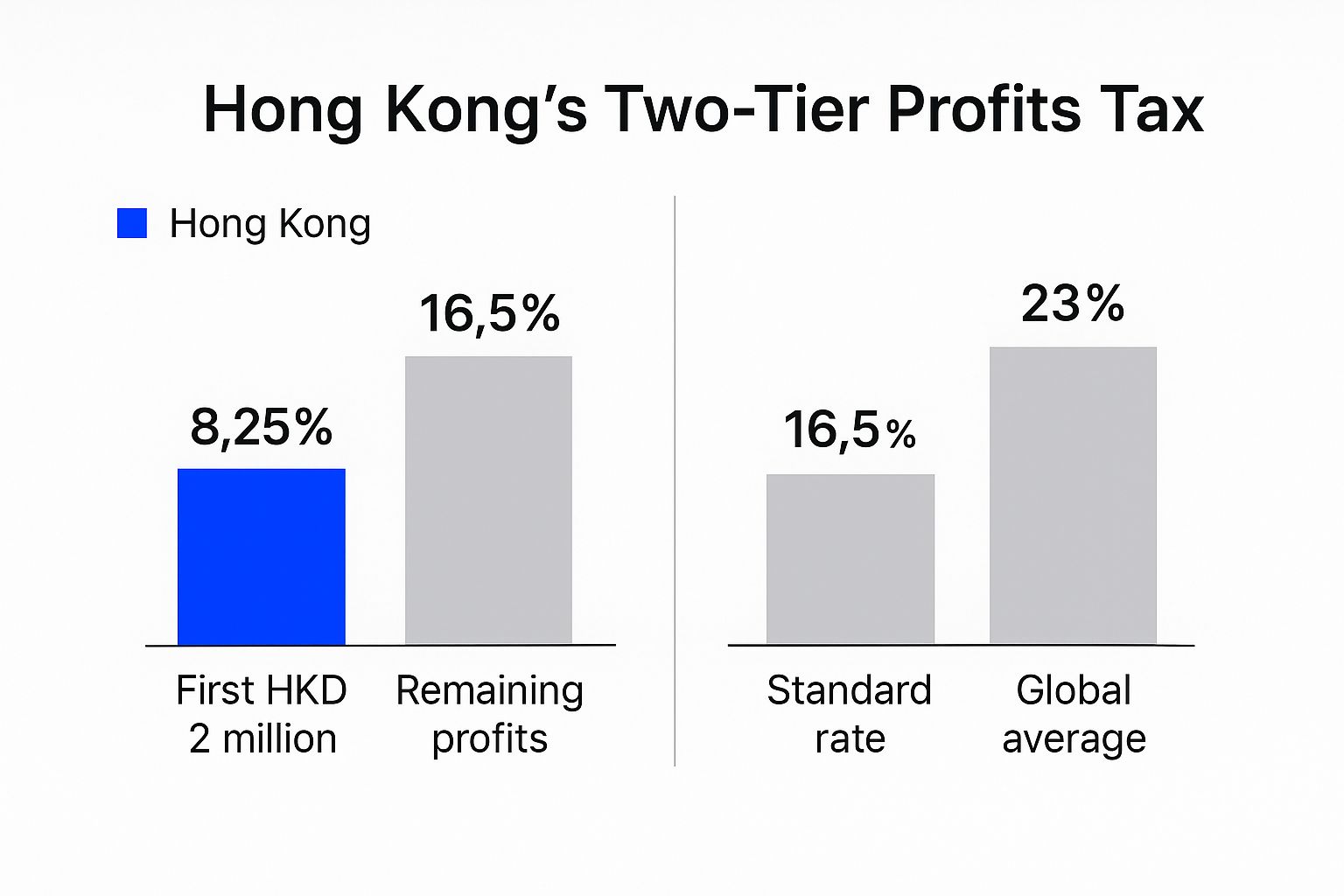

When you first hear about the corporate tax rate Hong Kong has, the numbers seem almost too good to be true. The city runs on a two-tiered system that’s incredibly friendly to businesses, especially for entrepreneurs and growing SMEs. It starts at a gentle 8.25% on your first HK$2 million in profits and then settles at 16.5% for anything beyond that. This isn't just a happy accident; it’s a deliberate strategy designed to give startups and small businesses the breathing room they need to thrive.

Understanding Hong Kong’s Two-Tiered Tax System

For anyone at the helm of a small or medium-sized business, Hong Kong's tax system feels less like a burden and more like a launchpad. It’s a world away from the rigid, one-size-fits-all flat tax rates you find elsewhere, which can put a serious strain on a company's cash flow in its crucial early days.

Think of it like this: the government is essentially giving you a tax discount on your first wave of success. It’s their way of saying, "Get your business off the ground, find your footing, and we’ll ease the tax pressure while you do."

The Core Mechanics

This approach, known officially as the Two-Tiered Profits Tax Regime, was introduced specifically to lighten the load for smaller enterprises. The mechanics are beautifully simple:

- First Tier: Your company’s first HK$2 million in assessable profits is taxed at just 8.25%.

- Second Tier: Any profit you make beyond that HK$2 million mark is taxed at the standard rate of 16.5%.

This progressive model ensures your tax liability scales with your growth, making it predictable and far more manageable. It helps you avoid that sudden cash flow crunch that high initial tax rates often inflict on a growing business.

Here’s a quick-glance table to make it crystal clear.

Hong Kong's Two-Tiered Profits Tax Rates at a Glance

| Assessable Profits Bracket | Tax Rate |

|---|---|

| First HK$2,000,000 | 8.25% |

| Over HK$2,000,000 | 16.5% |

This structure is a fundamental part of what makes Hong Kong’s business environment so compelling.

The infographic below really puts this into a global perspective.

As you can see, it isn't just the starter rate that's appealing. Even the standard 16.5% is significantly lower than what many other major economies demand, solidifying the city's reputation as a highly competitive place to do business.

A Practical Example

Let's put this into practice with a real-world scenario. Imagine your Hong Kong company earned HK$3 million in assessable profits this year. Here’s how the tax calculation would work:

- The first HK$2 million is taxed at 8.25%, which comes to HK$165,000.

- The remaining HK$1 million is taxed at 16.5%, which is another HK$165,000.

- Your Total Tax Payable: HK$330,000.

This blended rate creates substantial savings. Since its introduction in the 2018/19 tax year, this two-tiered system has become a cornerstone of Hong Kong's pro-business stance. For an even closer look, you can always check the official government rates for the complete details.

The Strategic Advantage of Tax Policy Stability

In a world where economic policies can shift with the political winds, predictability isn't just a nice-to-have—it's a massive competitive advantage. The corporate tax rate Hong Kong offers isn't just low; it's also incredibly stable. That consistency is one of the city's quiet superpowers.

For decades, while other global hubs experimented with sudden tax hikes and confusing new regulations, Hong Kong has held a steady course. This isn't a minor historical detail; it's a core part of its strategic appeal. When you can reliably forecast your tax liabilities years down the line, you're building your business on solid ground, not shifting sand.

Planning With Certainty

This stable tax landscape gives entrepreneurs and business leaders the confidence to make bigger, bolder decisions. You can allocate capital to R&D, map out a five-year expansion plan, or invest in top talent, all with a clear picture of your future financial obligations. It effectively removes one of the biggest unknowns from the strategic planning puzzle.

For a startup or an SME, this predictability is priceless. It means you can focus on perfecting your business model and executing your vision, not constantly reacting to fiscal shocks. It's how you build a reliable operational base in Asia.

The track record speaks for itself. After some minor adjustments in the early 2000s, Hong Kong's corporate tax rate settled at 16.5% back in 2008 and has remained there ever since. That kind of long-term consistency is a huge draw for international businesses looking for a regional headquarters.

This stability is a sharp contrast to other economies where tax policies can be a moving target. For a different perspective, you can compare this to the fluctuating corporate tax rates and strategic planning in Turkey to appreciate just how varied fiscal approaches can be.

Ultimately, a predictable environment fosters both growth and security. Once you understand the system, you can truly unlock the secrets to tax efficiency and financial freedom and make it work to your advantage.

How the Territorial Source Principle Works for You

While the low corporate tax rate in Hong Kong gets most of the attention, the city’s real secret weapon is its territorial source principle. This is the concept that truly separates Hong Kong’s tax system from almost every other major economy in the world.

Let’s ditch the dense legal jargon and use a simple story. Imagine your business is a fishing boat registered in Hong Kong. The government will only tax the fish you catch within Hong Kong's waters. Any fish you catch out on the open international sea are yours to keep, tax-free—even if you sail back to a Hong Kong port to sell them.

That’s the essence of it: only profits generated from activities inside Hong Kong are subject to tax. Any profits sourced from outside Hong Kong are completely exempt, even if that money is repatriated to your Hong Kong company’s bank account.

Defining Your Business "Waters"

So, how do you determine if your profits are "onshore" or "offshore"? The Inland Revenue Department (IRD) doesn’t just look at where your customers are or where your bank account is located. They dig deeper into the substance of the transaction, focusing on where the core operations that actually produced the profit took place.

The crucial question the IRD always asks is: "What did you do to earn the profits, and where did you do it?" This single question is the bedrock of Hong Kong's entire territorial tax system.

To successfully claim an offshore exemption, the core, profit-generating activities of your business must happen outside of Hong Kong. This is a very nuanced area of tax law, and getting it right is absolutely critical. For a more detailed breakdown, our guide to understanding Hong Kong's offshore profits exemption claim is an essential read for structuring your operations correctly.

Real-World Scenarios

Let's see how this plays out in a couple of common business models:

-

E-commerce Brand: Let’s say your Hong Kong company sells artisanal goods to customers in the UK. If you source those products from a supplier in Vietnam, store them in a warehouse there, and manage all your sales and marketing from a team based in Singapore, your profits would very likely be considered offshore. Why? Because all the key profit-generating activities—sourcing, logistics, and marketing—are happening outside Hong Kong.

-

Global Consultancy: You run a consulting business through your Hong Kong company. If you physically fly to Dubai to negotiate and sign a contract, then deliver the consulting services to a client while you're there, the income from that project is sourced offshore. Your physical presence and the location where you perform the service are the deciding factors.

Getting a firm handle on this principle is the key to unlocking true tax efficiency and is one of the biggest reasons entrepreneurs and international businesses flock to Hong Kong.

Maximising Deductions to Lower Your Taxable Income

A low corporate tax rate in Hong Kong is a fantastic starting point, but it's only one piece of the tax efficiency puzzle. The real art of smart tax planning lies in knowing exactly what you can legally deduct from your revenue. This is where your tax return transforms from a compliance chore into a strategic tool.

Think of it like this: your assessable profit is your raw block of marble. Every legitimate business expense you claim is a chisel, carefully carving away at that figure. The goal is simple: ensure you’re only paying tax on what you actually earned, not on the money you had to spend to make it.

This goes far beyond just accounting for rent and salaries. It means taking a fine-tooth comb to every single business expense to find every allowable deduction.

Common Yet Overlooked Deductions

It’s surprising how many businesses, especially SMEs, leave money on the table simply because they don't claim everything they're entitled to. While the specifics will vary by company, a few powerful deductions are consistently missed.

Getting these right can make a huge difference to your final tax bill. Here are a few key areas to watch:

- Capital Equipment Depreciation: Don't forget to claim annual allowances for the wear and tear on assets like computers, machinery, and office furniture. This allows you to write off the cost of these essential items over their useful life.

- Intellectual Property (IP) Acquisition: Did you buy a patent, trademark, or copyright? The cost of acquiring these intangible assets can often be deducted, which is a great incentive for protecting your brand.

- Research & Development (R&D) Costs: This is a big one. Hong Kong actively encourages innovation with some very generous R&D tax deductions. Certain qualifying expenses can be eligible for up to a 300% tax deduction, giving you a powerful reason to invest in your company's future.

Strategic Use of Government Incentives

Beyond standard deductions, the Hong Kong government often introduces special incentives to support businesses in specific sectors. While the low standard rates are the foundation, these dynamic schemes are designed to fuel growth and investment. In fact, despite having such competitive rates, corporate tax remains a critical funding source for the city’s public services, which you can read more about in this overview of Hong Kong's tax framework.

By proactively seeking out and applying for these schemes, you’re not just cutting your tax bill—you're aligning your business growth with government policy. It's a true win-win.

For instance, you might find deductions for installing environmentally friendly machinery or for refurbishing your business premises. Keeping an eye on these opportunities is what separates basic accounting from sharp tax planning. It’s a strategic move that directly improves your cash flow and frees up capital for expansion.

Common Filing Mistakes and How to Avoid Them

Even with Hong Kong’s famously straightforward tax system, it’s surprisingly easy for entrepreneurs to make mistakes that can lead to trouble. Knowing the corporate tax rate in Hong Kong is step one, but filing your returns correctly is where the real challenge lies. Getting it right keeps you on good terms with the Inland Revenue Department (IRD) and saves you from a world of headaches and penalties.

The Offshore Income Myth

One of the biggest traps we see businesses fall into is misunderstanding the territorial source principle. A common belief is that if their customers are overseas, their profits are automatically "offshore" and therefore tax-free. That's a dangerous oversimplification.

The IRD looks at where your core, profit-generating activities actually happen. If your team in Hong Kong is negotiating deals, managing projects, or making key decisions, then that income was earned right here—and it's taxable.

It all comes down to substance over form. Where your money comes from is less important than where you did the work to earn it. Simply invoicing an international client from Hong Kong isn't enough proof of offshore activity.

The Capital Versus Revenue Expense Trap

Another classic error is confusing capital expenses with revenue expenses. It sounds like a minor accounting detail, but getting it wrong can seriously skew your tax calculations and attract unwanted attention from the IRD.

Here's a simple way to frame it: buying a new delivery van is a capital expense. It’s a major asset that will serve your business for years. The petrol you put in that van is a revenue expense—a day-to-day cost of keeping the business running.

- Revenue Expenses: These are your everyday operational costs like salaries, rent, and marketing. You can deduct these in full from your profits in the year you incur them.

- Capital Expenses: These are major purchases of long-term assets, such as machinery, office equipment, or property. You can’t deduct the full amount at once, but you can claim depreciation allowances over time.

Muddling these two often leads to over-claiming deductions, which is a major red flag for the IRD. The best way to stay out of trouble is to maintain meticulous records and, when in doubt, seek professional advice. It's your best defense against these common filing errors.

Answering Your Top Hong Kong Corporate Tax Questions

Let's wrap things up by tackling some of the most frequent questions we hear from entrepreneurs about the corporate tax rate in Hong Kong and how the system works in practice. Getting clear, straightforward answers to these points can build your confidence in managing your company's tax affairs.

Are Dividends or Capital Gains Taxed in Hong Kong?

No, they aren't—and this is one of the most powerful features of Hong Kong's tax system. The city does not levy a tax on capital gains, which means any profit you make from selling assets like property or shares is entirely yours to keep.

Similarly, dividends paid out to shareholders are not taxed again, provided the company's profits have already been subject to Hong Kong profits tax. This clean, elegant policy avoids the headache of double taxation and is a huge reason why Hong Kong is a world-class hub for investment and holding companies.

Key Takeaway: The absence of capital gains and dividend taxes is a cornerstone of Hong Kong's appeal. It simplifies wealth management and encourages reinvestment, whether back into the business or into new ventures.

What Is the Filing Deadline for My Profits Tax Return?

There isn't a single, universal deadline for everyone. Your company's filing deadline is tied directly to its financial year-end date. The Inland Revenue Department (IRD) typically begins sending out tax returns on the first working day of April.

From the date of issue, you usually have one month to file. However, most businesses engage a tax representative who can apply for a "block extension" on their behalf. Depending on your accounting period, this can push your deadline to August, November, or even later. It’s always smart to check the IRD's official guidance each year. And if you receive queries, modern tools like AI for replying to income tax notices can help you prepare accurate and timely responses.

Can My Company Carry Forward Business Losses?

Yes, absolutely. If your company goes through a tough year and records a loss, that loss doesn't just vanish. From a tax perspective, it becomes a valuable asset.

Hong Kong tax law allows you to carry forward any assessed losses indefinitely. You can then use those losses to offset taxable profits you generate in future years, as long as it's from the same trade or business. This is an incredibly helpful provision that acts as a financial cushion, allowing businesses to recover from down periods without the added burden of a tax bill. For a deeper dive into financial management, it's worth understanding the tax implications of a Hong Kong bank account as well.

At Lion Business Consultancy Limited, we do more than just answer questions—we build the compliant, low-tax financial structures that let your business grow securely on the global stage. If you need a strategic partner to navigate banking, tax, and corporate services, we're here to help. Schedule a consultation with us today to ensure your business is built for long-term success.