Opening a bank account in Hong Kong isn’t just ticking a box on your setup checklist; it's a strategic power move for any global business. Think of it as your financial command center—a gateway to Asia's dynamic markets, a tool for seamless multi-currency transactions, and a shield provided by a world-class legal system. For ambitious entrepreneurs and SMEs, it's an indispensable asset.

Why Hong Kong Is Still the Go-To for a Business Bank Account

Before we dive into the nuts and bolts of applications and paperwork, let’s zoom out. Why is a Hong Kong bank account such a critical asset for an international company? It’s about so much more than a place to park your cash—it’s your entry ticket into a premier financial ecosystem.

Imagine plugging your business's financial operations directly into one of the most connected hubs on the planet. From this single vantage point, you can manage global transactions, access sophisticated trade finance, and tap into investment opportunities you simply won’t find anywhere else.

To paint a clearer picture, here’s a quick rundown of what makes a Hong Kong bank account so valuable.

Key Advantages of a Hong Kong Business Bank Account

| Advantage | What It Means for Your Business |

|---|---|

| Gateway to Mainland China | Seamlessly send and receive Renminbi (RMB), paying suppliers and accessing the world's second-largest economy with ease. |

| Multi-Currency Freedom | Hold, manage, and transact in major currencies like USD, EUR, GBP, and JPY from a single account, cutting down on conversion fees. |

| Financial Stability & Trust | Benefit from a robust, highly regulated banking system that lends credibility and security to your global operations. |

| No Foreign Exchange Controls | Move capital in and out of Hong Kong freely, without restrictions, giving you complete control over your funds. |

| Global Connectivity | Access a world-class banking infrastructure with sophisticated online platforms and services designed for international trade. |

These aren't just abstract benefits; they translate into real-world efficiency and growth for your business.

A Direct Bridge to Mainland China and Beyond

If the Chinese market is on your radar, a Hong Kong bank account is less of a nice-to-have and more of a necessity. The city's unique position makes cross-border transactions in Renminbi (RMB) incredibly smooth, which is a massive operational advantage.

I’ve seen this firsthand with countless e-commerce clients. They were getting hammered by high fees and frustrating delays when paying their suppliers in Shenzhen. The moment they established a Hong Kong company and bank account, those headaches vanished. Suddenly, they could pay suppliers in their local currency almost instantly, saving them money and strengthening those vital relationships.

A Hong Kong bank account acts as a financial bridge, connecting the international SWIFT system with Mainland China's domestic payment networks. This dual access is a strategic advantage that few other jurisdictions can offer.

This seamless connection goes beyond simple payments. It unlocks investment and capital flow opportunities through programs like the Stock Connect and Bond Connect schemes, paving unique pathways for growth.

The Power of Multi-Currency Freedom

One of the first things you'll appreciate is the end of currency conversion nightmares. Hong Kong has no foreign exchange controls, meaning capital can flow in and out without restriction. Most corporate accounts here are multi-currency by default, allowing you to hold, receive, and send funds in major currencies like USD, EUR, GBP, and of course, HKD and RMB.

For businesses working with international clients and suppliers, this is a complete game-changer. Imagine invoicing a client in London in GBP, paying a supplier in New York in USD, and covering your local costs in HKD—all from one integrated account. This agility slashes conversion fees and shields your business from unpredictable currency swings. To explore this further, check out the key benefits of opening a Hong Kong bank account for international businesses.

A Pillar of Stability and Trust

In a world full of economic uncertainty, stability is a currency of its own. Hong Kong’s banking system is known globally for its tight regulation, high liquidity, and commitment to international standards. This reputation for security and reliability instantly gives your business a layer of credibility.

Even when facing global headwinds, the city’s financial sector has proven its resilience. In 2024, Hong Kong's total banking assets grew by 4.5%, while operating profits jumped 7.8% year-on-year, driven by strong performance and digital innovation. This kind of stability provides a secure foundation for your company's finances, as highlighted in the latest Hong Kong banking report from KPMG. It's clear that putting in the effort to open an account here is a smart investment in your company's future.

Choosing the Right Bank for Your Business Needs

The first real decision on your journey is figuring out which bank truly aligns with your business model. This isn’t about picking a familiar name; it’s about finding a financial partner that understands your industry, your transaction patterns, and your global ambitions.

Getting this right from the start can be the difference between a smooth setup and months of frustrating delays.

For most entrepreneurs, the choice boils down to two main camps: the established, traditional giants and the nimble, modern virtual banks. Each has its own distinct flavour, and the best fit depends entirely on what your company actually does day-to-day.

Traditional Giants vs Virtual Challengers

Think of banks like HSBC, Standard Chartered, or Bank of China as the established titans of the industry. They offer a massive global footprint and a full suite of services like trade finance, letters of credit, and complex loans.

If your business involves heavy international trade or you need an in-person relationship manager to hash out complex financing, a traditional bank is often the most reliable choice. They’ve seen it all before.

On the other hand, you have the agile disruptors—virtual banks like ZA Bank, Mox, and Airstar. They operate entirely online, which means lower overheads for them and often minimal or no monthly fees for you. Their onboarding is typically much faster, making them a fantastic choice for tech startups, consultants, and SMEs with straightforward, online-focused businesses.

A Real-World Example: We worked with an international trading company sourcing goods from Mainland China for European markets. They absolutely needed the robust trade finance facilities and global network of a bank like HSBC. In contrast, a SaaS startup with customers worldwide found a perfect fit with a virtual bank. They secured their bank account in Hong Kong in under two weeks with zero initial deposit, letting them accept international payments almost immediately.

Comparing Traditional vs Virtual Banks for SMEs in Hong Kong

To make the decision clearer, it helps to see the key differences side-by-side. Your business model—whether it’s high-volume, low-margin trade or a digital service—will point you toward the right column.

| Feature | Traditional Banks (e.g., HSBC, SCB) | Virtual Banks (e.g., ZA Bank, Airstar) |

|---|---|---|

| Onboarding Process | In-person meetings often required; can take weeks or months. | Fully remote and digital; often completed in days. |

| Fees & Deposits | Higher initial deposits and monthly maintenance fees are common. | Low or no initial deposit; minimal to zero monthly fees. |

| Service Scope | Comprehensive services including complex trade finance, loans, wealth management. | Focused on core banking: deposits, transfers, debit cards. Limited credit facilities. |

| Customer Support | Dedicated relationship managers, branch support, phone banking. | Primarily through in-app chat, email, and digital channels. |

| Best For | International trade, manufacturing, businesses needing complex credit facilities. | Digital nomads, startups, e-commerce, and service-based SMEs. |

Ultimately, the choice comes down to weighing the comprehensive, hands-on services of a traditional bank against the speed, low cost, and convenience of a virtual one.

Understanding Core Eligibility Criteria

No matter which path you choose, banks in Hong Kong follow strict due diligence protocols. They need to understand who you are, what your business does, and where your money is coming from.

For non-resident owners, the scrutiny is even higher. Banks want to see a clear, logical connection to Hong Kong. Maybe you have local clients, suppliers, or a strategic reason for basing your financial operations here. It's a key piece of the puzzle.

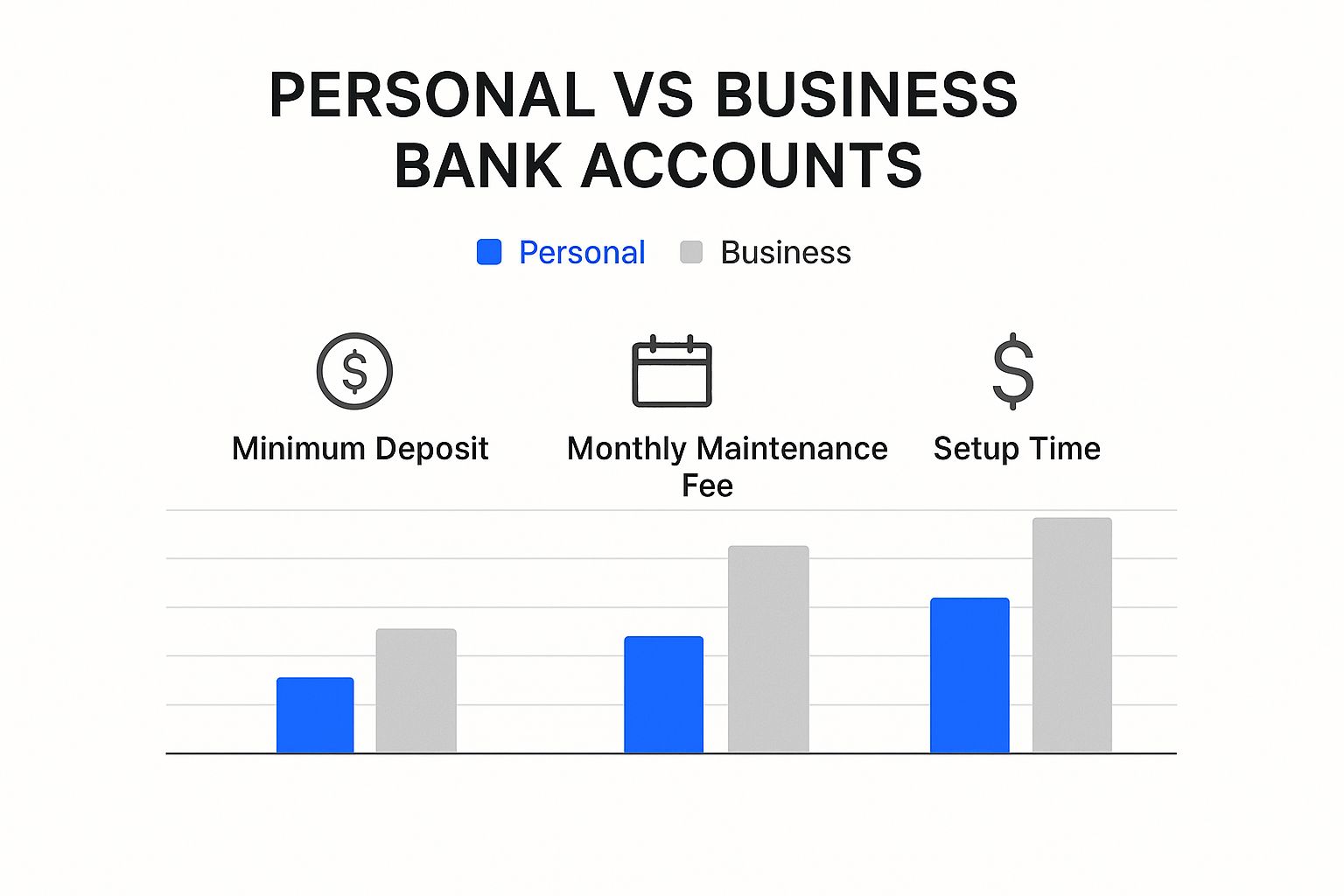

Many first-time applicants get tripped up on the differences between personal and business accounts. Let's clear that up.

As you can see, business accounts simply involve more complexity, higher financial thresholds, and longer verification times because of the regulations involved.

What Banks Look for in an SME Applicant

Beyond the paperwork, banks are assessing risk and legitimacy. They want to partner with sustainable, transparent businesses.

Here's what they're really evaluating:

- Business Model Clarity: Can you explain what your company does in a simple, compelling way? A vague or confusing business plan is a major red flag.

- Proof of Business: This is non-negotiable. You need tangible evidence of your operations—think signed contracts, invoices, and supplier agreements.

- Transaction Logic: Your expected payments should make sense for your business. A large, unexpected transfer without a clear commercial reason will trigger an immediate compliance review.

- Director and Shareholder Background: Banks will run background checks on all key people. A clean financial history is crucial.

The banking scene in Hong Kong is also shifting with wider economic trends. Recent monetary statistics from the HKMA show a growing preference for foreign currencies, especially the Renminbi. In one recent month, total deposits grew slightly, driven by a 1.9% rise in foreign currency deposits while Hong Kong dollar deposits fell. More telling, renminbi deposits surged by 6.4%, reflecting deepening financial ties with the Mainland.

This trend highlights just how important it is to choose a bank that's proficient in handling RMB if your business deals with China.

Making the right choice demands a clear-eyed look at your own business. To help you weigh the options, our detailed guide on choosing the right Hong Kong bank for your business needs offers an even deeper comparison. By matching what you do with what a bank does best, you set yourself up for a successful and lasting financial partnership.

Assembling Your Document Toolkit

This is where most applications for a bank account in Hong Kong hit a wall. Getting your documents perfectly in order isn't just a suggestion; it's the most critical step in the whole process. Think of it less like a chore and more like building a solid case for why the bank should want your business.

A banker's primary job, especially in the compliance department, is to manage risk. Every single document you submit helps them piece together the story of your business, confirm your identity, and get comfortable with you as a client. Let's walk through what you'll need and, just as importantly, why it matters so much.

The Core Company Documents

First up, you need to prove your company is a legitimate, properly registered entity. This is the bedrock of your entire application. You’re showing the bank that you’re not just a name on a piece of paper but a legally structured business that meets Hong Kong's strict regulatory standards.

These are the non-negotiables:

- Certificate of Incorporation: Essentially your company's birth certificate. It's the official proof from the Hong Kong Companies Registry that your business legally exists.

- Business Registration Certificate: This one comes from the Inland Revenue Department. It shows you're registered for tax and cleared to operate commercially.

- Articles of Association: This document is the rulebook for your company's internal affairs—it outlines director powers, shareholder rights, and who has the authority to run the show. The Memorandum of Association is also a crucial part of this package, establishing your company's objectives and legal boundaries.

Think of these three items as your company's passport. Without them, your application is going nowhere.

Proving Who Is Behind the Business

Once the bank is satisfied your company is real, they'll zoom in on the people running it. Hong Kong banks are bound by tough Know Your Customer (KYC) regulations, which means they have to verify the identity of every major player. This includes every director, significant shareholder (usually anyone with 10% or more ownership), and authorised signatory.

For each person, you'll need to provide:

- Certified True Copy of Passport: A simple photocopy won't do. This has to be certified by a professional—a notary public, lawyer, or CPA—who attests that it’s a genuine copy of the original.

- Proof of Residential Address: This needs to be a recent document, typically issued within the last three months. Think utility bills, personal bank statements, or official government letters that clearly show the individual’s name and home address.

A very common slip-up is providing a PO Box or work address. That's an immediate red flag for the compliance team. They need to know where the people making the decisions actually live.

If you're looking for a more detailed breakdown, especially for applicants living outside Hong Kong, our guide on Hong Kong bank account requirements for non-residents has a complete checklist.

Crafting Your Business Narrative

Now we get to the heart of it. This is where you go beyond basic paperwork and actually tell your company's story. Your "proof of business" documents are arguably the most influential part of your application because they show your company is a real, active commercial enterprise.

The bank needs to see hard evidence of what you do. Vague descriptions or future plans just won't cut it. You need to back up your words with solid proof.

What does strong proof of business look like?

- Signed contracts with clients or key suppliers.

- Invoices you've issued for services or products already delivered.

- Purchase orders you've sent to your manufacturers.

- Shipping documents like bills of lading that prove you're moving goods.

- Your professional business website and any marketing materials.

Your business plan ties this all together. Keep it short and to the point—a few pages at most. Clearly explain what you do, who your customers are, where your money comes from, and what kind of transactions you expect to make. The goal is to make it incredibly easy for a busy banker to understand your entire business model in five minutes. This is your chance to build trust and show them you’re the kind of serious, credible partner they want to work with.

Making It Through the Bank Meeting

Once your application is submitted, the next stage often involves a meeting. Whether you’re sitting in a Central high-rise or dialing in for a video call, this is your moment to bring your application to life. It's your opportunity to show the banker who you are beyond the paperwork.

Think of it less as an interrogation and more as a professional conversation. Your goal is to build rapport and demonstrate that you’re running a legitimate, transparent business they can confidently partner with. They’ve seen the documents; now they need to hear the story behind them, straight from you.

How to Handle the Interview

First impressions are everything. Arrive prepared, not just with a tidy folder of your documents, but with a crystal-clear narrative about your business. A relationship manager’s primary job is to mitigate risk, and nothing puts them at ease like a founder who is confident, organized, and in control.

Remember, they're not just assessing your business plan; they're assessing you. Be ready to walk them through every facet of your operation, from how you find suppliers to how you get paid. It’s similar to pitching an investor—be clear, knowledgeable, and genuinely passionate about what you're building.

Answering the Banker's Favourite Questions

Bankers in Hong Kong tend to circle around the same key areas. They’re trying to connect the dots between your application and the real world. Let’s tackle the questions that almost always come up.

1. "So, what exactly does your business do?"

This is your elevator pitch. Ditch the jargon and be direct. If you run an e-commerce store, don't just say that. Explain what you sell, who your customers are, and where your products come from.

- A poor answer: "We're in the B2B trading space."

- A much better answer: "We source high-quality electronic components from verified suppliers in Shenzhen. We then sell these to small and medium-sized manufacturers in Germany, handling all the logistics and quality control ourselves."

2. "Why Hong Kong? Why do you need an account here?"

This is the big one, especially if you’re a non-resident. Your answer needs to draw a direct, logical line to the city.

- A weak answer: "Because Hong Kong is a major financial centre."

- A strong answer: "The majority of our key suppliers are in Mainland China, and they prefer to be paid in RMB or USD via a Hong Kong bank. Having an account here will slash our transaction fees and speed up payment settlements, which makes our entire supply chain more efficient."

3. "What will your typical transactions look like?"

Get specific. They need to understand the frequency, average amounts, and currencies for both incoming and outgoing payments. This helps them build a profile of what’s "normal" for your business, which is crucial for their compliance monitoring.

It's all about building a baseline. The banker needs a clear picture of your expected financial activity to meet their Anti-Money Laundering (AML) obligations. Any sudden, unexplained activity that doesn't match what you told them is a huge red flag down the road.

Proving Your Business is the Real Deal

Answering questions well is only half the battle. You also need to proactively prove your business is legitimate. This is where you bring your "proof of business" documents to life.

Don't just say you have contracts. Reference them. For instance, "As you can see from the signed agreement with 'ABC Corp' that we provided, we have a 12-month contract to supply them with…". This simple act connects the paper to reality, making the banker's job easier and boosting your credibility.

If your supply chain is complex, grab a pen and sketch it out. A simple diagram showing the flow of goods and money—from your supplier, to your company, to your customer—can clear up confusion about international operations in seconds. You want to leave that meeting with the banker feeling confident that you're running a real, thriving business they'll want as a client.

Keeping Your Account Healthy and Compliant

Congratulations, your bank account in Hong Kong is open. It’s easy to feel like the hard part is over, but this is actually where the ongoing work begins. Your new focus is keeping that account in good standing. Hong Kong's financial system is built on trust and strict regulation, so ongoing compliance isn't just a bureaucratic chore—it's vital to your business's longevity.

Think of your new banking relationship as a partnership that needs clear communication and transparency to thrive. Neglecting it can lead to frustrating account reviews, frozen funds, or, in the worst-case scenario, account closure.

Understanding KYC and AML in Practice

Hong Kong banks operate under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This isn't a one-time check during your application; it's a continuous process. Behind the scenes, the bank's compliance teams and algorithms constantly monitor for activity that doesn't align with the "normal" business operations you described in your interview.

What does this mean for you day-to-day? Every transaction needs a clear commercial purpose. A large, unexpected transfer from a country completely unrelated to your business will almost certainly raise a red flag. The same goes for a pattern of unusual payments to individuals instead of other companies.

The key is to always be ready to explain the "why" behind your money movements. Keep meticulous records—contracts, invoices, and email threads—that justify every transaction. This isn't just good bookkeeping; it's your primary defense against compliance headaches.

Common Red Flags That Can Trigger an Account Review

Banks are trained to spot patterns that suggest risk. Understanding what they look for is the best way to avoid unnecessary scrutiny. It’s all about ensuring your financial story makes sense.

Here are some of the most common triggers I've seen:

- Sudden spikes in transaction volume: If you told your banker you expect around HK$500,000 in monthly turnover and you suddenly receive HK$5 million, they're going to have questions.

- Transactions with high-risk jurisdictions: Doing business with countries on international sanctions lists is an immediate cause for concern.

- Vague or missing transaction details: Always use clear invoice numbers or purpose descriptions in your payment references. A note saying "for services" is far too vague and will get flagged.

- Rapid fund movement: Receiving a large sum and immediately wiring it out to multiple other accounts can look like a classic money laundering technique, even if it's for legitimate reasons.

The goal isn’t to avoid growth or complex transactions. It’s to communicate proactively. If you’re about to receive a large investment or land a major contract that will change your transaction patterns, inform your relationship manager before the money hits your account.

Building a Strong and Lasting Banking Relationship

A solid relationship with your bank is your best tool for long-term stability. It transforms the bank from a simple service provider into a genuine partner who understands your business journey. This all comes down to keeping them in the loop.

Be proactive. Let your bank know about any significant changes to your business, such as:

- A change in directors or major shareholders.

- A new business address.

- A pivot in your business model or an expansion into new markets.

When you're transparent, you build the trust and context the bank needs to understand your company's evolution. This simple, proactive communication ensures your legitimate business growth isn't mistaken for suspicious activity.

Hong Kong’s economic environment is incredibly dynamic, which is precisely why this level of compliance is so important. In the second quarter of 2025, for example, the total value of credit card transactions hit HK$268.4 billion, with a huge amount flowing through both local and overseas retail. This sheer volume of transactions highlights why banks must maintain such rigorous oversight. You can see the official numbers on consumer spending trends in the Hong Kong government's press release. This robust economy is exactly why keeping a compliant bank account in Hong Kong is so vital for future-proofing your business.

Questions I Hear All the Time About Hong Kong Bank Accounts

Let's cut to the chase. After guiding hundreds of founders through this process, I’ve seen the same questions and anxieties surface time and again. Here are the straight-up answers to what’s likely on your mind.

Can I Really Open an Account from Overseas, 100% Online?

This is the million-dollar question for every international entrepreneur. The short answer is: rarely, at least not with the big, traditional banks.

While digital and virtual banks have made the process far more remote-friendly, most established players like HSBC or Standard Chartered will still want to see a director's face. This might mean a video conference, but an in-person meeting is also common. It’s best to expect a "hybrid" approach—you'll do most of the work online but should plan for that crucial face-to-face (or screen-to-screen) interaction.

It's all about compliance. They need to verify who you are, and that final check is their non-negotiable step in getting to know the person behind the business.

My advice? Don't view the meeting as a hurdle. It’s your chance to make a great impression and build trust. A clear, confident conversation about your business can be more impactful than any document you submit. Banks want to partner with real, credible entrepreneurs.

What Exactly Is "Proof of Business" and Why Is It Such a Big Deal?

Think of it like this: the bank needs to see that your company is a genuine, operating business, not just a paper entity designed to hold money. After your personal ID, this is the most critical part of your application.

Banks are under immense regulatory pressure to prevent money laundering, so they need to understand your business and where its revenue comes from. Solid proof of business isn't a suggestion; it's a firm requirement. We're talking about tangible evidence, such as:

- Signed contracts or agreements with your customers.

- Invoices that have actually been paid.

- Shipping records (like a bill of lading) if you sell physical products.

- Email chains showing detailed negotiations with suppliers or clients.

The more evidence you provide, the clearer the picture you paint for the bank, making their decision to approve you much, much easier.

How Long Is This Actually Going to Take?

Honestly, it varies wildly. Anyone promising a fixed, super-fast timeline isn't being realistic. If your paperwork is flawless and you're applying to a modern virtual bank, you could be approved in as little as one to two weeks.

But for a traditional bank account in Hong Kong—especially if your company has multiple international directors or a complex ownership structure—you should realistically budget for four to twelve weeks. I've seen cases drag on longer when the bank returns with follow-up questions. The only factor you can control is your own organization from day one.

What Happens If My Application Gets Rejected?

It’s a setback, for sure, but don't panic—it’s rarely the end of the road. Your first step should be to politely ask the bank for feedback. Be prepared for a vague answer, as they are often tight-lipped for legal reasons.

Next, conduct a frank review of your application. Was your business plan a bit thin? Was your proof of business unconvincing? Often, the solution is to gather stronger documentation and re-apply. Sometimes, it’s not you; it’s them. You may have simply applied to a bank whose risk appetite doesn't align with your industry. If a big traditional bank says no, a virtual bank might say yes. If you’re still stuck, it might be time to bring in a professional to help you polish your application and target the right financial partner.

Navigating the world of international banking can feel overwhelming, but you don't have to do it alone. At Lion Business Consultancy Limited, we specialise in cutting through the red tape for entrepreneurs and SMEs. If you're ready to get your Hong Kong bank account set up the right way, let's have a chat.

Get started with your Hong Kong company and bank account today.