Thinking about setting up shop in one of the world's premier financial hubs? You’re in the right place. As a consultant at Lion Business Co., I’ve personally guided hundreds of entrepreneurs like you through this journey. It’s my job to cut through the jargon and give you practical, experience-based advice on how to incorporate a company in Hong Kong.

Think of this guide as a direct conversation. We’ll walk through the entire process, step by step, so you can make your move into Asia with confidence.

TL;DR: The Hong Kong Advantage in 60 Seconds

No time to read the full guide? Here are the three key takeaways for 2025:

- Incredible Speed: With the right preparation, you can incorporate a company online in as little as 24-48 hours. It's built for efficiency.

- Simplicity for Foreigners: You don't need to be a resident or have a local partner. Foreigners can own 100% of their Hong Kong company.

- Powerful Tax Benefits: Hong Kong has a territorial tax system. This means if your profits are generated outside of Hong Kong, you could legally pay 0% tax on them.

Why Hong Kong Is a Global Hub for Business Incorporation

Ever wondered why so many international startups and SMEs flock to Hong Kong? It's not just one thing—it’s a powerful combination of factors that create an unmatched business environment. When you decide to incorporate a company here, you're plugging into an ecosystem designed for global commerce.

0% Tax on Offshore Profits: A Game-Changer

Let's start with the headliner. Hong Kong's territorial tax system is a massive draw. In simple terms: the government only taxes profits that arise in or are derived from Hong Kong.

Imagine you're a UK-based consultant with a Hong Kong company. You provide services to clients in the USA and Australia, and all the work is done from your home office in London. Because the income-generating activities happen outside Hong Kong, those profits are not subject to Hong Kong profits tax. It’s a clean, straightforward system that makes it a top choice for e-commerce stores, SaaS companies, and global consultants.

The Gateway to Asia

Location is everything. Situated at the heart of Asia, Hong Kong is the perfect launchpad into Mainland China and the booming APAC markets. Its world-class logistics, free port status, and deep economic ties make it an ideal base for international trade and investment. You’re not just setting up a company; you’re establishing a strategic foothold in the world’s fastest-growing economic region.

A Trusted Legal System You Can Rely On

For entrepreneurs from Western countries, Hong Kong's legal framework feels familiar and secure. It’s based on English common law, which means contracts are robust, intellectual property is protected, and dispute resolution is transparent. This stability removes a huge layer of uncertainty that often comes with expanding into new territories.

In our experience, clients value this legal predictability just as much as the tax benefits. There's a real sense of security in knowing your assets and agreements are protected by a world-class judicial system. It’s this unique combination of benefits that keeps Hong Kong on top. You can explore this further in our detailed guide on why Hong Kong company incorporation is a great option for expanding your business.

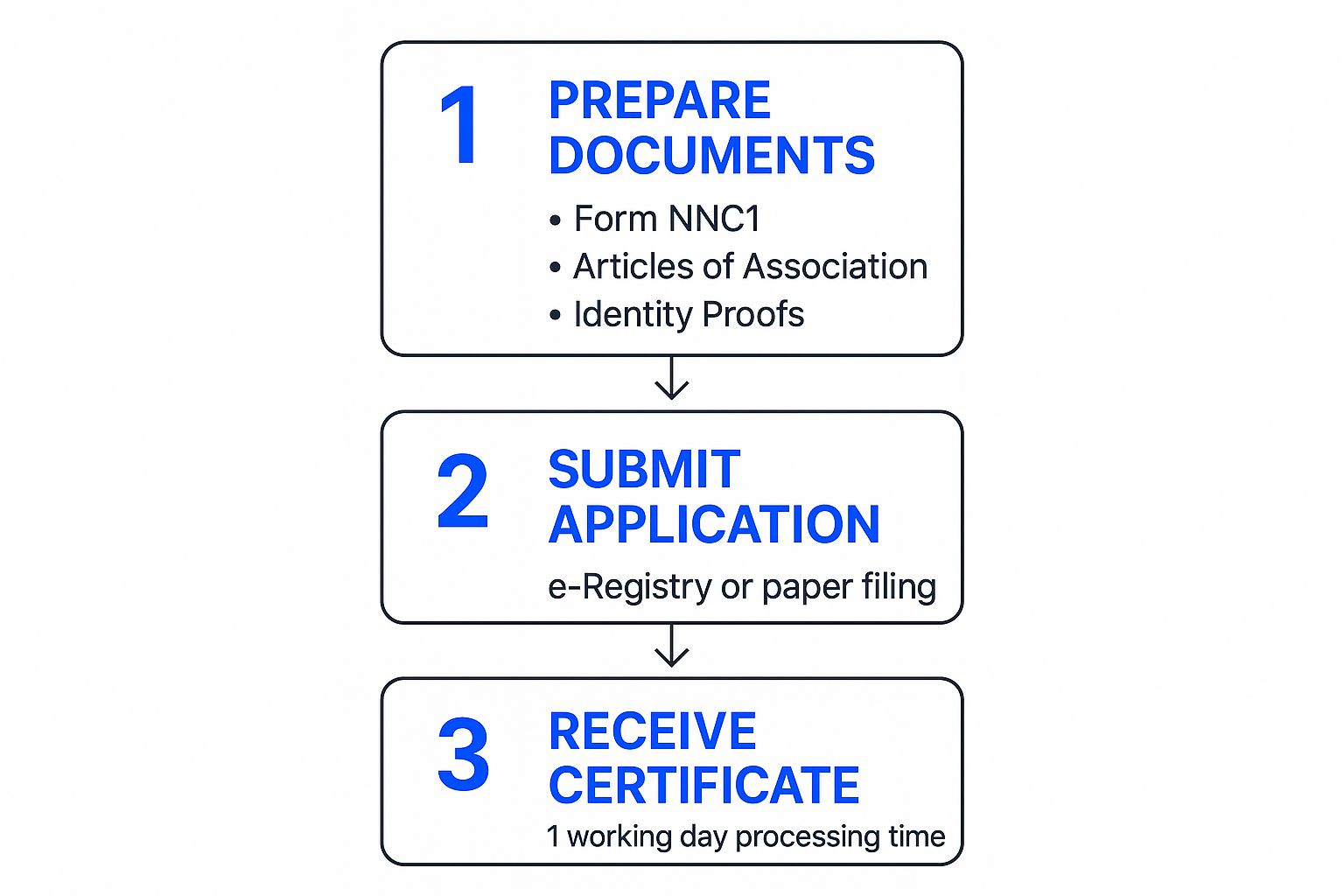

The Step-by-Step Incorporation Process

Ready to get started? Let’s walk through what it actually takes to get your company registered. This is the exact path we guide our clients down, and it's more straightforward than you might think.

Step 1: Choose Your Company Name

Before anything else, you need a name. It’s the start of your brand's story in Asia. The main rule is that your name must be unique and not too similar to any existing company on the register. You can choose an English name, a Traditional Chinese name, or both. A quick search on the Companies Registry's online portal will tell you if your desired name is available. It's a simple first step, but a crucial one for getting your brand identity right. If you need inspiration, it’s worth understanding what makes a good brand name.

Step 2: Prepare Your Documents

With a name selected, it’s time to gather your paperwork. This is where most self-filing applications hit delays, usually due to small, avoidable mistakes.

Documents You'll Need:

- Incorporation Form (NNC1): This is the main application form. It captures your company name, registered address, and the details of your directors, shareholders, and company secretary.

- Articles of Association: This is the rulebook for how your company will be governed.

- Identification Documents: Clear passport copies and proof of residential address (like a recent utility bill) for all directors and significant shareholders.

Accuracy is key. A tiny mismatch, like a missing middle name on the form that appears on the passport, is one of the most common reasons for rejection.

Step 3: File with the Companies Registry

Once your documents are prepared and double-checked, it's time to submit them. The fastest way is through the online e-Registry, which we almost always recommend. It's incredibly efficient.

Step 4: Receive Your Certificates

After the Companies Registry approves your application, they issue two key documents:

- Certificate of Incorporation (CI): Your company’s official birth certificate.

- Business Registration Certificate (BRC): Your proof of registration with the Inland Revenue Department for tax purposes.

With these two certificates in hand, your Hong Kong company is officially open for business!

Core Requirements: The Building Blocks of Your Company

To build a strong and compliant company, you need to get the foundation right. Here are the essential requirements you'll need to meet.

- Shareholder: You need at least one shareholder, who can be an individual or a company of any nationality. A shareholder can also be a director.

- Director: You must have at least one director, who must be a natural person (not a company). There are no nationality or residency restrictions.

- Company Secretary: This is a crucial one. You must appoint a company secretary who is either a Hong Kong resident or a licensed Hong Kong corporate body (like Lion Business Co.). A sole director cannot act as their own secretary.

- Registered Address: Your company needs a physical address in Hong Kong for official government mail. A P.O. box is not acceptable. We can provide this service to protect your privacy and ensure important documents are handled correctly. You can learn more about how a correspondence address works here.

- Business Scope: You’ll need to describe your company’s intended business activities. This is important for the government and absolutely critical for opening a bank account later. Be specific but allow for future growth.

Common Mistakes & Compliance Pitfalls to Avoid

Over the years, I've seen the same issues trip up new founders. A huge part of our job is helping you sidestep these common pitfalls.

Avoid These Common Errors:

- Misunderstanding Nominee Directors: Some founders think a nominee director makes them anonymous. This is a myth. Under global transparency rules, banks will always ask for the details of the ultimate beneficial owner (UBO). A nominee is a compliance tool, not a shield.

- Incorrect Business Activity Scope: A vague scope like "General Trading" is a red flag for banks. An overly restrictive one can limit your growth. We help clients strike the right balance to ensure their business description is clear, professional, and bank-friendly.

- Missing Annual Filings: This is a big one. Your company has annual obligations, like filing an Annual Return and a Profits Tax Return. Missing these deadlines leads to hefty fines and can even result in legal action against the directors. Staying compliant isn't optional.

A Client Story: How Expert Guidance Makes a Difference

Last year, a Turkish trading entrepreneur came to us after trying to register a Hong Kong company on his own. The process stalled for three weeks because his business proof didn’t clearly show supplier relationships.

Our team at Lion Business Co. helped restructure the incorporation documents, added a proper business plan summary, and coordinated directly with the Companies Registry. The company was approved in three days — and the client opened a bank account within two weeks.

This story shows how proper preparation and guidance can save weeks of delay and help clients build compliant business structures from day one.

Timeline & Costs: What to Realistically Expect

So, how long does it all take, and what’s the investment?

- Standard Timeline: While the official registration can happen in a day, a realistic timeline from start to finish (including document preparation and courier time) is about 5-7 working days. If you opt for an expedited service, we can often get it done faster.

- Costs: The cost includes one-time government fees and professional service fees for handling the incorporation. There are also annual recurring costs for your company secretary and registered address to keep your company compliant.

The official process itself is very fast. You can find more details on the Hong Kong Companies Registry's website.

Post-Incorporation Essentials: Your First 90 Days

Congratulations, your company is registered! But the work doesn’t stop there. Here are your immediate next steps.

1. Opening a Bank or EMI Account

This is your top priority. You'll need a corporate account to manage your finances. While traditional Hong Kong banks have a thorough due diligence process, many modern Electronic Money Institutions (EMIs) offer a more streamlined, remote-friendly experience. Having all your documents perfectly in order is critical for a smooth application. We can guide you through this, and you can learn more about the process of opening a corporate bank account in Hong Kong.

2. Setting Up Accounting

Hong Kong law requires all companies to maintain proper books of accounts. Start this from day one. Good bookkeeping isn't just for compliance; it gives you a clear view of your business's financial health and makes your annual audit and tax filing much easier.

3. Understanding Tax Filing

Your company will need to file a Profits Tax Return annually. Even if your company qualifies for the 0% offshore tax exemption, you still need to file and declare this to the Inland Revenue Department. Staying on top of this is key to maintaining your company’s good standing. Once you are established, look for actionable growth strategies for small businesses to scale your new venture.

to see how we can help.

"""