliant structure. In many cases, modern alternatives offer far better protection.

Modern Alternatives For Asset Protection

For the international entrepreneur, privacy is now achieved through intelligent architecture. These methods are not only compliant but often more resilient than a numbered account on its own.

- Sophisticated Private Banking: A solid relationship with a private banker who genuinely understands your business is your first line of defense. They act as a trusted gatekeeper, ensuring your confidentiality is always maintained.

- Well-Structured Corporate Entities: Using holding companies in reputable financial centers like Hong Kong or Singapore creates a clear legal separation between you and your assets. It’s a foundational strategy for asset protection.

- Dedicated Trusts & EMI Sub-Accounts: For long-term wealth preservation, nothing beats a properly established trust. For operational needs, an Electronic Money Institution (EMI) can provide sub-accounts that add another layer of discretion for B2B transactions.

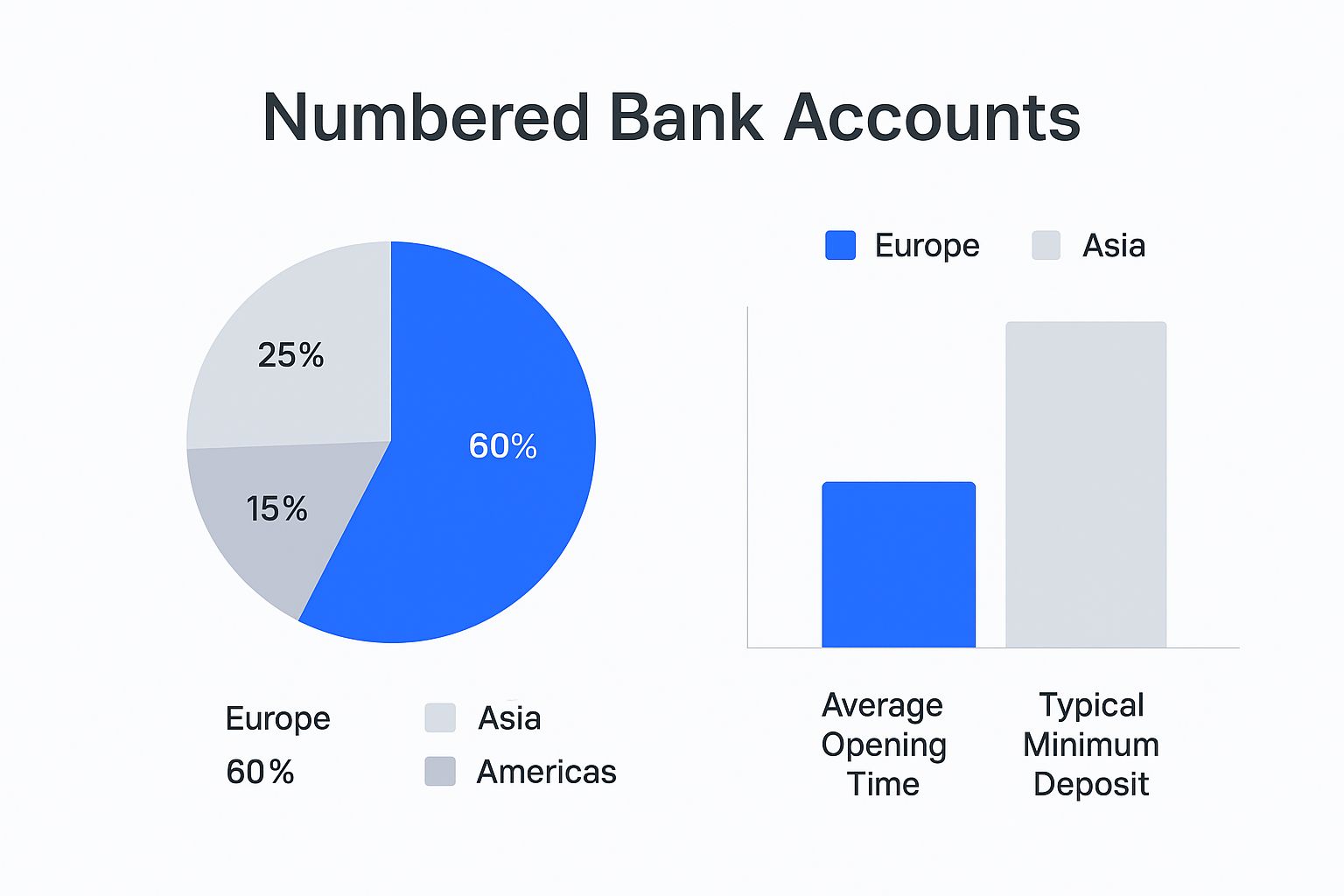

This visual breaks down where these services are most common and what you can expect when you start the process.

The data makes it clear: while Europe still leads the pack, the setup process is intensive. This simply reflects the high compliance standards now required across the globe.

The financial landscape is also shifting, particularly in Asia. Take Hong Kong's competitive banking sector, where mainland banks hold a significant market share of around 33-35% in customer deposits. This has fuelled innovation in both traditional and digital banking. The rise of virtual banks is also opening up new avenues for discreet financial management, hinting that the privacy tools of tomorrow may look very different from the classic numbered account.

Beyond specific banking products, there’s a growing awareness of the need to protect personal information online in general. At its core, modern financial privacy is about proactive, intelligent structuring—not chasing an outdated idea of secrecy.

Common Questions About Numbered Bank Accounts

We get a lot of questions about numbered accounts, so let’s clear up some of the most common misconceptions. This is the straight-up, no-nonsense information you actually need.

Can I Open a Numbered Bank Account Anonymously Online?

This is probably the biggest myth out there, and the short answer is no.

Forget what you see in the movies. Opening a legitimate private banking account, particularly a numbered one, involves a very thorough identity verification process. Banks are legally required to follow strict Know Your Customer (KYC) regulations to combat financial crime. You’ll likely need to meet them in person.

The 'numbered' feature is just a layer of operational privacy that kicks in after the bank knows exactly who you are.

Is a Numbered Bank Account a Tool for Tax Evasion?

Absolutely not. Thinking you can hide from the taxman with a numbered account is a dangerous and outdated idea.

Under global agreements like the Common Reporting Standard (CRS), banks are mandated to automatically report your account information to the tax authorities where you reside. The number shields your identity from prying eyes or low-level bank staff, not from legitimate government and tax agencies. Trying to use any account for tax evasion is illegal and will land you in serious trouble.

How Much Money Do I Need for a Numbered Account?

These aren’t standard high-street accounts. They are an exclusive service offered to high-net-worth individuals within a private bank.

The exact amount varies, but as a rule of thumb, you should be prepared to have at least $1 million USD (or its equivalent) in assets for the bank to manage. It's a premium feature for clients with significant, often international, financial needs.

Are There Modern Alternatives Offering Similar Privacy?

Yes, and frankly, they’re often better.

Today, savvy entrepreneurs achieve far greater privacy and asset protection using fully compliant legal structures. A well-designed holding company, a family office, or a trust, when set up in a solid jurisdiction and paired with a standard private bank account, provides a much more robust and flexible solution than a numbered account on its own.

Navigating the world of financial discretion requires a partner who understands both the rules and your goals. At Lion Business Co., we build compliant, private banking structures that protect your assets and support your international growth.

Ready to design a banking framework that truly works for you? Schedule a private consultation with us today.