When you're building a business in Hong Kong, getting your accounting right isn't just a box-ticking exercise—it's the bedrock of compliance and smart decision-making. Imagine your accountant not just as a number-cruncher, but as a financial co-pilot navigating everything from daily bookkeeping to your annual filings with the Inland Revenue Department (IRD).

Why Smart Accounting Is Your Business Compass in Hong Kong

Launching a business in Hong Kong is a thrilling prospect. It’s a global hub buzzing with opportunity, but the financial landscape can feel as intricate as the MTR network during rush hour. It might seem daunting at first, but once you learn the routes, it's remarkably efficient. This guide is your map.

Here, good financial management is about much more than just keeping the books balanced. It’s the foundation for strategic growth and rock-solid compliance. We're going to skip the dense jargon and show you how professional accounting services act as a compass for your business, guiding you toward sound decisions and helping you sidestep costly mistakes.

This is about building a financially healthy company from day one. To start on solid ground, getting the initial setup right is vital, a topic we explore in our guide on incorporating a company in Hong Kong.

A Thriving Hub for Financial Expertise

The sheer demand for top-tier accounting services in Hong Kong speaks volumes about its standing as a premier international business centre. The industry is incredibly stable, with service exports reaching HK$2.35 billion in 2022. A significant slice of that demand comes from Mainland China, highlighting Hong Kong's pivotal role as a gateway for businesses expanding globally.

This dynamic ecosystem gives entrepreneurs like you access to some of the sharpest financial minds in the world. When you partner with the right firm, you unlock some powerful advantages:

- Regulatory Peace of Mind: They ensure you never miss a deadline or a detail required by the IRD and the Companies Registry.

- Strategic Insight: Your financial data transforms from a set of static figures into a powerful tool for budgeting, forecasting, and planning your next big move.

- Time and Resource Savings: This is a huge one. It liberates you to focus on what you're best at—running and growing your business.

What Accounting Services Do You Actually Need? A Breakdown

When you hear terms like "bookkeeping" or "audit," it's easy for them to sound a bit abstract. But these aren't just buzzwords; each service is a specific tool designed to keep your business financially healthy and compliant in Hong Kong.

Think of them as building blocks. One supports the next, creating a solid financial structure that frees you up to focus on what you do best: running your business. Let's get to grips with what each one really involves.

Bookkeeping: The Daily Pulse of Your Business

Bookkeeping is the absolute foundation of your financial world. Picture it as your company's daily pulse monitor—it tracks every single dollar that comes in and every dollar that goes out. It's the disciplined work of recording all financial transactions, from sales invoices and supplier bills to expense claims and bank payments.

If your bookkeeping is off, everything that follows will be, too. Your tax calculations will be flawed, financial reports will be useless, and you'll be flying blind when it comes to your company's performance. At the heart of this is understanding the general ledger, which is essentially the master book of your company's entire financial story.

This isn’t just admin. Good bookkeeping organises your financial data into a clean, logical format, paving the way for everything else.

Financial Statements: Your Company’s Annual Report Card

If bookkeeping is the daily pulse check, your financial statements are the annual report card. They take all that raw day-to-day data and transform it into a clear story about how your business performed over the year.

Key Takeaway: Financial statements aren't just numbers on a page. They are the official story of your company's performance, profitability, and overall health, building essential trust with investors, banks, and regulators.

This "report card" has three main sections:

- The Profit & Loss (P&L) Statement: This is the bottom line. It shows your revenue, costs, and expenses to reveal whether you made a profit or a loss.

- The Balance Sheet: This gives a snapshot of your company’s financial position on a specific day, outlining your assets, liabilities, and owner’s equity.

- The Cash Flow Statement: This tracks the actual cash moving in and out, showing how well your company is generating and managing its money.

Tax Filing: Managing Your IRD Obligations

In Hong Kong, your relationship with the Inland Revenue Department (IRD) is a given. Tax filing is the process of preparing and submitting your tax returns using the information from your meticulously prepared financial statements. It's about meeting your legal obligations on time and, most importantly, accurately.

A good accountant does far more than just fill in the forms. They know the ins and outs of Hong Kong's tax code, ensuring you claim every legitimate deduction and allowance. This turns a potentially stressful chore into a strategic part of your financial planning.

The Annual Audit: A Stamp of Credibility

The annual audit can feel like a final exam, but it’s much more than that. The best way to think of it is as a credibility booster. An independent Certified Public Accountant (CPA) thoroughly examines your financial statements to confirm they present a true and fair view of your company’s position.

This third-party validation signals to banks, investors, and potential partners that your numbers are reliable. For any SME hoping to secure a loan, attract investment, or simply build a stellar reputation, a clean audit report is gold. It’s the ultimate stamp of financial integrity.

Why Professional Accounting Is a Strategic Investment

For any ambitious entrepreneur setting up shop in Hong Kong, seeing accounting as just another expense is a fundamental mistake. It’s far more than just keeping the books tidy; it's a strategic investment in your company’s future. In a business hub governed by the strict rules of the Companies Ordinance, professional financial management is your first line of defence against risk and a launchpad for real growth.

Think of it this way: two startups launch on the same day. The first founder, Alex, decides to handle all the accounting himself to save a bit of cash. The second founder, Mei, partners with a professional accounting firm right from the get-go. Initially, Alex feels pretty clever, putting the money he saved into a new marketing campaign.

But as the business starts to pick up, so does the complexity. Alex quickly gets swamped, losing track of filing deadlines, miscategorising expenses, and dealing with a constant, nagging worry about compliance. Mei, on the other hand, is laser-focused on her product and her customers, completely confident that her financial reporting, tax filings, and payroll are all being handled by experts.

The True Cost of DIY Accounting

The real story unfolds when the first Profits Tax Return deadline approaches. Alex is in a panic, trying to make sense of a year’s worth of messy receipts and invoices. He makes a few critical errors and misses the filing deadline, earning him a penalty from the Inland Revenue Department (IRD). Even worse, his disorganised books make it impossible to get the business loan he desperately needs. His "savings" have now become a major liability, grinding his growth to a halt.

Mei’s experience couldn't be more different. Her accounting team had her books perfectly organised and audit-ready months in advance. Her tax return was filed on time without a hitch, and armed with clean, professional financial statements, she confidently secured a new round of funding.

The lesson here is simple: In Hong Kong's demanding business environment, professional accounting isn't a cost centre—it's a critical risk management tool. It buys you the peace of mind to make bold, strategic moves without constantly looking over your shoulder.

The city’s regulatory framework is built on transparency and accountability. The accounting industry is tightly regulated, and all companies are required to maintain proper books and prepare audited financial statements every year. These aren't just for show; they are vital for tax compliance and must be submitted to the IRD, following an audit by a Hong Kong CPA with a valid practising certificate. You can find more details about Hong Kong's stringent audit standards on statrys.com and see how they bolster financial credibility.

Turning Compliance into a Competitive Edge

Expert accounting services in hong kong do a lot more than just keep you out of trouble. They turn compliance from a chore into a powerful competitive advantage. When you hand off this critical function, you unlock several key benefits that directly impact your bottom line.

- Mitigated Risk: Specialists are always on top of changing regulations, ensuring you steer clear of the costly fines and legal headaches that come with non-compliance.

- Enhanced Focus: Free from the burden of financial admin, you can pour all your energy into what you do best—innovating, serving customers, and scaling your business.

- Improved Decision-Making: With accurate, real-time financial data at your fingertips, you can make smarter decisions on budgeting, pricing, and expansion with confidence.

- Increased Credibility: Professionally audited financial statements build trust with banks, investors, and potential partners, opening doors to new funding and opportunities.

In the end, Mei’s startup surges ahead of Alex’s—not because her idea was necessarily better, but because her operational foundation was solid. She understood that truly knowing your numbers and meeting your obligations is the bedrock of any sustainable business. To explore this idea further, take a look at our article on the advantages of outsourcing accounting. Investing in expert help from day one lets you build a resilient company that’s ready for long-term success.

Understanding the Costs of Accounting Services

Trying to figure out the cost of accounting services in Hong Kong can feel a bit like asking, "How much does a car cost?" The answer is always: it depends. There's no one-size-fits-all price tag, because the fee is a direct reflection of your company's specific needs, size, and complexity.

Most business owners just want a straightforward number, but the reality is that a solo entrepreneur with a handful of monthly transactions will have a very different bill from a growing SME dealing with cross-border sales. The key is to shift your mindset from seeing this as just another expense to viewing it as a critical investment in your company’s financial health and compliance.

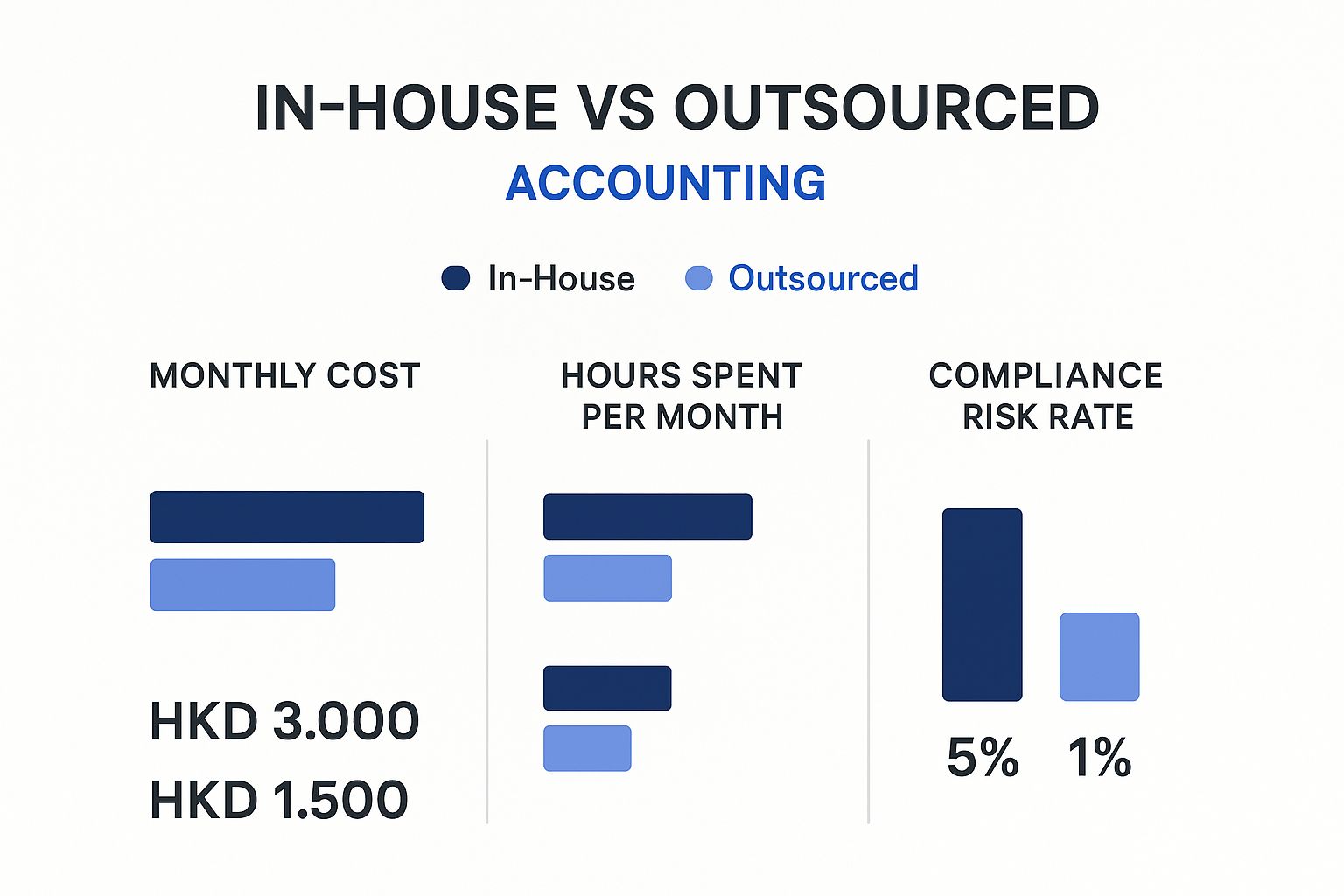

This infographic breaks down the classic dilemma: should you handle accounting in-house or outsource it? It gives a great visual snapshot of the differences in cost, time commitment, and risk.

As you can see, turning to an external expert often makes more financial sense. Not only can it be cheaper, but it dramatically reduces the risk of making a mistake that could lead to serious penalties from the IRD.

What Drives Accounting Fees in Hong Kong

So, what are the things that will actually move the needle on the quotes you receive? It boils down to a few core factors. Understanding them will put you in a much better position when you start talking to potential accounting firms.

- Transaction Volume: This is the big one. A business processing 50 transactions a month is a world away from one handling 500. More transactions simply mean more work—more data entry, more reconciliation, and more time.

- Business Complexity: Are you juggling multiple currencies? Do you have suppliers in Europe and customers in the US? The more moving parts your business has, the more specialised expertise is required to keep everything in order.

- Industry Specifics: Certain sectors, like financial services or international trading, operate under their own set of complex reporting rules. This requires a level of specialised knowledge that naturally comes at a premium.

- Quality of Your Records: This is the honest truth—if your records are a shoebox full of crumpled receipts and half-forgotten invoices, your accountant has to play detective first. That initial clean-up effort will definitely show up on your first bill.

Common Fee Structures You Will Encounter

In Hong Kong, accounting firms generally work with a few common pricing models. Getting to know them will help you pick an arrangement that suits your budget and gives you the predictability you need.

Pro Tip: Always ask for a detailed service agreement that spells out exactly what is—and isn't—included. Things like audit support or in-depth tax advice are often add-ons to a standard bookkeeping package. Clarifying this at the start saves a lot of headaches later on.

To give you a clearer picture, here's a look at some typical fee structures you'll find in the market.

Estimated Accounting Fee Structures for Hong Kong SMEs

This table provides a general idea of what you can expect to pay, but remember that these are just estimates. Your final quote will depend on the factors we just discussed.

| Service Type | Typical Fee Model | Estimated Annual Cost Range (Micro-Business) | Estimated Annual Cost Range (Growing SME) |

|---|---|---|---|

| Bookkeeping | Monthly Retainer | HK$8,000 – HK$15,000 | HK$20,000 – HK$50,000+ |

| Audit | Fixed Project Fee | HK$7,000 – HK$12,000 | HK$15,000 – HK$40,000+ |

| Tax Filing | Fixed Project Fee | HK$2,500 – HK$5,000 | HK$5,000 – HK$15,000+ |

| Advisory | Hourly or Retainer | Varies based on need | Varies based on need |

Ultimately, armed with this knowledge about cost drivers and fee models, you can have much more productive conversations with potential providers. You'll be better equipped to find a partner who is transparent with their pricing and truly delivers value for your money.

How to Choose the Right Accounting Partner

Picking an accounting partner is one of the most important relationships you'll ever build for your business. It’s so much more than just finding someone to file your taxes. This is about entrusting a vital part of your company's future to a professional who should be a genuine strategic advisor.

The right firm won’t just crunch numbers. They'll translate them into a clear story, helping you see where you stand financially, manage your risks, and spot those golden opportunities for growth. Think of them less as an outside service and more as an extension of your own leadership team.

With so many accounting services in Hong Kong to choose from, making the right decision means looking far beyond the basics. You need a partner who gets your vision and fits with how you operate.

Looking Beyond the Credentials

Every Certified Public Accountant (CPA) in Hong Kong is held to an incredibly high professional standard. That's a great starting point, but it's just the baseline. It doesn't tell you if they're the right fit for your business.

This is where you need to dig deeper into their actual experience. A firm that deals mostly with huge multinational corporations might not grasp the fast-paced, lean reality of a startup. On the other hand, a smaller firm might not have the muscle to handle complex international transactions if your business suddenly takes off.

Key Insight: The best accounting partner speaks your language—and I don't just mean Cantonese or English. They speak the language of your industry. They understand your unique pain points, whether it’s inventory management for an e-commerce brand or regulatory hurdles in fintech.

This is where you shift from ticking boxes to having real conversations. A great accountant will be just as curious about your business model as you are about their qualifications.

Essential Qualities to Look For

As you start to vet potential firms, zero in on these key qualities. They're often what separates a merely functional relationship from a truly game-changing partnership.

- Industry Specialisation: Have they worked with businesses like yours before? An accountant who already knows your sector can give you proactive advice, not just reactive compliance work.

- Technological Fluency: Is the firm up-to-date with modern tools? In an era of cloud accounting, being comfortable with platforms like Xero is essential for efficiency and getting real-time financial data.

- Clear Communication Style: Your accountant has to be able to explain complex tax rules or financial reports in simple terms. If you leave a meeting feeling more confused than when you walked in, that’s a massive red flag.

- Proactive Advisory: A great partner doesn't just tell you what happened last quarter. They should be helping you plan for the next one, offering insights on cash flow, budgeting, and smart tax planning.

A Practical Checklist for Your Search

To give your selection process some structure, use this checklist of critical questions to ask every accounting firm you speak with. Their answers will tell you a lot about how they work and if they're the right partner for you.

- Onboarding and Integration: "What's your onboarding process like, and how will you work with our current systems?" You need a smooth handover to avoid any business disruption.

- Day-to-Day Contact: "Who will be my main point of contact, and what's their level of experience?" You want to make sure you won't be passed off to a junior associate after you've signed on.

- Experience with the IRD: "Can you share an example of how you've helped a client handle an inquiry from the Inland Revenue Department?" This proves they have real-world experience with local authorities.

- Reporting and Communication: "How often will we get financial reports, and what format will they be in? How often can we expect to meet to review our performance?" It's crucial to set clear communication expectations right from the start.

- Banking Compliance: "How do you help clients with their banking compliance?" Keeping your financial activities in line with bank rules is non-negotiable, and our guide on how to maintain compliance with a Hong Kong bank account gives you a deeper look into this critical area.

Taking the time to ask these questions will put you in a great position to choose a partner who not only keeps your books in order but actively helps your business succeed.

The Future of SME Accounting in Hong Kong

The accountant's role is changing, and fast. Gone are the days when they were just number-crunchers, looking backwards at what your business did last year. The best accounting services in Hong Kong are now forward-looking strategic partners, and for any SME, this shift is a massive advantage.

This isn't just a small tweak; it's a complete reimagining of the accountant's job, fuelled by smart technology and a fresh perspective. Instead of simply telling you where your business has been, a modern accountant helps you chart a course for where it could go. Think of them less as a historian and more as a financial co-pilot, using real-time data to help you dodge risks and jump on opportunities.

From Bookkeeper to Strategic Advisor

The biggest change we're seeing is the jump from reactive compliance to proactive advice. Traditionally, accounting was all about making sure last year's books were tidy for the Inland Revenue Department (IRD). The future, however, is all about using that financial data to make sharper, faster decisions for tomorrow.

Imagine your accountant calling you up with insights from your live cash flow, helping you pinpoint the perfect moment to invest in new equipment or expand the team. This is what's happening right now, all thanks to cloud accounting platforms that give you a live pulse on your business's financial health. The conversation is no longer about last year's performance; it's a strategic huddle about next quarter's game plan.

This shift is crucial. A modern accounting partner doesn’t just keep you compliant; they equip you with the financial intelligence to become more agile, profitable, and competitive in a dynamic market like Hong Kong.

The Rise of Automation and RegTech

Automation is the engine behind all this. It's what frees accountants from the drudgery of manual data entry, allowing them to focus on the high-level advice that truly matters. A key development to watch is how Robotic Process Automation in accounting gets put into practice, as it can handle everything from invoices to bank reconciliations with blistering speed and accuracy.

At the same time, Regulatory Technology (RegTech) is making the tangled web of compliance much simpler. These tools automate regulatory reports and flag potential issues, cutting down the risk of human error and saving a huge amount of time. The bottom line? Your accountant spends less time buried in paperwork and more time helping you plot your next move.

Hong Kong's financial sector is gearing up for a strong recovery, thanks to new policies and tech advancements. In this climate, businesses need to think smart, balancing cost-cutting with long-term growth. You can dive deeper into Hong Kong's banking outlook and its push for innovation on kpmg.com. A modern accounting partner is the key to striking that perfect balance.

ESG Reporting: The New Competitive Edge

Another trend you can't ignore is the growing focus on Environmental, Social, and Governance (ESG) reporting. This used to be something only the big players worried about, but now investors, customers, and even potential hires are looking at an SME's ESG credentials.

A sharp accountant can help you measure and report on these non-financial metrics, turning what seems like a chore into a genuine competitive advantage. Strong ESG performance can polish your brand, attract investment, and unlock new opportunities. This isn't just a "nice-to-have" anymore; it's fundamental to building a resilient, sustainable business that will thrive in the years to come.

Frequently Asked Questions

When you're diving into Hong Kong's business world, it's natural to have questions about the financial side of things. Let's tackle some of the most common queries we hear from entrepreneurs just like you, giving you the straight answers you need to move forward.

When Is the Right Time to Outsource My Accounting?

A lot of founders ask if it's too early to hire an accountant. Honestly, the best time to outsource is before you're drowning in paperwork.

Look for these signs: compliance tasks are eating into your core business time, you're gearing up for a growth spurt and need solid financial systems, or you simply know you don't have the deep expertise to get it right. It’s a classic case of being proactive instead of reactive.

Expert Tip: Outsourcing isn't just a big-company game. For startups and SMEs, it's a smart strategic play. It gives you immediate access to professional expertise, helping you sidestep common (and often expensive) early-stage mistakes and build a strong financial base from the ground up.

I Use Xero, So Do I Still Need an Accountant?

Yes, you absolutely do. Think of cloud accounting software like Xero as a high-performance vehicle—it’s an incredible tool, but it still needs a skilled driver.

The software is brilliant for tracking daily transactions and giving you a real-time snapshot of your cash flow. But it can't navigate the nuances of Hong Kong's tax laws, make sure your financial statements are perfectly aligned with Hong Kong Financial Reporting Standards (HKFRS), or give you strategic advice on how to structure your finances for tax efficiency. Your accountant is the expert who uses that tool to provide professional oversight and guidance.

What’s the Real Difference Between Bookkeeping and Accounting?

It's helpful to think of it as the difference between recording history and interpreting it to predict the future.

- Bookkeeping is the day-to-day grunt work. It’s the meticulous process of recording every single financial transaction—each sale, every invoice, all payments. This is the bedrock of your financial data.

- Full accounting services take that raw data and turn it into intelligence. This means preparing official financial statements, managing complex tax filings with the IRD, ensuring you're compliant with all regulations, and offering the kind of high-level advice that helps you make sound business decisions.

How Much Should I Budget for Accounting Services?

The cost for accounting services in Hong Kong really depends on the size and complexity of your business. There's no one-size-fits-all answer.

As a rough guide, a small startup or micro-business might find basic annual bookkeeping and tax filing services starting around HK$10,000 – HK$20,000. For a growing SME with a higher number of monthly transactions and more intricate needs, the annual fees could be anywhere from HK$25,000 to HK$60,000 or even higher. The golden rule is to always ask for a detailed quote that spells out exactly what services are covered so there are no surprises down the line.

At Lion Business Consultancy Limited, we're more than just accountants. We become your private financial manager, building the secure banking and tax frameworks your business needs to expand internationally with complete confidence. To create a compliant and protected financial foundation for your next big move, visit us at lionbusinessco.com and see how our 1:1 advisory can help you hit your goals.