Thinking about incorporating a company in Hong Kong? It’s a strategic move. For years, global entrepreneurs have flocked to this dynamic city, drawn by its incredible efficiency, remarkably low tax rates, and a reliable, internationally respected legal system. The entire process is refreshingly straightforward, which is why everyone from lean startups to multinational corporations chooses Hong Kong as their foothold in Asia.

Why Hong Kong Is a Top Choice for Global Business

Before diving into the step-by-step process, it’s essential to understand exactly why Hong Kong is a global business powerhouse. The city’s appeal goes far beyond its iconic skyline; it’s built on tangible benefits that create an unparalleled environment for commerce.

For most entrepreneurs, Hong Kong isn't just a location—it's a strategic asset. It serves as the ultimate gateway to Mainland China, providing direct access to one of the world's largest markets while allowing you to operate under a familiar, English-based common law framework. This "best of both worlds" advantage is a massive pull for any business with ambitions for Asian expansion.

A World-Class Financial and Legal System

At the core of Hong Kong's appeal is its simple, business-friendly tax regime. The two-tiered profits tax system is a significant advantage for new and growing businesses. Your company's first HK$2 million in profits is taxed at a low rate of just 8.25%. This structure allows you to reinvest more of your earnings back into your company's growth.

Supporting this financial incentive is a robust, independent judiciary founded on English common law. For you, this means a predictable and secure commercial environment where contracts are enforceable and intellectual property is protected. For international investors, this legal certainty is invaluable.

Hong Kong's success formula combines minimal government intervention, the free flow of capital, and a stable political environment. It’s a place where businesses can genuinely flourish without being hindered by excessive red tape.

The Numbers Tell the Story

Hong Kong's pro-business stance is reflected in its official statistics. In the first half of 2025 alone, 84,293 new local companies were incorporated, bringing the total number of registered companies to a staggering 1,494,806. This consistent growth speaks volumes about the supportive business climate.

This is not just a local trend. Over the same period, 761 non-Hong Kong companies established a place of business in the city, pushing the total to 15,509. These figures cement Hong Kong's reputation as a premier global hub. If you're considering joining this dynamic ecosystem, our detailed guide on setting up a business in Hong Kong is an excellent resource.

Unlocking Strategic Advantages

Ultimately, incorporating in Hong Kong is more than a logistical step; it's a strategic one. Business leaders are consistently drawn here for several key reasons:

- Free Port Status: With no customs tariffs on imports or exports, Hong Kong is a paradise for trading and logistics businesses.

- Ease of Capital Movement: You can move capital, profits, and dividends in and out of the city without restrictions, offering complete financial freedom.

- Global Connectivity: Its world-class infrastructure and prime geographical location make it the perfect base for managing regional operations.

Choosing the Right Business Structure

When you’re setting up a company in Hong Kong, your first decision—choosing the right legal entity—is also one of the most critical. This choice will shape everything from your personal liability and tax obligations to your ability to raise capital. Getting this right from the start lays a solid foundation for your company's future success.

For the vast majority of entrepreneurs, the Private Company Limited by Shares is the optimal choice. It’s incredibly versatile, suitable for a solo founder as well as for a growing small or medium-sized enterprise (SME). The most significant benefit is limited liability, which means your personal assets are legally separated and protected from any business debts.

This separation is a crucial safety net. It ensures that if the business faces financial challenges, your personal property, such as your home and savings, remains secure. This peace of mind is precisely why it’s the default structure for most commercial ventures in Hong Kong.

The Clear Favourite: Private Companies

The data confirms the popularity of this structure. In the first half of 2025 alone, an overwhelming 99,833 private companies were registered. This accounted for the vast majority of the 100,561 total new incorporations.

In contrast, only 56 public companies and 672 companies limited by guarantee were established during the same period. It’s clear that private enterprises dominate Hong Kong's business landscape. To dive deeper into the latest trends, you can explore more statistics in this detailed 2025 guide to Hong Kong company formation.

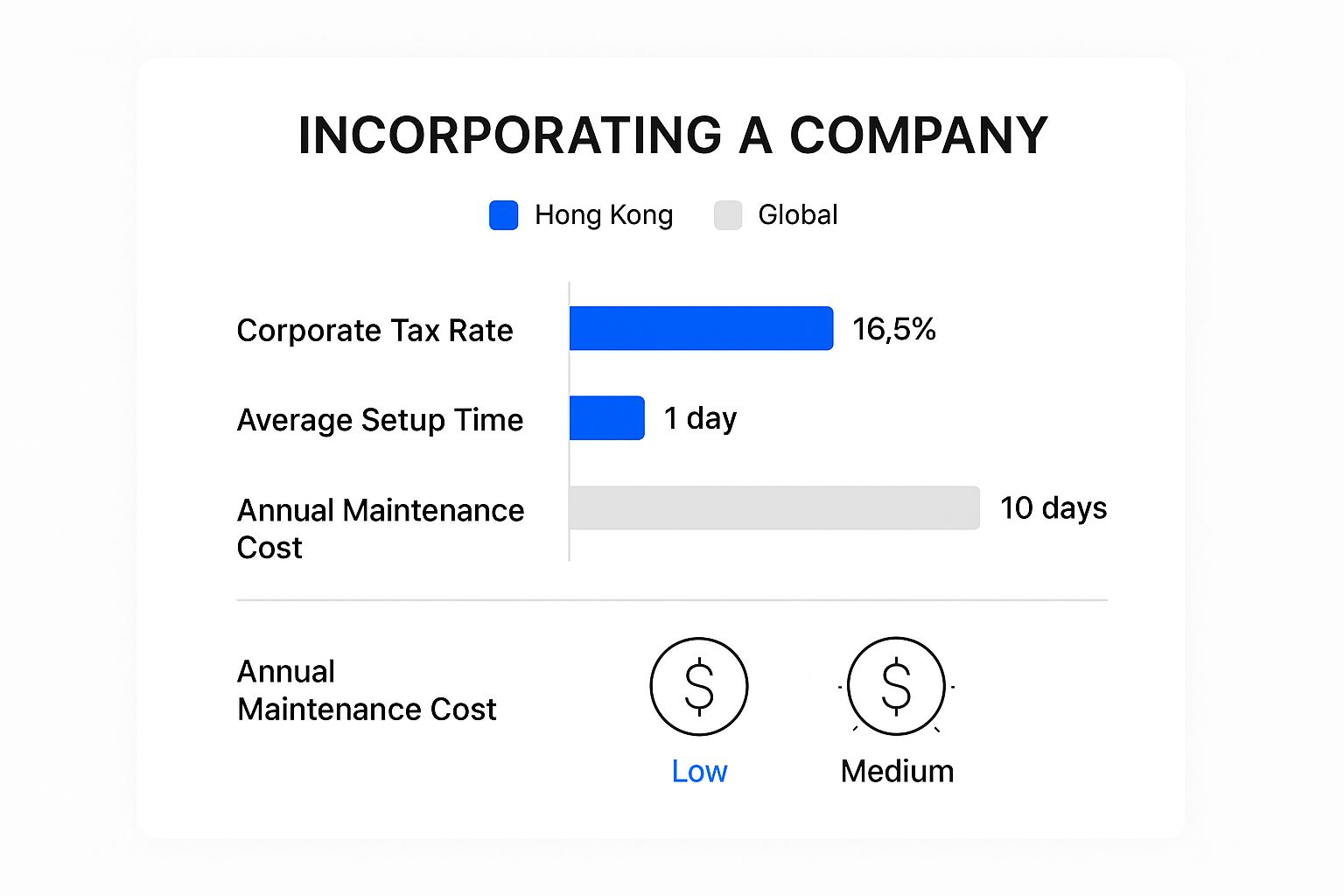

The infographic below highlights Hong Kong's competitive edge by comparing its setup process against global benchmarks.

As you can see, the efficiency and low-cost environment make Hong Kong an incredibly attractive jurisdiction for launching a new business.

When Might You Consider Other Options?

While the private limited company is the most common route, it's useful to know about other available structures. Understanding their specific purposes helps confirm that the private option is genuinely the best fit for your goals.

A Public Company Limited by Shares is intended for large enterprises that plan to raise capital from the public by listing on a stock exchange. This structure can have an unlimited number of shareholders, but it comes with a much heavier burden of regulatory compliance and public disclosure.

A Company Limited by Guarantee is designed specifically for non-profit organisations. Key features include:

- Mission: These entities are established to promote charitable, educational, religious, or other community-based objectives.

- Funding: They have members, not shareholders, who "guarantee" to contribute a pre-determined amount if the company is wound up.

- Profit Usage: Any profits generated must be reinvested into the organisation's core mission and cannot be distributed to its members.

To help clarify the differences, here’s a quick comparison of the three main business structures in Hong Kong.

Hong Kong Business Structures Compared

| Feature | Private Company Limited by Shares | Public Company Limited by Shares | Company Limited by Guarantee |

|---|---|---|---|

| Primary Use | Commercial ventures (SMEs, startups) | Large enterprises, listing on stock exchange | Non-profits, charities, clubs |

| Liability | Limited to unpaid shares | Limited to unpaid shares | Limited to the guarantee amount |

| Shareholders | 1 to 50 | Minimum of 1, no upper limit | No shareholders, only members |

| Profit Distribution | Can distribute profits to shareholders | Can distribute profits to shareholders | Profits must be reinvested |

| Public Fundraising | Cannot offer shares to the public | Can offer shares to the public | Cannot raise funds via share sales |

| Compliance | Relatively simple | High level of regulation and disclosure | Moderate, focused on non-profit rules |

This table clearly illustrates why the private company is the go-to choice for most commercial businesses, offering the best balance of protection and simplicity.

The key takeaway is this: unless you plan to list on a stock exchange or are establishing a non-profit, the Private Company Limited by Shares is almost certainly the correct and most efficient choice for incorporating a company in Hong Kong.

Making Your Final Call

Choosing your business structure is a practical decision driven by your business model and long-term vision. The private limited company offers the perfect blend of liability protection, operational simplicity, and professional credibility for nearly any commercial venture.

Consider a tech startup seeking venture capital funding. This structure is ideal as it easily accommodates new investors as shareholders and presents a stable, credible entity. Or think of an international trading company—the limited liability protection is invaluable when dealing with potential commercial disputes. This flexibility ensures the structure can adapt as your business grows, making it a reliable foundation for success.

Your Pre-Incorporation Checklist

Completing your prep work before starting the official paperwork is the secret to a smooth and fast registration. A little groundwork now will help you avoid the common pitfalls and frustrating delays that can trip up new founders. This checklist covers the absolute essentials for incorporating a company in Hong Kong.

Think of it as creating a blueprint for a house before laying the foundation. A few hours of planning at this stage can save you weeks of headaches down the line.

Nailing Your Company Name

First, your company needs a name. This isn't just about branding; the name must be unique and comply with the rules set by the Hong Kong Companies Registry. The last thing you want is a rejection because your chosen name is too similar to an existing one.

Your essential first step is to conduct a thorough search on the Companies Registry's Cyber Search Centre. Company names can be in English, traditional Chinese, or both. Be sure to avoid misleading terms that suggest a connection to the government, such as "Bureau" or "Commission."

A common mistake is choosing a name that is available at the Registry but clashes with a registered trademark. A quick trademark search can prevent significant legal issues over your brand identity later. It’s a simple check that provides an extra layer of peace of mind.

Before finalising your structure, it is also wise to have a strategic blueprint for intellectual property protection to safeguard your company's unique assets from day one.

Assembling Your Core Team

With a name selected, it's time to define the key personnel. Hong Kong law is very specific about the roles required to operate a private limited company.

- Directors: You need at least one director, who must be a natural person (not another company). There are no nationality or residency restrictions for directors.

- Shareholders: A minimum of one shareholder is also required. For a solo entrepreneur, the director and shareholder can be the same person.

- Company Secretary: This is a mandatory appointment. The Company Secretary must be a Hong Kong resident or a corporate body with a registered office in Hong Kong. This role is legally responsible for maintaining the company's statutory compliance.

Crucially, the Company Secretary cannot be the same person if you are the sole director. If you are a one-person company, you must appoint a separate individual or a professional firm to fulfill this role.

Defining Your Company Structure

Next, let's establish the operational and legal framework of your new venture. This involves setting a registered office address and deciding on your share structure.

A registered office address is a legal requirement. It must be a physical address in Hong Kong—a P.O. box is not acceptable. All official government correspondence will be sent to this address. Many foreign entrepreneurs use a corporate services provider for this, which satisfies the requirement without the overhead of a physical lease.

You also need to define your share capital structure. While Hong Kong does not have a minimum paid-up capital requirement, you must decide on the initial number of shares and their allocation. A common and straightforward setup is 10,000 shares at HK$1 each, all held by the founder. This structure provides flexibility for bringing in investors later. Making these decisions now ensures you have all the necessary details for the application forms.

The Official Company Registration Process

With your preparation complete, it’s time to make it official with the Companies Registry by submitting your company name, director details, and share structure. This is the stage where your business idea becomes a legally recognized entity.

Hong Kong's system is designed for speed, but this efficiency depends on submitting perfectly accurate paperwork from the start. A small error can mean the difference between getting incorporated in a few hours and being stuck in a cycle of corrections for days.

Preparing Your Core Incorporation Documents

The entire process hinges on three key documents. These serve as your company's birth certificate, internal rulebook, and tax ID application. Getting them right is essential.

- Incorporation Form (NNC1): This is the master application. It formally states your company name, registered office address, the identities of your directors and shareholders, and your share capital structure.

- Articles of Association: This document is your company's constitution. It outlines the internal governance rules, such as shareholder rights, director responsibilities, and meeting procedures. While you can draft custom articles, most new businesses use the standard model articles provided by the Companies Registry for simplicity.

- Notice to Business Registration Office (IRBR1): This form is submitted along with your incorporation application. It automatically registers your new company with the Inland Revenue Department for tax purposes. This integrated step ensures you are compliant from day one.

It is crucial to double-check every detail on these forms. A single typo in a name or an incorrect address can result in your entire application being rejected, forcing you to start over.

Choosing Your Submission Method: Digital vs. Traditional

Once your documents are in order, you have two methods for filing them with the Companies Registry. Your choice will primarily depend on how quickly you want to complete the process.

The most popular option is online submission through the e-Registry portal. It is incredibly efficient. If all information is correct, you can receive your Certificate of Incorporation and Business Registration Certificate—the two documents that officially bring your company to life—in just a few hours.

The e-Registry exemplifies Hong Kong's efficiency. You also receive a discount for filing online—the fee is HK$1,545 compared to HK$1,720 for a paper submission. This small saving comes with a significant speed advantage, which is exactly what most founders need.

Alternatively, you can file physical, hard-copy documents in person at the Companies Registry. This method is effective but slower, typically taking about four to seven working days. It is a viable option if you are not in a rush or prefer handling physical paperwork.

Avoiding Common Application Pitfalls

Many first-time founders encounter delays due to small, avoidable mistakes. Being aware of these common slip-ups will help you navigate the process smoothly.

- Inconsistent Information: All details must be identical across every form. If a director's middle name is included on the NNC1, it must also appear in the Articles of Association.

- Incorrect Registered Address: You cannot use a P.O. box. The address must be a physical location in Hong Kong. An incorrect address will lead to an instant rejection.

- Missing Signatures: Ensure that every director, shareholder, and the company secretary has signed in the designated places.

To avoid these issues, many entrepreneurs engage a professional corporate services firm. These firms specialize in the Hong Kong company registration process and can manage the entire submission, ensuring it is done correctly the first time.

Whether you file online or in person, the outcome is the same. The Companies Registry reviews your application and, upon approval, issues your Certificate of Incorporation. At that moment, your company legally exists, and you are ready to begin operations.

Life After Incorporation: Navigating Ongoing Compliance

Receiving your Certificate of Incorporation is a major milestone, but it's just the start. The real work shifts from the one-time task of formation to the ongoing, crucial work of compliance and operation. This is where you establish the practices that will keep your company in good legal standing for years to come.

Your first practical hurdle is establishing your business finances. This begins with opening a corporate bank account, a process that has become more stringent due to global anti-money laundering regulations. Hong Kong banks are thorough, so be prepared to provide a full suite of documents and attend an in-person meeting.

Securing Your Corporate Bank Account

Do not underestimate this step. Opening a bank account is no longer a simple formality. Banks must perform extensive "Know Your Customer" (KYC) checks, and a lack of preparation can seriously delay your ability to conduct business.

You will need to provide a complete, certified set of your company documents, including your Certificate of Incorporation, Business Registration Certificate, and Articles of Association. Banks will also typically request a detailed business plan, proof of address for all directors and shareholders, and potentially evidence of business activity, such as contracts or letters of intent from clients. The goal is to prove you are running a legitimate, well-planned operation. For a deeper dive into this topic, see: the process of opening a corporate bank account in Hong Kong.

Your Annual Compliance Obligations

With a bank account established, your focus can turn to the annual cycle of compliance duties. These are mandatory requirements; missing deadlines can result in significant fines and legal complications.

Here is a breakdown of the core tasks you will manage each year:

- Renewing Your Business Registration Certificate: This must be renewed one month before its expiration date each year. While the Inland Revenue Department (IRD) typically sends a reminder, the responsibility for timely payment is yours.

- Filing the Annual Return (Form NAR1): This is your company’s annual check-in with the Companies Registry. It confirms that key details like your directors, shareholders, and registered address are up-to-date. It must be filed within 42 days of the anniversary of your company's incorporation date.

- Holding an Annual General Meeting (AGM): While most small private companies can waive this requirement by passing a written resolution, it remains a formal procedure that must be properly addressed.

Pro Tip: Set calendar reminders for these deadlines well in advance. While the government portals are efficient, a last-minute rush is when mistakes often happen. A missed deadline results in an unnecessary penalty that could have been easily avoided.

Staying on Top of Accounting and Tax

Maintaining meticulous financial records is not just good business practice—it's a legal requirement in Hong Kong. The IRD requires you to keep sufficient records for at least seven years. Establishing a robust bookkeeping system from the start is essential. If this is new to you, a guide on Essential bookkeeping for startups can be a valuable resource.

You can expect to receive your first Profits Tax Return from the IRD approximately 18 months after incorporation. You must complete it and submit it along with audited financial statements prepared by a Hong Kong Certified Public Accountant (CPA). The audit requirement applies to every limited company, regardless of its size or revenue.

Staying compliant is a fundamental aspect of doing business in a world-class jurisdiction like Hong Kong. By understanding these responsibilities from the outset, you can integrate them into your regular operations and build your business on a solid, secure, and fully legal foundation.

Common Questions About Hong Kong Incorporation

Setting up a company in Hong Kong is relatively straightforward, but it's natural to have questions, especially for foreign entrepreneurs. Here are answers to some of the most common queries about incorporating a company in Hong Kong.

Can a Foreigner Own 100 Percent of a Hong Kong Company?

Yes, absolutely. This is one of Hong Kong's most attractive features for international business. The law permits 100% foreign ownership of a private limited company. There is no requirement for a local partner, and there are no nationality or residency rules for shareholders or directors.

The only residency requirement pertains to the Company Secretary. This is a mandatory legal appointment, and the appointee must be a Hong Kong resident or a corporate body with a registered office in Hong Kong.

What Is the Minimum Capital to Set Up a Company?

Legally, the minimum required share capital is just HK$1. This makes incorporating in Hong Kong highly accessible, particularly for startups and small businesses that need to manage costs carefully.

However, consider the practical implications. While you can register with HK$1, it may not create the best impression with banks, suppliers, or potential investors, as it could suggest the business is under-resourced. It is often advisable to start with a more credible, yet still modest, amount that reflects your business's ambitions.

A word of advice: Banks often consider your share capital when you apply for an account. A nominal HK$1 figure can sometimes raise concerns. Opting for a more realistic amount, such as HK$10,000, can contribute to a smoother banking application process.

How Long Does the Incorporation Process Take?

Hong Kong is known for its efficiency, and company registration is a prime example. The time it takes depends on your filing method.

If you use the government’s e-Registry portal for online submission, the process is incredibly fast. With all documents in order, you can receive your Certificate of Incorporation and Business Registration Certificate within a few hours.

If you prefer to file physical hard-copy documents, the process takes longer, typically around 4 to 7 working days. This efficiency is a significant advantage when you are eager to launch your operations.

Do I Need to Be in Hong Kong to Incorporate?

No, you do not need to be physically present in Hong Kong to register your company. The entire incorporation process can be managed remotely from anywhere in the world, a major benefit for international entrepreneurs.

This is where a professional corporate services firm can be invaluable. They can handle all the filings on your behalf, ensuring everything is completed correctly and efficiently.

However, you should be prepared to travel to Hong Kong later. Most banks require company directors and key shareholders to attend an in-person meeting as part of their "Know Your Customer" (KYC) due diligence before opening a corporate bank account.

Ready to navigate the Hong Kong incorporation process with an expert partner? At Lion Business Consultancy Limited, we specialise in making company formation seamless for global entrepreneurs and SMEs. Let us handle the complexities so you can focus on building your business. Learn more and get started today.